Thanksgiving & Black Friday typically kicks off the festive gifting season.

Yet arguably this Xmas, some of the best deals for investors reside in the ‘Innovation & secular growth’ arena - which has fallen 70% from its peak.

In Part 3 of our series highlighting several IPR rich ‘fallen angels’ on the cusp of breaking out in 2023, we examine medtech innovator Belluscura (BELL ). The company is yet another great deal in the ‘Innovation & secular growth’ arena, which has fallen 70% from its peak.

Belluscura: Breakthrough Technology at BlackFriday prices

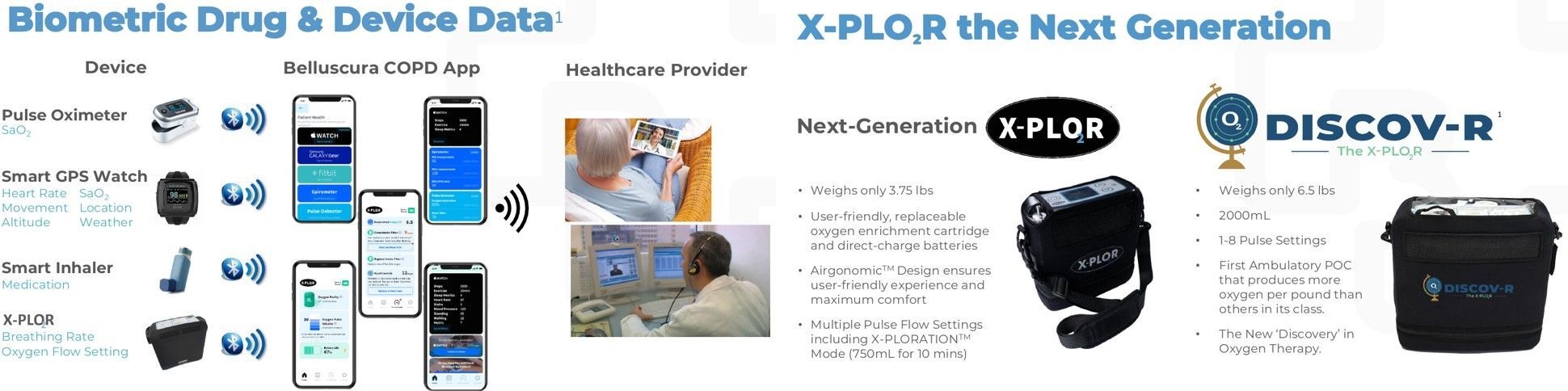

Belluscura - a specialist developer of best-in-class, portable oxygen concentrators (POCs) that are used to treat patients with acute respiratory conditions (eg COPD, pneumonia & long COVID).

BELL has accelerated the commercialisation of its patented & FDA approved medical devices - with the potentially game-changing launch of its new DISCOV-R POC scheduled for Q1’23, followed by expansion across Asia & Europe.

Elsewhere too, the Board has lifted production volumes, improved supply chain resilience, reduced unit costs and signed a transformational agreement with one of the world’s largest contract manufacturers.

View from Vox

Not only do we think are the shares materially undervalued trading at 61p (MktCap £80m) vs Dowgate’s 200p/share target price, alongside having net cash of $9.3m (Est Dec’22, Dowgate); but DTC and 3rd party distribution channels continue to go from strength to strength on the back of strong underlying demand ($1.6bn TAM) as reflected in the forecast jump in unit shipments to >500 in Q3 (vs 377 FY’21), 1,000-3,000 for Q4’22, and 18,000 in FY’23 (Dowgate).

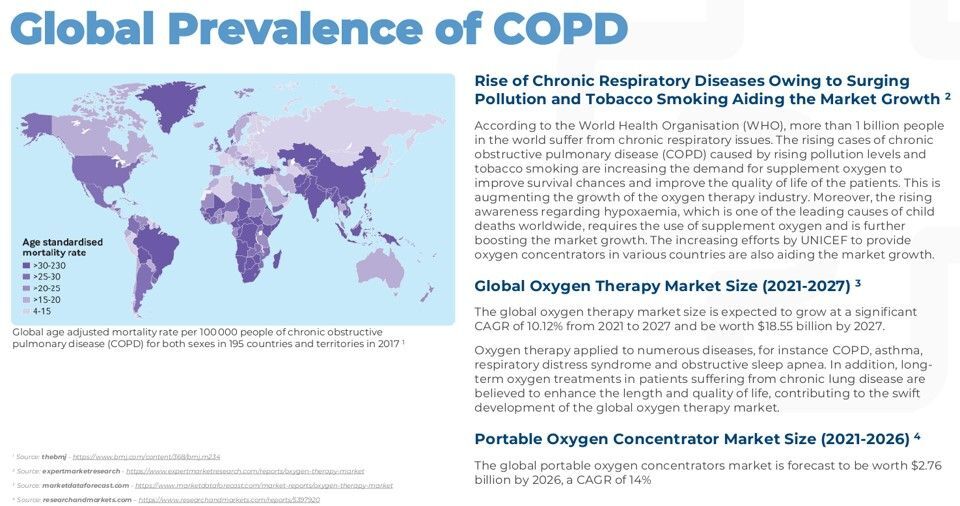

However, this could be just the tip. There are around 1bn people worldwide who suffer from chronic respiratory issues (Source WHO), with the global POC market set climb at 14% CAGR to $2.76bn by 2026. In fact, almost 100m people in China alone have COPD (400% higher than the US), on top of another 50m in India and 5m people in Japan.

Meaning that ultimately - assuming BELL achieves its financial 2025 targets (Dowgate: units, sales, EBITDA & ESP of 70k, $140m, $44.5m & 28.3c respectively), then I’d expect the stock to re-rate to a minimum 12x-15x EV/EBITDA - equivalent to between 325p-410p per diluted share.

Onwards & upwards form here.

Follow News & Updates from Belluscura: