Amid rising borrowing costs, soaring input cost inflation & demand destruction, how many businesses can claim to have rock-solid visibility, resilient profit margins & good pricing power?

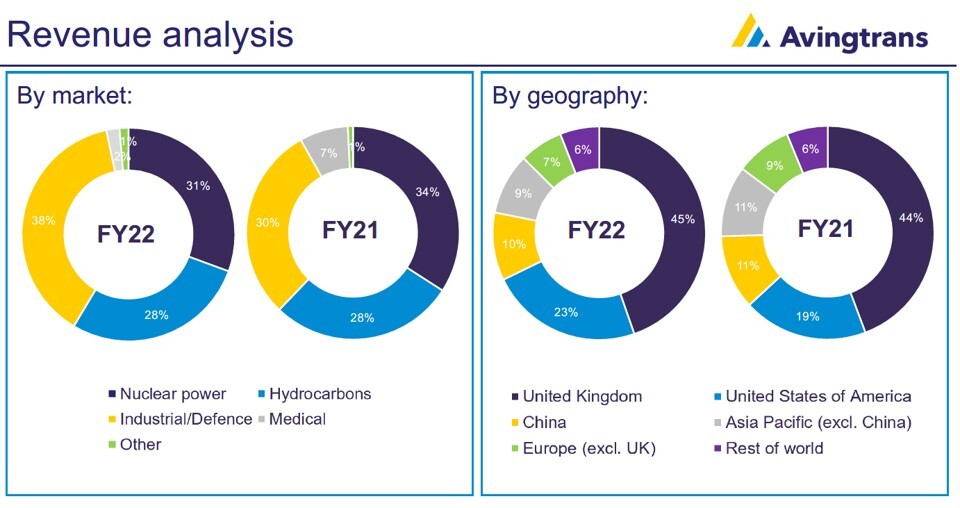

Avingtrans AVG AVG is one, reflecting its exposure to the highly regulated & secular growth sectors of nuclear (31% turnover), Industrial/Defence (38%), hydrocarbons (28%) & medical (2%).

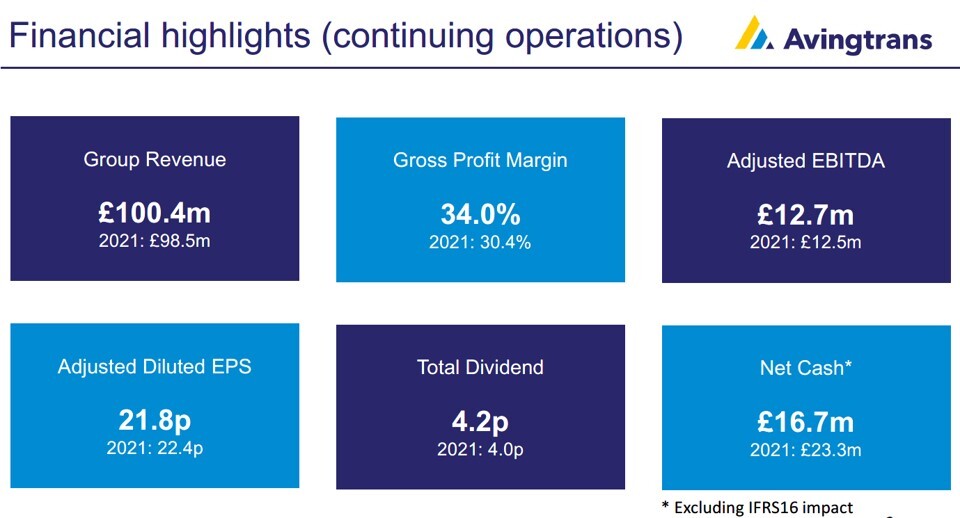

Indeed today, this specialist engineer of mission critical, niche products & services (55% non-UK) posted ‘in line’ FY22 results (adjusted EBITDA of £12.7m on sales of £100.4m), alongside providing positive guidance for the year ahead. Adding that it remains “confident about market prospects”.

Underpinned by robust demand & long term contracts, such as supplying high integrity storage boxes (Metalcraft) to Sellafield, pumps/equipment at nuclear power plants (Hayward Tyler & Energy Steel) and blast proof doors for HS2 tunnels (Booth).Looking forward, house broker Singers is forecasting FY’23 revenues & adjusted EBITDA to climb to £108.7m (+8.2% LFL) and £13.5m respectively - closing May’23 with a hefty net cash pile of £18.1m (vs £16.7m May’22 ex IFRS16, or 52p/share).

CEO Steve McQuillan, commenting: “Despite the current global macroeconomic environment, our markets continue to develop and M&A opportunities remain a priority for us. Businesses like ours can command high valuations at the point of exit, as demonstrated by the disposal of Peter Brotherhood in FY21. The Board remains cautiously confident about the strategic direction and potential future opportunities.”

View from Vox

AVG’s healthcare division is flourishing, with partner Adaptix (11.9% stake) having already filed for 510(k) premarket notification with the FDA. If approved, this will enable the firm to begin selling its groundbreaking, Point-of-Care (PoC), 3D orthopedic system (re skeleton/bone scanner) in the US.

Here Adaptix has developed novel technologies that allow affordable, low-dose 3D imaging using Digital Tomosynthesis, to provide quicker, more accurate diagnosis possibilities.

In turn, hopefully also opening the door for Magnetica (58.1% stake), which is commercialising its own ‘1st of its kind’ small form MRI (re soft tissue) scanner for the orthopaedics & veterinary markets.

My ‘sum-of-the-parts’ valuation for #AVG comes out at 560p/share (vs Singers at 510p & finnCap 495p) - further indicating significant potential upside for long term investors.