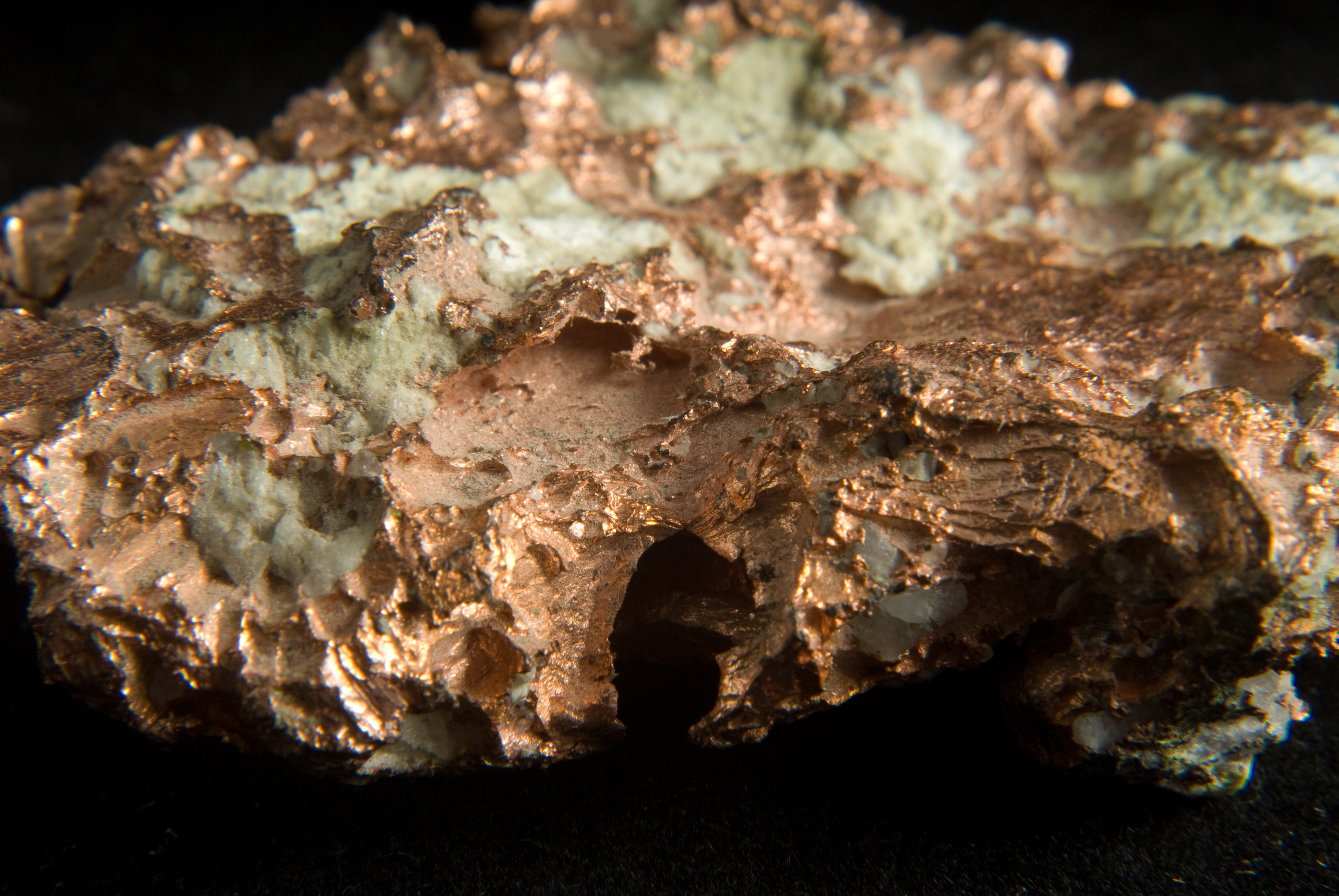

Bezant Resources (BZT ) said it has entered into an exclusive option agreement with Caerus Mineral Resources PLC (CMRS ) to enable it to develop copper gold projects in Cyprus.

The London-listed copper-gold exploration and development company said the exclusive option agreement will grant the Company months to assess the merits and economic prospects of all Caerus potential copper and gold hard rock mining assets in Cyprus.

The agreement will enable Bezant to review Caerus' portfolio of properties in Cyprus and for both parties to identify one project as a potential development project. Under these terms, the parties will jointly fund and explore up to $1m on the selected project.

Should the project selected surpass the development criteria then Bezant and Caerus will form a joint venture company to develop the project whereby Bezant will be responsible for the designing, construction and operation of any mine developed under this agreement.

Caerus' expenditure during the pre-mining exploration phase will be recovered from future cash flows and Caerus will retain a 20% beneficial interest in all future revenues, it noted.

Colin Bird, Executive Chairman of Bezant, said: “The mission of both Bezant and Caerus is to be well positioned in what is globally accepted to be the new copper supply deficit. We both believe that the deficit is very real and will need to be met by large and small mines.”

“The Caerus portfolio has the propensity to produce a number of secondary developments and/or primary developments and Caerus intends to meet the new copper demand by partnering with like-minded companies in this sector,” Bezant explained to shareholders.

Bird said the arrangement “benefits both parties” in that Bezant will assist Caerus in fast tracking its assessment, whilst gaining access to new small-scale copper development assets.

He added that the Caerus team, in Bezant’s opinion, “have assembled and positioned themselves with an extraordinarily gold/copper portfolio in a mining friendly jurisdiction."

View from Vox

In June 2021, the Group told investors that its recently completed reconnaissance mapping, prospecting and sampling work at its 100% owned high-grade Kanye manganese project in Botswana had indicated the potential of the project’s high-grade manganese deposits.

Bezant said it plans to follow-up the main targets with clearance/trenching by mechanical excavator to facilitate detailed mapping, prospecting and more systematic sampling. It said the confirmed targets will be drill tested to define lateral and depth extent of deposits.

Reasons to BZT

Bezant is focused on building ‘significant value’ in projects from highly cost-effective work programmes. Following its work in delineating mineable reserves at our Mankayan project in the Philippines, it is now focused on gold-copper exploration and development activities.

BZT has repositioned its portfolio as copper demand continues to surge. In 2020, it ramped up its copper projects by acquiring Kalengwa in Zambia and the Hope project in Namibia.

As a result, the Company is now ‘well positioned’ in the gold-copper space just as Copper prices jump well above pre-COVID-19 levels, with the commodity seeing its highest quarterly increase since mid-2009 as a result of resurgent sales in China with demand for copper forecast to double by 2030.

In January 2021, BZT said that samples taken from the Hope Copper-Gold Project in Namibia confirmed the group’s assertion that gold should be present at the Gorob-Vendome deposit.

Bezant said the accompanying gold values in the Bezant holes support management’s belief that the gold content could be higher than previously reported in the Gorob-Vendome Inferred Mineral Resource estimate and therefore could add considerable value to the project.

For more news and updates on Bezant Resources here: