Boohoo released their final results for the year ended 28th February 2023, today. I put their results through my spreadsheet to see how they performed but also to see whether there's any potential upside from this former stock market darling.

You can see the video by clicking here

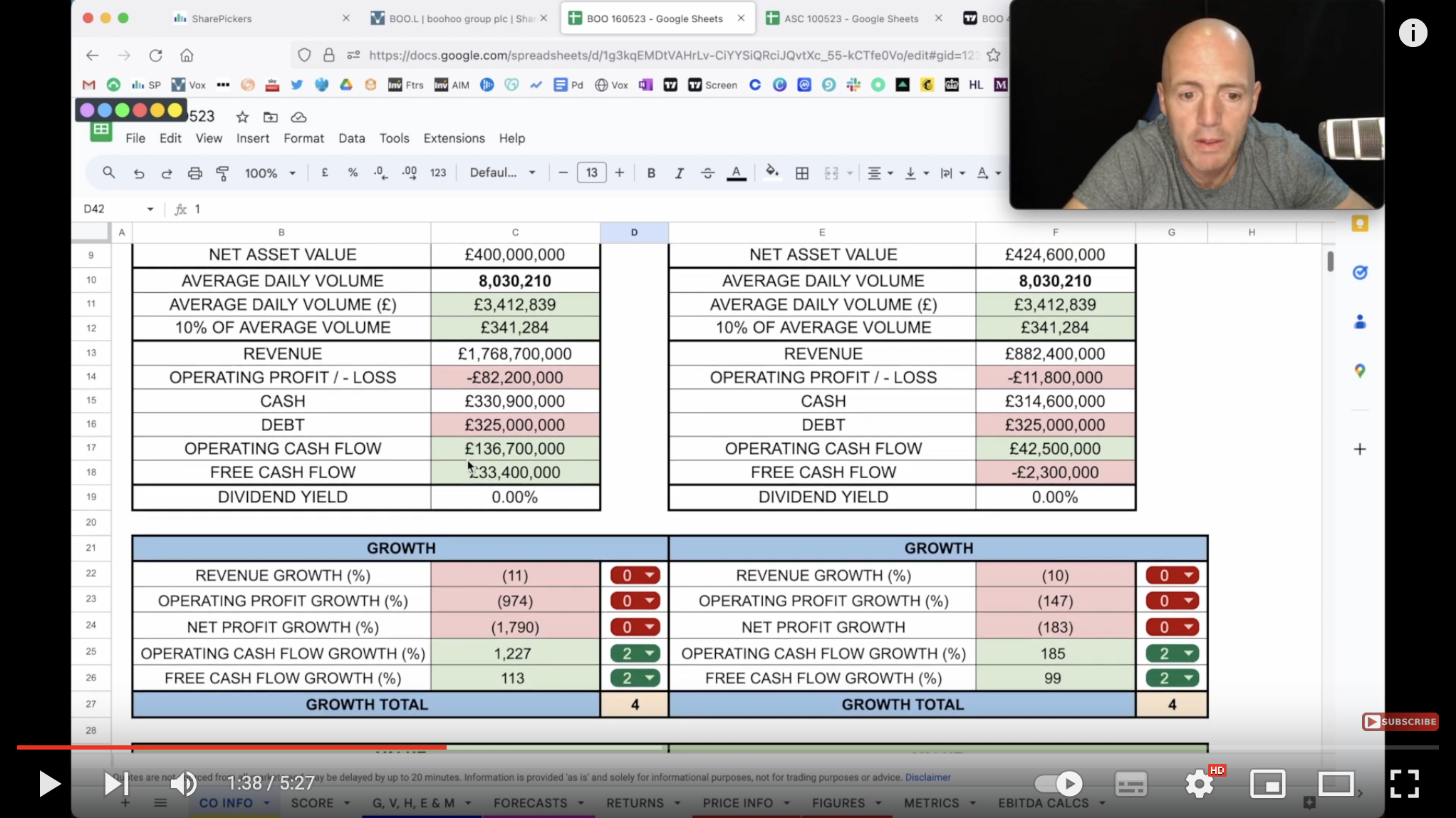

Financial highlights

· Revenue £1.769 billion, down 11% vs last year, and up 43% on 2020

o UK revenues down 9% vs last year, and up 61% on 2020, demonstrating significant market share gains over 3 years

o International revenues down 13% vs last year, and up 22% on 2020

· Gross margin 50.6%, down 190bps vs last year, reflecting Covid related cost pressures on raw materials and freight, and stock clearance

· Inventory has been reduced significantly, down 36% year on year or £101m in absolute terms as at the end of February

· Adjusted EBITDA of £63.3 million, down 49%, with Adjusted EBITDA margin of 3.6%

· £91 million capital expenditure investment, building infrastructure for future growth, including Sheffield automation and US distribution centre

· Strong cash generation with free cash flow of £30.2 million as a result of significant inventory and working capital improvements (2022: -£251.2 million), and balance sheet strength maintained with £136.1 million of unencumbered freehold assets, £5.9 million net cash and a £325 million Revolving Credit Facility, giving £331 million of liquidity headroom