The best things in life are worth waiting for. For investors in Avacta – a ground breaking developer of cancer therapeutics & diagnostics - this might not be too long either. Why?

Well as explained in today's prelims, there are a host of potential major value catalysts coming down the track over the next few years.

The first hopefully being sometime this summer - assuming data from the ongoing AVA6000 Phase 1a clinical trial demonstrates that its pre|CISION platform is effective at reducing the toxicity of doxorubicin in humans.

If so, then this could open up a pipeline of next generation, FAP-activated, chemotherapy based prodrugs (eg the next candidate being AVA3996) in a market forecast to be worth $56bn by 2024.

But that’s not all. Other significant ‘shots on goal’ include:

1) Launching a host of new In-vitro diagnostics using AVCT’s Affimer platform (eg antibody replacements) into a multi $bn pa TAM.

2) Reformulating its Covid RLFT, so as to be able to consistently identify Omicron in line with the extremely high standards achieved with all previous variants.

3) Numerous technology licensing opportunities with partners such as LG Chem, Daewoong Pharmaceuticals, POINT Biopharma, etc - across both the Affimer & pre|CISION platforms.

4) Further progress wrt Avacta’s Affimer enabled immunotherapies & patented TMAC drug conjugate concept.

Ok, so how much is all this worth?

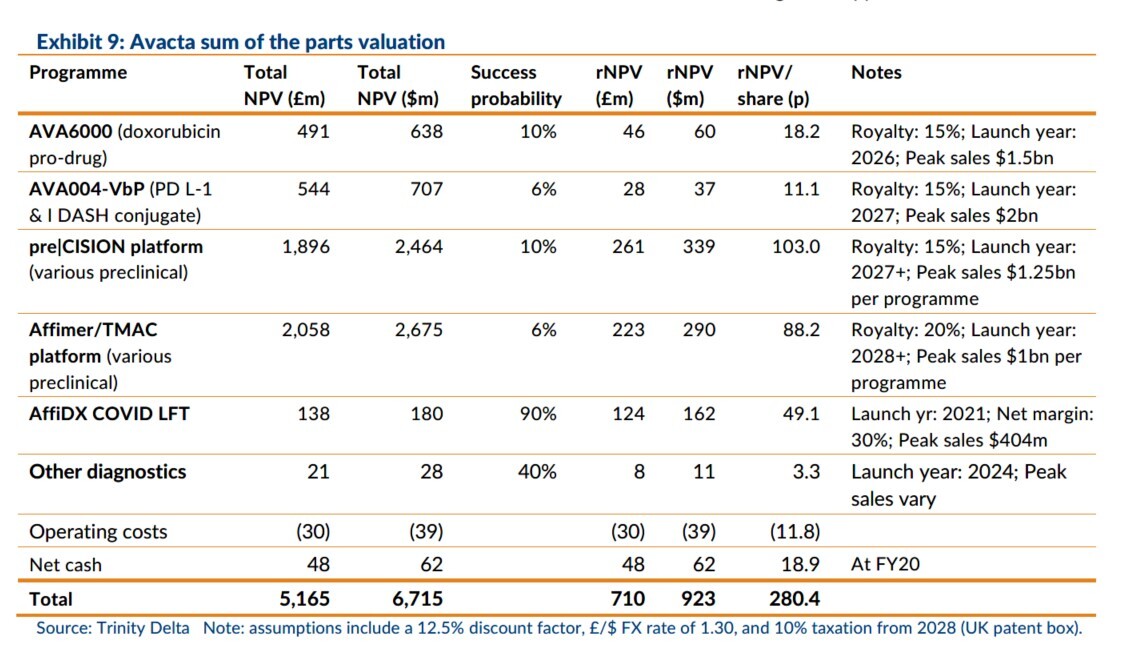

Well back in June 2021, research house Trinity Delta valued these opportunities (excluding the Covid19 RLFT) on a risk adjusted basis at 230p/share (see chart) vs 64p today.

Moreover since then, several of these risks have actually fallen, with the company announcing in early Feb’22 that the patient dosage wrt its AVA6000 pro-doxorubicin study would be increased following positive safety data.

CEO Alastair Smith adding: “We are confident & excited about the immediate & long-term future prospects of the Group, with both potential near-term value drivers relating to AVA6000's clinical trial progress, a pipeline of IVD products and a redeveloped SARS-CoV-2 antigen test offering immediate & long-term opportunities."

Finally in terms of available funding, there was net cash of £26.2m as at Dec’21.