Cadence Minerals (KDNC ) updated markets on progress across three of its investments: Hastings Technology Metals, Sonora Lithium Project, and Amapa Iron Ore Project.

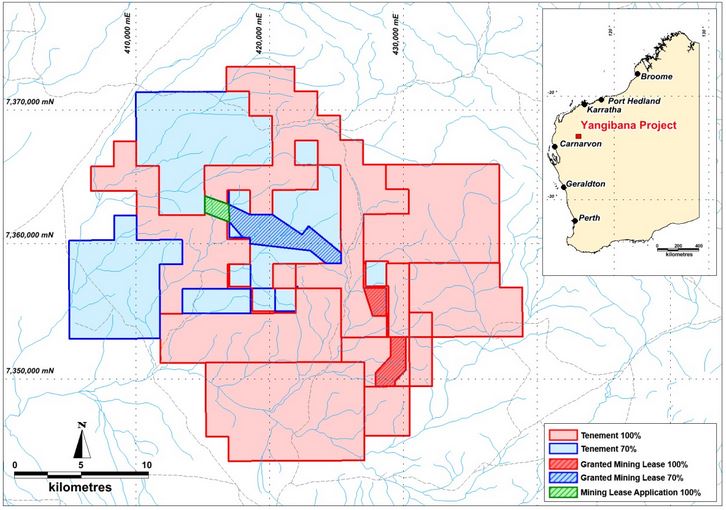

Cadence completed the sale of its 30% stake in the Yangibana Rare Earths project in Western Australia for 1.9% of Hastings Technology Metals' issued share capital.

Hastings recently updated markets on Yangibana, detailing US$146m in contractual commitments made to date. In February, Hastings upgraded Yangibana's ore reserves by 25% to 20.95Mt at 0.90% TREO grade, increasing its mine life (LOM) to 17 years.

Yangibana Rare Earths Project, Western Australia

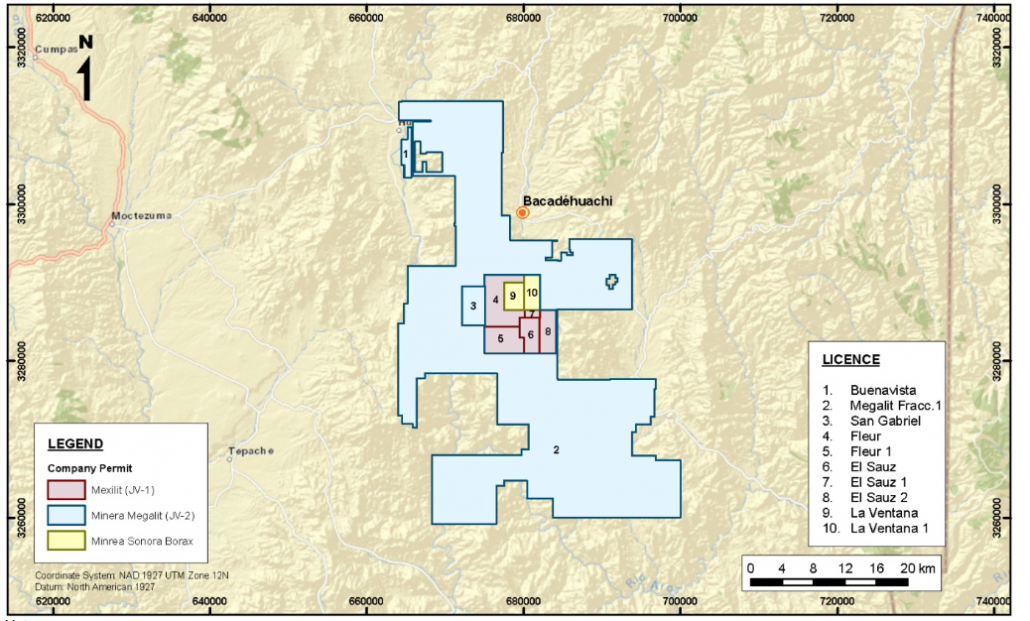

Cadence also holds a partial interest in the Sonora Lithium Project in Mexico via a 30% stake in the JV of Mexilit SA and Megalit SA. The other 70% is held by Ganfeng Lithium Co.

A feasibility study report was published for Sonora in 2018. The report estimated a pre-tax NPV of US$1.253bn at 8% discount rate, an IRR of 26.1%, and Life of Mine operating costs of US$3,910/t of lithium carbonate. Ganfeng expects phase 1 to deliver 50,000 tons of lithium oxide, which is 42% higher than what was outlined in the feasibility study.

Sonora Lithium Project mineral concessions, Northwestern Mexico

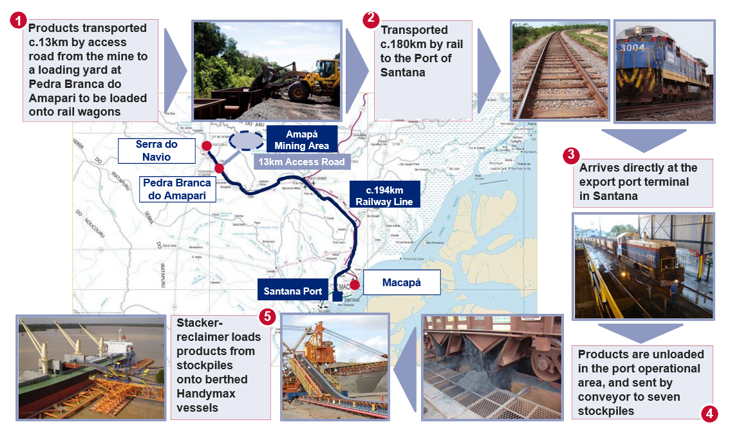

Last month, Cadence published a pre-feasibility study on its 30%-owned Amapa Iron Ore Project in Brazil. Today, the company identified three areas of possible improvement to Amapa:

The first is to review historical drilling and geological data north of the existing Amapa concessions, to identify further iron ore resources and increase LOM. Second is to change the layout of the port at Santana by moving the railway loop further from the shore, expected to result in capital savings. Third is to improve the final product quality above the current 65% iron ore concentrate.

Key logistical components of Amapa Iron Ore Project, Northeast Brazil

Kiran Morzaria, CEO, commented: "As is the nature of any investment company, our value is driven by the sum of our parts. With the recent reduction in Hastings share price our portfolio valuation has also reduced. However, we see no fundamental reason for this price volatility given the substantial progress. Hastings is making in the construction of the Yangibana rare earth project and we look forward to them advancing to project towards production in 2024.

Cadence's current public and private investments have continued to perform delivering a unrealised return of approximately 172% and our listed investments have delivered a total return (realised and unrealised) of 328%.

Our confidence in Amapa continues to grow thanks to a potential further increase in the overall iron ore resource, improvements to the port and prospects for restarting iron ore shipments in the coming months. I look forward to providing further updates."

View from Vox

Cadence's corporate update was welcomed by investors who drove its shares 9.5% higher this morning. The company continues to make steady progress across its portfolio - as global supply chain pressures abate and Yangibana moves toward production, we expect the company's value to increase in 2023 and beyond.

Through its ownership in Hastings, Cadence has full equity exposure to the Yangibana rare earths project in Western Australia. Cadence gained ownership in Hastings in exchange for 30% of its stake in Yangibana in a restructuring initiated last year and completed on January 23 2023. The move resulted in Cadence owning 1.9% of Hasting's share capital, worth AS$9m (£5.17m). This consideration was a premium over the NPV of the Cadence portion of Yangibana, based on a definitive feasibility study updated by Hastings on 21 February 2022.

Yangibana holds substantial neodymium and praseodymium resources with an NPV of £570m. Hastings recently upgraded the project's ore reserve by 25% to 20.95Mt at 0.90% TREO grade, increasing its mine life to 17 years. Hastings has engaged Boston Consulting Group to assist in further investigating the merits of an integrated mine-to-magnets strategy and exploration of partnership opportunities at Yangibana.

Cadence's 30%-owned flagship Amapa iron ore project in Brazil is also shaping up to be a win for the company after a recently completed pre-feasibility study indicated an NPV of US$949m at a discount rate of 10%, with gross revenues and after-tax profit of of US$9.39bn and US$2.96bn respectively over at least a 16-year Life of Mine (LOM). The pre-feasibility study also indicated a post-tax IRR of 34%, with an average LOM EBITDA of US$235m per year. In October, Amapa's ore reserve was upgraded to 276.24 Mt at 38.33% Fe.

With improving iron ore prices and stability returning to shipping costs, the sale of Amapa's 58% iron ore concentrate stockpile is now economically viable. Cadence expects shipping to recommence in the next six months, and to increase Amapa's product quality above the current 65% Fe concentrate. Cadence also aims to expand Amapa to the north, extending its LOM.

Last month, Cadence announced its portfolio company Evergreen Lithium would list on the ASX in March 2023. On admission, Cadence will own 8.7% of Evergreen Lithium, worth US$3.96m (£2.27m) at the offer price. Cadence came to own interest in Evergreen after the former sold its 31.5% stake in Lithium Technologies and Lithium Supplies (LT and LS) to Evergreen last summer.

Evergreen intends to advance 3 hard rock lithium exploration projects in Australia. The flagship Bynoe Field shows much promise as competitor Core Lithium has delineated a JORC mineral resource of 18.9mt at 1.32% Li2O at its immediately adjacent Finniss project. Core Lithium has achieved excellent drilling intercepts at their BP33 prospect of 107 metres at 1.70% Li2O, located within 1 km of the Bynoe project.

Overall, considerable potential exists across Cadence's portfolio, with strong momentum going into 2023. The sales of LT and LS to Evergreen, and sale of Yangibana to Hastings generated a 321% ROI for Cadence last year. In total, Cadence's listed and unlisted investments have delivered an unrealised return of 172% to date. Evergreen's listing on ASX should should add further value to the company whose shares are already up 40% YTD.

Follow News & Updates from Cadence Minerals: