When it comes to medicine, investors often ask what they should look for when selecting science rich healthcare stocks. Clearly, there is no ‘one size fits all’ answer. However, focusing on companies with best-of-breed technology endorsed by blue chip customers/partners and serving large addressable markets tends to be a winning strategy.

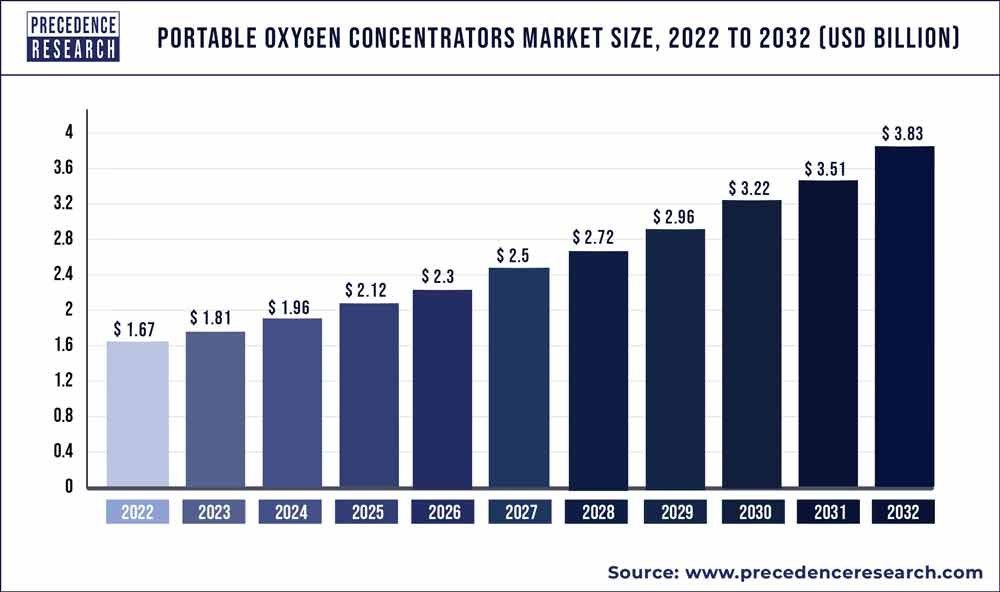

Enter medical devices expert Belluscura (BELL,) who is disrupting the global $1.7bn+ portable oxygen concentrator (POC) sector (8.7% CAGR over the next decade, see chart).

Indeed, after securing $15m worth of pre-orders only 2 weeks ago for its new DISCOV-R POC, Belluscura said today that it had signed a transformational 10 year agreement (effective 1st Oct’23) worth a minimum of $55m in royalties (increasing annually) with its world class manufacturing partner, lnnoMax Medical Technology (a JV between a Foxconn subsidiary & the Chinese gov’t).

In return, Innomax has been granted an exclusive licence to manufacture & distribute BELL’s X-PLOR & DISCOV-R POCs across China, Hong Kong, Macau & Singapore. The contract is exclusive for the 1st 5 years, though if minimum sales quantities are not achieved, both parties can mutually agree to grant InnoMax a non-exclusive license for the remainder of the term, whereby the minimum cumulative royalties would instead be $27.5m.

Elsewhere, Belluscura will also receive a share of the associated accessory net profits and be responsible for in territory sales & marketing (re jointly funded) on behalf of Innomax. Plus the deal greatly improves BELL’s cashflow as it reduces future working capital & fixed asset spend, alongside scaling production capacity faster than otherwise would be possible and improves unit economics.

Let’s not forget too, there is a enormous untapped demand. An estimated 100m people suffer from COPD in China alone, or around 6x the number in the US with the broader Asia Pacific region anticipated to become a $1bn market by 2027. Meaning ultimately these royalties might be materially much higher.

Chairman Adam Reynolds commenting: “It is a tremendous accomplishment for the team at Belluscura to have partnered with Innomax, a world class organization.”

CEO Bob Rauker, adding: “This agreement provides the basis for an extremely financially beneficial partnership for both companies as we jointly broaden the reach of Belluscura's next-generation technology.”

In terms of the numbers, the stock is attractively priced on a risk/reward basis - trading at 41.5p (Mrkcap £51m) vs Dowgate Capital Limited’s upgraded 125p/share target (100p B4). The latter being based on unit sales of 6,250, ($7.5m revs), 20,000 ($28.8m) & 40,000 ($62.8m) respectively between 2023-25, with BELL becoming cashflow positive in 2025, & closing Dec’23 with net funds of +$2.3m (vs $1.8m LY).

Lastly going forward, a similar capital-lite royalty model might also be used to accelerate market penetration & patient adoption in other jurisdictions (eg EMEA). Watch this space.