Atlantic Lithium (ALL) , an Africa-focused lithium explorer, announced a successful equity placement, raising A$8.0m (£4.2m) at A$0.44p/share (23.35p). The company said proceeds will contribute to the funding of its flagship Ewoyaa lithium project in Ghana and provide additional working capital. The issue price represents a 10.2% discount to ALL's last closing price.

Proceeds will be used to advance activities agreed under the recently granted Mining Lease for Ewoyaa. These include expenditures associated with the planned Feldspar Definitive Feasibility Study, as well as costs related to a study to determine the viability of downstream lithium conversion in Ghana, and listing of Atlantic Lithium on the Ghana Stock Exchange.

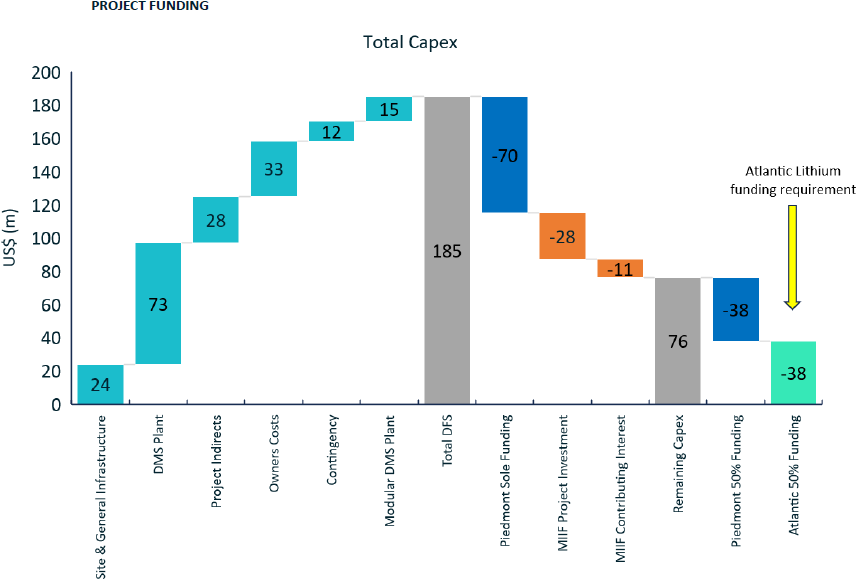

Proceeds will also help with general expenditures, including EPA permitting, land acquisition, relocation of powerline and engineering works. Atlantic's share of Ewoyaa's development cost is c. US$38m, which is expected to be fully funded through the equity placing, as well as an investment by the Minerals Income Investment Fund of Ghana (MIIF) and an ongoing off-take financing process due to complete in Q1 2024.

View from Vox

With the additional £4.2m successfully raised in this placing, Atlantic is fully funded to cover its US$38m share of development costs for the Ewoyaa lithium project in Ghana. Proceeds will enable the completion of activities agreed under the grant of the Mining Lease for the project, key items of early works and permitting-related project expenditure, for further extensional drilling to support the delivery of an upgraded Mineral Resource Estimate for Ewoyaa in Q3 2024, and for general working capital purposes.

Ewoyaa's development cost is estimated at US$185m. Atlantic's main partner on the project is US-based Piedmont Lithium who has committed US$70m and 50% thereafter of the total capex. Additionally, Ghana's Mineral Income Investment Fund has provisionally agreed to invest US$32.9m. Atlantic has also commenced an offtake partnering process with a major investment bank due to complete in Q1 2024. As it stands, once in production Atlantic will own 40.5% of Ewoyaa, Piedmont will own an equal 40.5%, Ghana's Mineral Income Investment Fund will own 6%, and the government of Ghana will own 13%.

Proceeds from the placing will also be allocated for further drilling following the report of a 106m continuous pegmatite interval and broad intersections of visible spodumene outside the current MRE.

Follow News & Updates from Atlantic Lithium: