[Amapa Project Processing Plant. Source: Cadence Minerals]

Cadence Minerals (KDNC ) announced a new Mineral Resource Estimate compliant with JORC 2012 for its Amapa Iron Ore Project in Brazil. Prominas Mining was commissioned by DEV Mineração to complete the MRE.

As expected, the MRE reveled a much improved iron resource at Amapa.

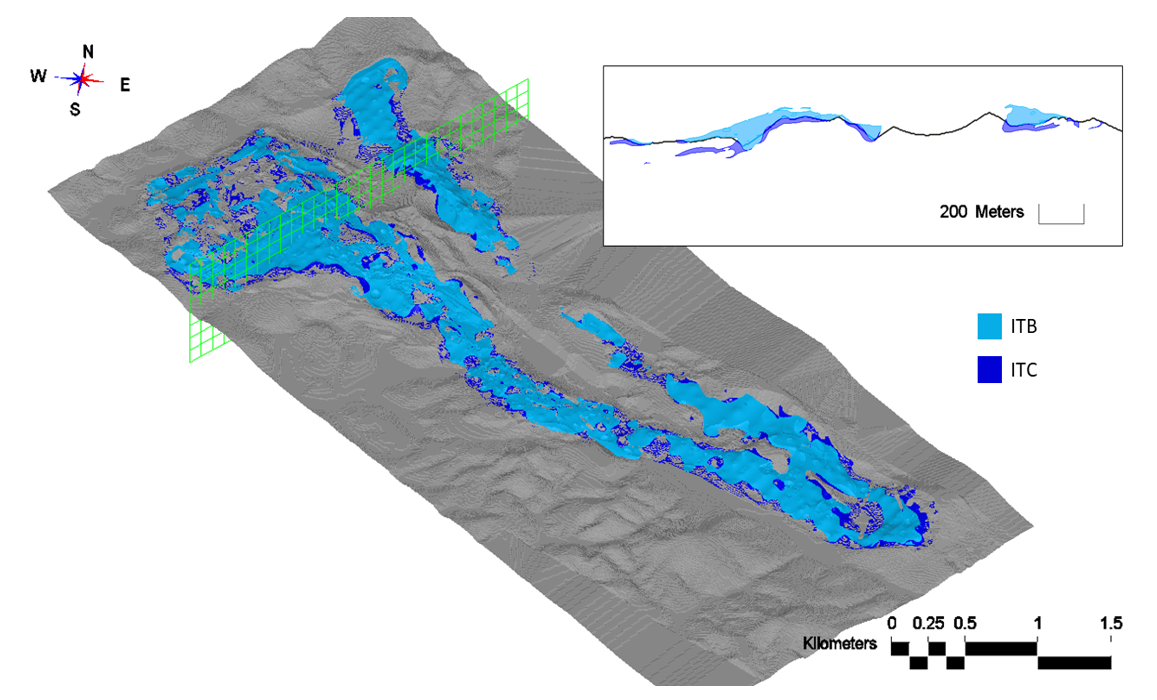

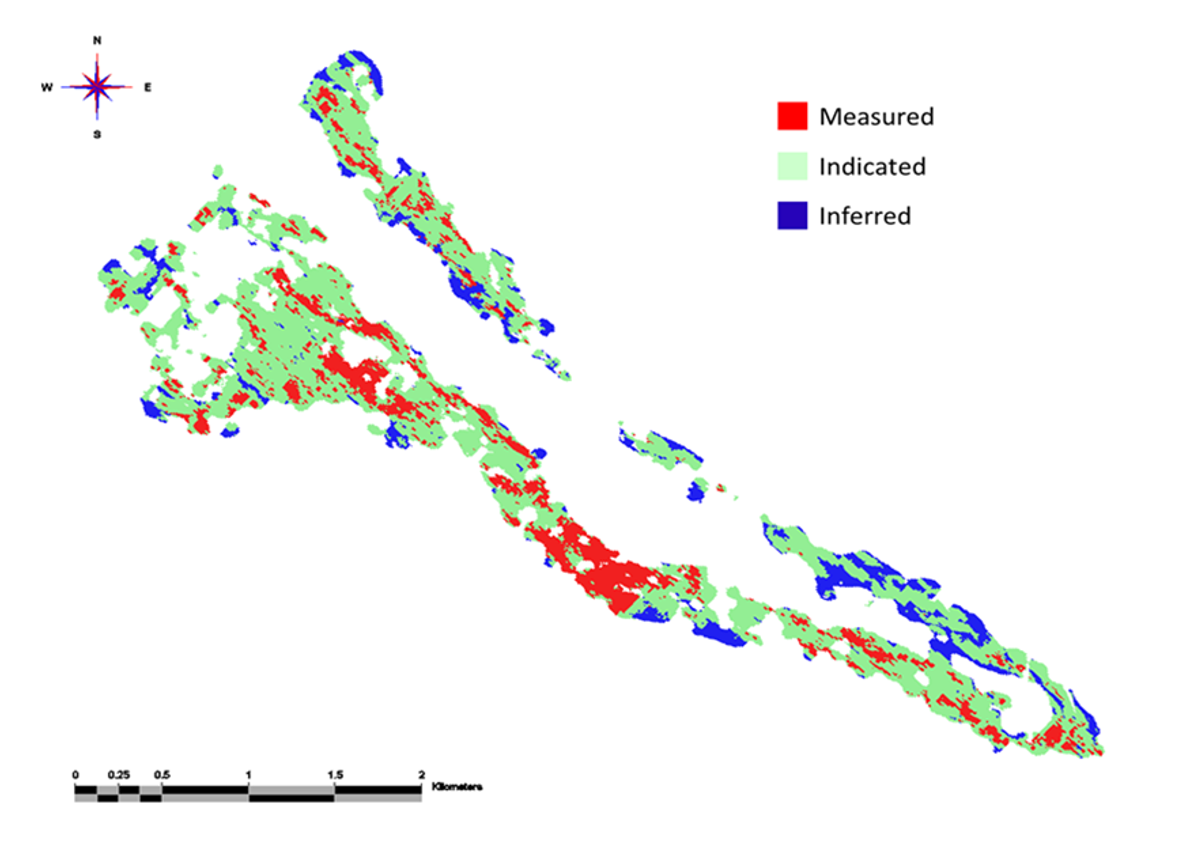

The total Measured, Indicated, and Inferred mineral resource increased to 276.24 Mt grading 38.33% Fe, with a new Measured resource of 55.33 Mt grading 39.26% Fe.

The Measured + Indicated Resource increased to 229.48 Mt at 38.76% from the previous 2020 MRE of 176.7 Mt at 39.75% Fe. The Inferred portion increased substantially to 46.76 Mt at 36.2% Fe from 8.7 Mt at 36.9% Fe.

The new estimate was reported within an optimised pit shell and using cut-off grade of 25% Fe.

Kiran Morzaria, CEO, commented:

"The main aim of our new mineral resource statement was to provide a sound basis for pre-feasibility studies. In particular, to convert a significant portion of the indicated mineral resource into the measured category. The results reported today have achieved this goal and more.

The results clearly indicate the robustness and consistency of the Amapá resource.

As we move closer to the next stage of development, this higher degree of certainty in our mineral resource estimate provides more funding options for the Project. The new measured resource and the overall increase in the mineral resource provides a sound basis for an initial 15-year mine life, with the potential to expand this further by upgrading the 46.76 Mt of inferred resources."

View from Vox

Today's MRE result from Cadence improves substantially on the previous November 2020 estimate, which itself increased the MRE by 21%. The Inferred portion's increase to 46.76 Mt from 8.7 Mt is particularly exciting as it presents opportunities for significant further upgrades. The trend is clearly toward a lower risk profile and higher profitability at Amapa as Cadence moves to its pre-feasibility study, expected later in 4Q.

Mineralisation extends approximately 6.5km in strike length, 1.5km in width, and exists in some areas to more than 100m in depth.

Breakdown of the updated mineral resource

The PFS will be based on producing 5.3 Mt of iron concentrate per year. It should should convert more of the Indicated mineral resource into Measured, and outline more fully the company's development timelines and capital requirements over an expected 15-year life for the project.

After the publication of an economic PFS, DEV Mineração is expected to commission a Definitive Study (DFS), required to seek project debt and equity finance.

In 1H22, Cadence successfully increased its stake in Amapa to 27%. In 2022, Cadence's two key operational priorities at Amapa have been: 1) To progress the permitting pathway, including regularisation of mining concessions, tailing storage facilities, and environmental permits. And 2) To advance the PFS following an updated MRE. Both are progressing on schedule.

In addition to its development work at Amapa, Cadence generated capital growth in its private investments this year via sales of its 31.5% interest in Lithium Technology Pty and Lithium Supplies Pty, as well as its 30% interest in the Yangibana Rare Earth Project. Cadence made a 321% cumulative return on those investments. The upcoming IPO of Evergreen Lithium represents further potential value.

Despite challenging macroeconomic conditions, the lithium and rare earth sectors have remained positive, with pricing in both remaining robust. Demand continues to be driven by electrification of transport and the continued undersupply of feedstock. Cadence does not believe an oversupply of lithium is imminent, but sees a continued market deficit.

The global slowdown has had an impact on iron ore with the Platts index dropping from US$125/dmt to US$100/dmt in 1H22. Prospects for iron ore are driven by China, being the world's largest steel producer, and buyer of 70% of global seaborne iron ore. Cadence expects China to emerge as a source of stability for iron ore demand, with recent indications pointing to a recovery in its growth momentum.

Investors welcomed today's MRE update, sending KDNC shares up 3.7%.

Follow News & Updates from Cadence Minerals: