One trait of best-in-class businesses is that they consistently beat and sometimes even smash expectations. 12 months ago, Equals (EQLS) – an international business-to-business payments and fintech platform - entered 2022 with consensus adjusted EBITDA forecasts sitting at £8.4m on £47.1m of turnover.

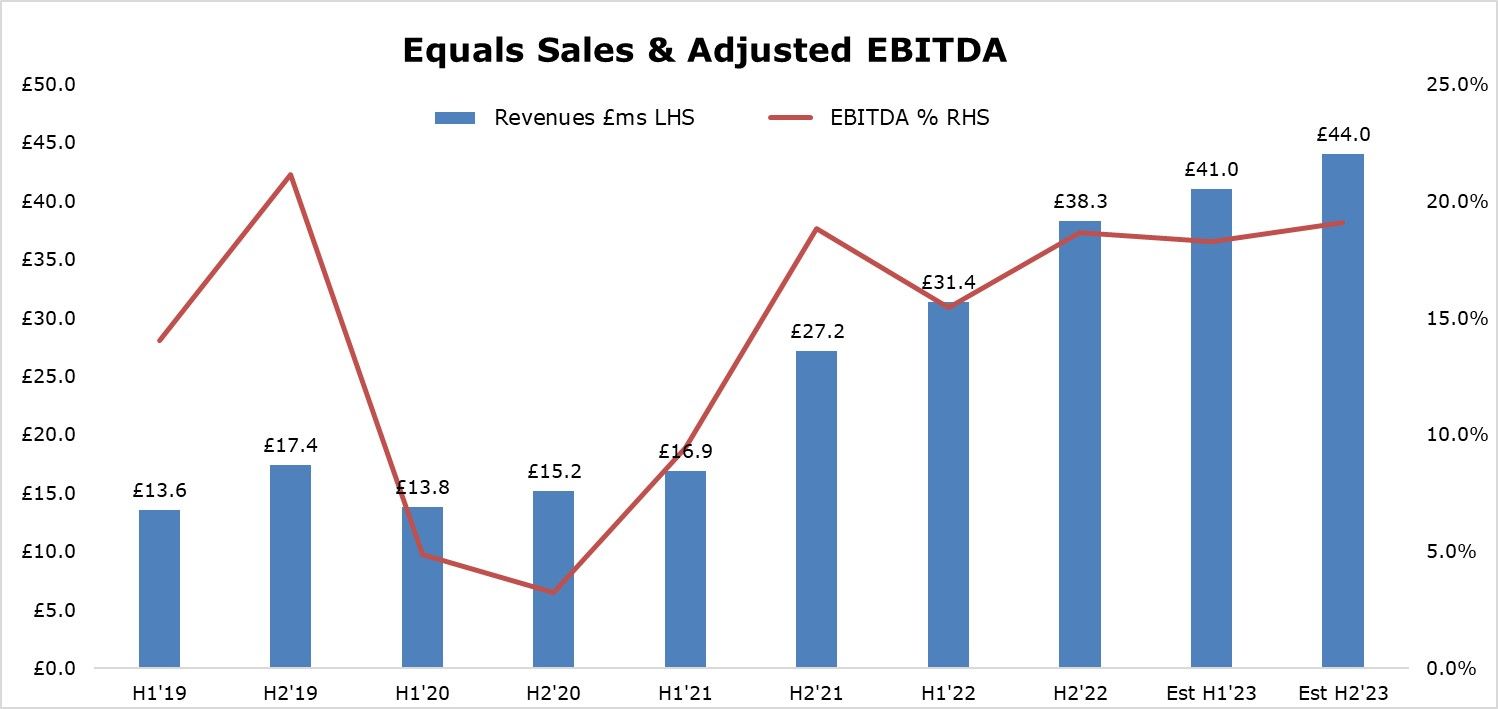

Four upgrades later, the firm said this morning that it had delivered FY22 sales and EBITDA of £69.7m (+59% YoY) and £12.0m (+79%), respectively. Demonstrating its robust momentum, second half sales were up 22% to £38.3m against the first half, with revenues per day up 60% year on year. Positive operating leverage also boosted profitability, with H2 EBITDA margins hitting 18.7%, up from 15.5% in H1.

Sure there was an unusual uptick in client volumes in September due to the exceptional forex volatility. Yet equally, this simply brought forward demand from Q4 into Q3, and by the end of December, the overall effect on full year figures was negligible. In fact, the underlying year-on-year numbers were even better, as 2021 included £1.5m of ‘one-off’ revenues from a material trade, which delivered gross profits of £0.8m.

Looking ahead, what does this mean for 2023?

I believe Equals will once again deliver another impressive top and bottom line performance, with turnover and adjusted EBITDA expected to climb 22% and 32%, respectively, to £85.0m and £15.9m. At 92p, that leaves the stock -at 92p - trading at modest EV/EBITDA and PEG multiples of 10.2x and 0.3x, respectively. That compares favourably to my 160p/share valuation, especially given the healthy balance sheet with an estimated £10m net cash/liquidity.

CEO Ian Strafford-Taylor commented: “We have delivered a particularly strong financial performance in 2022 as the Group reaped significant benefits from operational gearing and economies of scale. This has been made possible as a result of prudent and sustained investments into the proposition, specifically technology and connectivity, since 2018.”

“That investment continued throughout 2022, supporting and enabling rapid growth, and will continue through 2023 as we target investment into an exciting roadmap of product development and growth initiatives that will expand our capabilities. We look forward to this year and beyond with confidence in our proposition, our teams, our technology and, ultimately, our sustained growth prospects”.

Preliminary results are scheduled for Monday 27th March 2023.