When a naturally cautious Finance Director says the “business is flying”, investors should take note.

No wonder really, given today’s record 1st half results, buoyant outlook & upgraded profit expectations from niche power reliability firm Crestchic load .

Indeed, H1’22 turnover from its specialist hire (+43% to £12.4m) and equipment sales (+25% £8.9m) was literally ‘off the charts’, despite the challenging economic backlog.

Driven by not only the secular growth themes of data centres, grid security and renewables (eg battery farms), but also right across the world – covering almost every geographical region (eg Middle East, US, Europe, Asia, etc) and vertical market (eg oil & gas, infrastructure, Marine, etc).

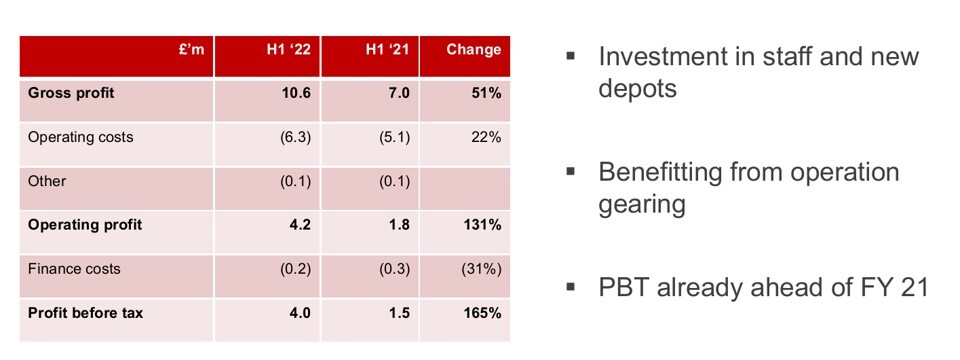

Total H1 revenues of £21.3m (£15.8m LY) were up an incredible 35% LFL – propelling adjusted EBIT 131% higher at £4.2m and ROCE above 25%, as the strong demand, positive operating leverage (re mix) & improved fleet utilisation fed through to the bottom line.

But that’s not all:

Orders continue to power in with the group recently signing another major rental project in Q3. The quality problem now being to ramp up supply - by further lifting production capacity & utilisation rates, alongside buying/refurbishing older load banks and using 3rd party contract manufacturers (re US).

The good news is the expansion plan is working flawlessly, with the company adding that this was a “sustainable step change in performance”.

Sure inflation and supply chain challenges remain, yet equally these are being managed via internal efficiencies, sensitive price increases and imaginative procurement.

Exec Chairman Peter Harris commenting: “To date, 2022 has been a record year. The strength of our pipeline makes us confident that Crestchic will continue to grow strongly into 2023. This buoyant performance across all sectors around the world has led the Board to raise expec

tations for the 4th time this year.”Finally, an interim dividend 1.33p was declared, and the final part of Tasman disposal (re Middle East) should concluded soon, once local regulators have rubber stamped the deal.

View from Vox

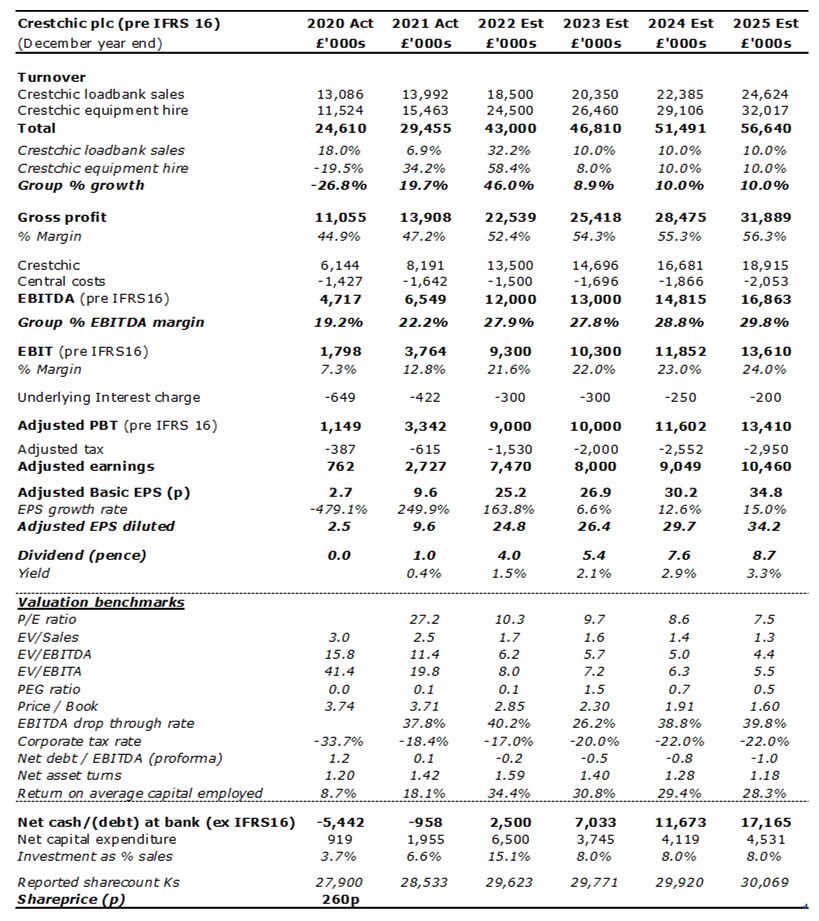

WRT to the FY’22 numbers, I’ve hiked my adjusted EBITDA (pre-IRFS16), PBT & EPS forecasts to £12.0m (vs £6.5m LY), £9.0m (£3.3m LY) & 25.2p (11.3p H1’22) respectively, on revenues up 46% YoY to £43m (£29.5m LY).

Similarly, pushing Dec’22 ROCE north of 30% (18.1% LY), net cash to £2.5m (-£1.5m Jun’22) & the valuation 21% higher at 400p/share (vs 330p B4).

The latter based on a 10x EV/EBITDA multiple & a 12% post tax cost of capital.