Thanksgiving & Black Friday typically kicks off the festive gifting season.

Yet arguably this Xmas, some of the best deals for investors reside in the ‘Innovation & secular growth’ arena - which has fallen 70% from its peak.

In our second installment highlighting several IPR rich ‘fallen angels’ that are substantially undervalued AND on the cusp of breaking out in 2023, we take a look at Avacta, the clinical stage, oncology therapeutic & medical diagnostics firm, that is set to release pivotal Phase 1 clinical trial data soon with respect to its patented pro-doxorubicin (AVA6000) treatment for cancerous tumours.

Avacta: Breakthrough Technology at BlackFriday prices

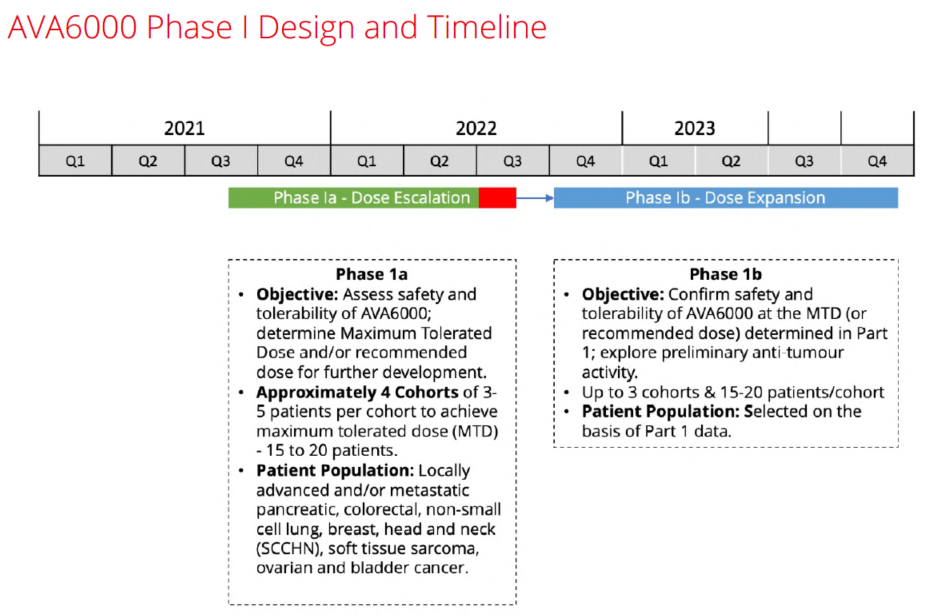

Avacta AVCT is a clinical stage, oncology therapeutic & medical diagnostics firm, that is set to release pivotal Phase 1 clinical trial data soon wrt its patented pro-doxorubicin (AVA6000) treatment for cancerous tumours.

Avacta develops cancer immunotherapies and diagnostics based on its two proprietary platforms - Affimer biologics and pre|CISION tumour targeted chemotherapies.

- The Affimer platform is an alternative to antibodies and is derived from a small human protein. It's been designed to address many of the negative issues of antibodies, which currently dominate markets worth in excess of $100bn.

- Avacta's pre|CISION platform is designed to selectively release active chemotherapy in FAP rich tumour tissue to limit the systemic exposure that causes damage to healthy tissues. In this way, it aims to improve the overall safety and therapeutic potential of powerful anti-cancer treatments.

- AVA6000 is a novel form of doxorubicin that has been modified with Avacta’s pre|CISION platform to improve its safety and therapeutic index.

View from Vox

We suspect many investors have significantly under-estimated AVA6000’s chances of success. Indeed, even analysts at Trinity Delta have used standard industry failure rates of 90% (source: ScienceDirect) in their risk adjusted valuation models.

However to me, this approach is far too broad brush. Instead, a more tailored solution - closely aligned with the specifics of AVA6000 - should be adopted.

In fact, some of the most common problems associated with drug discovery (ie Insufficient efficacy 40%, high toxicity 30%, poor chemical action 10% & lack of medical need 10%) don’t appear to be quite so prevalent here, as the stats might imply.

For instance, AVA6000 has already reported good safety results having advanced to the 4th patient cohort at a dosage level (200mg/m2) - more than twice the usual prescribed level for doxorubicin.

Plus, the TAM for FAPα-activated drugs like AVA6000, the wider pre|CISION platform & chemotherapies in general is predicted to be worth $56bn by 2024. Whilst in terms of efficacy, doxorubicin in its raw form is one of the most powerful chemotherapies ever invented. It's been prescribed for years & has been proven to shrink/destroy tumours.

Doxorubicin’s Achilles heal up to this point has been that without the protection of a targeted pro-drug release mechanism - it harms healthy tissues, especially around the heart. Thus it’s typically employed only in small doses & for limited periods.

Meaning if the imminent AVA6000 data proves favourable, then this could provide a major lift to the stock. How much is anybody’s guess - albeit ceteris paribus & assuming a re-appraised 25%-50% success rate - I estimate TrinityDelta’s valuation could hypothetically be upgraded from 219p currently to between 330p-580p per fully diluted share.

Better still, AVA6000 is not the only value driver either. Avacta also has a host of other ‘shots on goal’, not least its proprietary Affimer therapeutics & diagnostics platform (re bispecifics, TMAC), promising 3rd party licensing deals (LG Chem, Daewoong Pharma) and recent £24m acquisition of Launch Diagnostics.

All told, lots of possible major inflection points coming down the track.

Follow News & Updates from Avacta: