EQTEC (EQT ) has announced its intention to raise around £15m at 1.5p a share which will form part of its efforts to accelerate revenue growth into both new and existing markets.

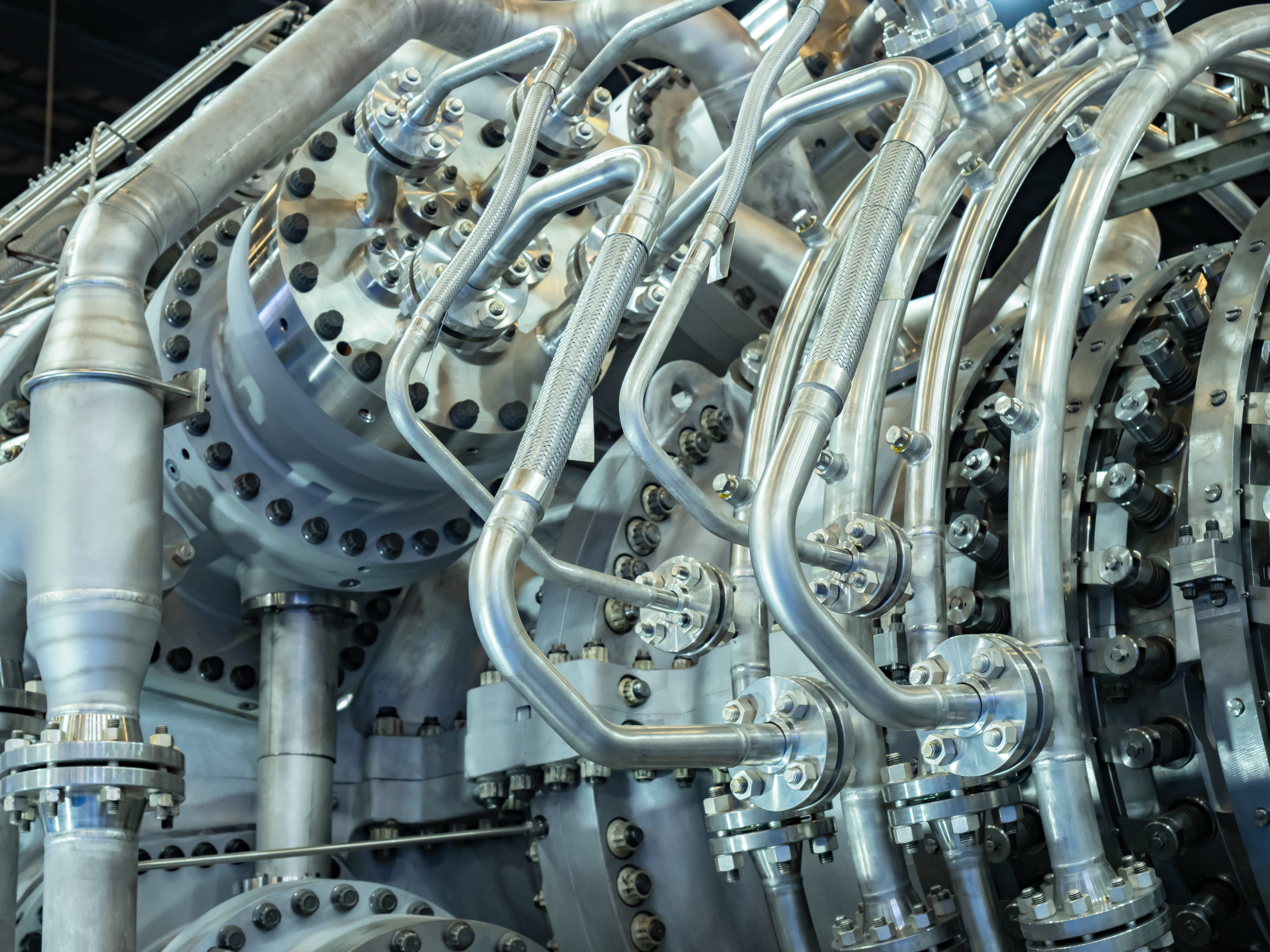

EQTEC strategy is aimed at addressing the global need for the reduction of large volumes of waste and to meet the growing demand for clean energy, ‘with higher versatility and reliability, a lower emissions profile and higher efficiency than alternative methods.’

The energy firm said it intends to build more advanced gasification plants “in more markets with a greater, cleaner impact on local communities and greater returns for investors.”

In particular, the proceeds will enable the group to accelerate its revenue growth in target markets across Europe, including the recently announced revival of such a plant in Italy.

The group said the establishment and funding of joint ventures with local partners in target markets, for dedicated, local operations will drive sales growth and delivery while markets immediately targeted for revenue growth include Greece, Croatia, Italy and Spain.

The funds will also be used in the UK to secure and deliver the group’s RDF-to-Energy pipeline which includes placing capital investment in freehold land and full project rights for some of the firm’s major RDF-to-energy projects including as well as others in the pipeline.

The funds from the placing will also be used to formalise market entry into the United States and extend its platform for growth for multiple projects in multiple geographies’.

In addition to the placing, EQTEC said it intends to enter into a settlement and termination agreement with Syngas Technology Engineering, a company controlled by Dr. Yoel Alemán, the group’s CTO and current Board Director who invented EQTEC's Gasifier Technology.

Syngas is entitled to an ongoing royalty on sales of EQTEC's Gasifier Technology up to and until such time as a cumulative maximum of €2.88m has been received by Syngas. To date, €0.436 million has been paid under these royalty arrangements to the company, it noted.

Under the terms of the settlement and termination agreement, EQTEC explained that Syngas will receive a cash payment of €1m plus €1.44m in EQTEC shares, or 92.98m shares.

Shares in EQTEC have seen an over three-fold increase in value since November 2020. The stock was trading 6.80% lower this morning at 1.575p following the announcement.

EQTEC also announced within its statement that the company’s Finance Director, Gerry Madden, intends to retire in 2021. The Board said it is already underway with the selection of a successor and explained that it will announce an appointment in due course.

CEO, David Palumbo said, "Gerry has been with EQTEC for 14 years, since its predecessor company was a developer of clean energy projects. He has been a steadfast custodian of the business through multiple stages of its development and he leaves it in the best position of its history.”

EQTEC revenues from both current and new projects and gradual growth from maintenance and consulting contracts are forecasted to generate revenues of around €15m in 2021.

The firm said this assumes the planned progression of a number of projects in the period within the timeframe expected by the Board, including several biomass-to-energy and biomass-to-bioenergy projects in Europe and the US and one RDF-to-energy deal in the UK.

EQTEC explained that the combined revenues, if secured within the timeframe expected, together with expected income from returns on investment of its development capital, are forecast to generate positive EBITDA, making 2021 EQTEC's first year of profitability.

Between July 2020 and February 2021, EQTEC added non-contracted tender opportunities worth a total potential value of €316 million for a total potential pipeline value of €657 million. Over the same period, EQTEC sent full commercial offers worth a total of €246m.

Follow News & Updates from EQTEC here: