Should investors ‘run winners’ or ‘top slice’ after enjoying hefty gains? Clearly it depends on an individual's risk tolerance, time horizons & financial objectives.

However for me, if management consistently ‘knocks the ball out the park’, and there’s still plenty of gas left in the tank - then such stocks fall into Warren Buffet’s ‘hold forever’ camp.

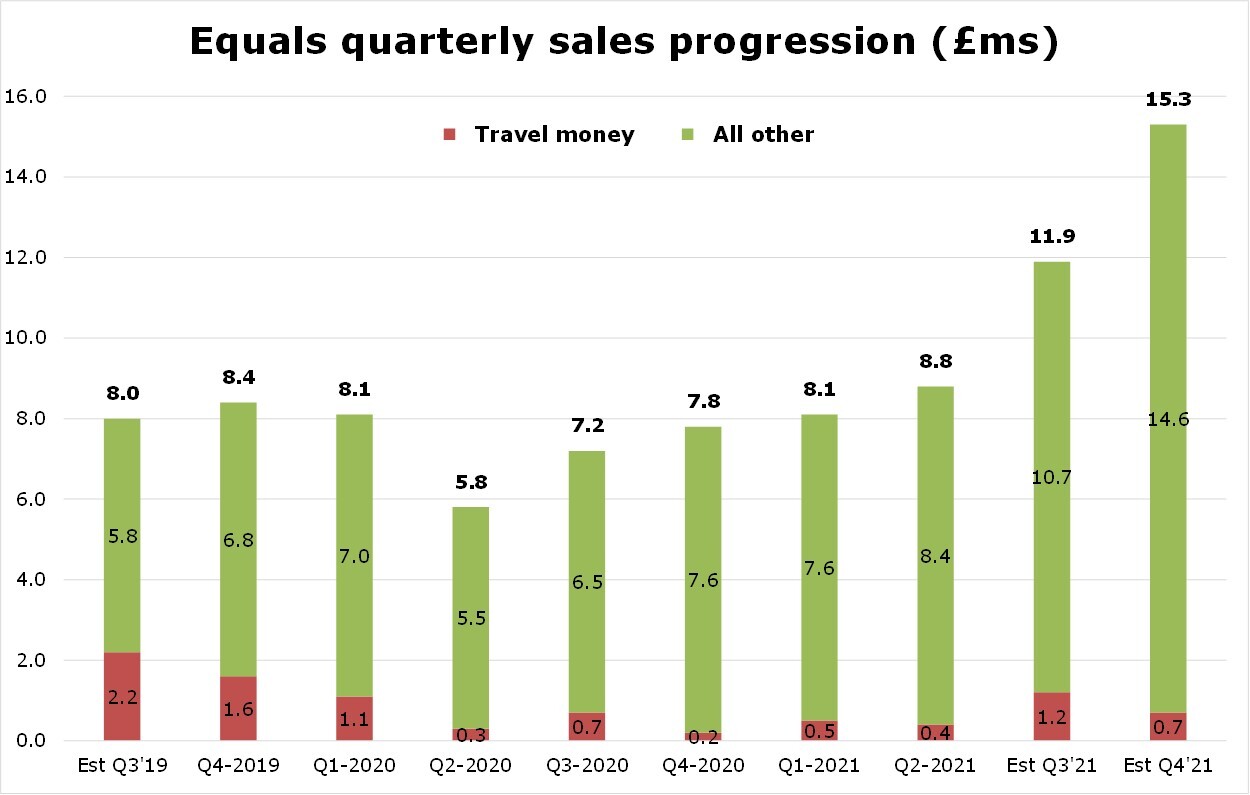

This is the case with B2B international e-payments & forex platform Equals Group (EQLS ) who today reported Q4 LFL turnover up 96% to £15.3m (or 73%, excl. a £1.5m one-off transaction) & +28% sequentially vs Q3’21.

Similarly closing Dec’21 with a higher than expected cash pile of £13.2m - or an est £10.6m net (pre IFRS16 & post deferred VAT) worth 5.7p/share.

Here there’s buoyant demand across the patch - especially for the group's rapidly expanding 'Solutions' – a multicurrency IBAN service for large corporates that has already generated £3.5m of sales since its launch in May’21 & £1.6m in Q4 - ‘Spend’ & white-label (eg HomeSend) platforms.

What’s more the outlook is upbeat, with CEO Ian Strafford-Taylor saying that EQLS will continue to invest in top line growth. Adding ”our repositioning as a B2B focused fintech off the back of our technology & product developments has differentiated us from our peers. We are extremely excited and confident in the future”.

Indicating, there’s ample opportunity to deliver further superior shareholder returns - even after the shares have trebled since the pandemic lows.

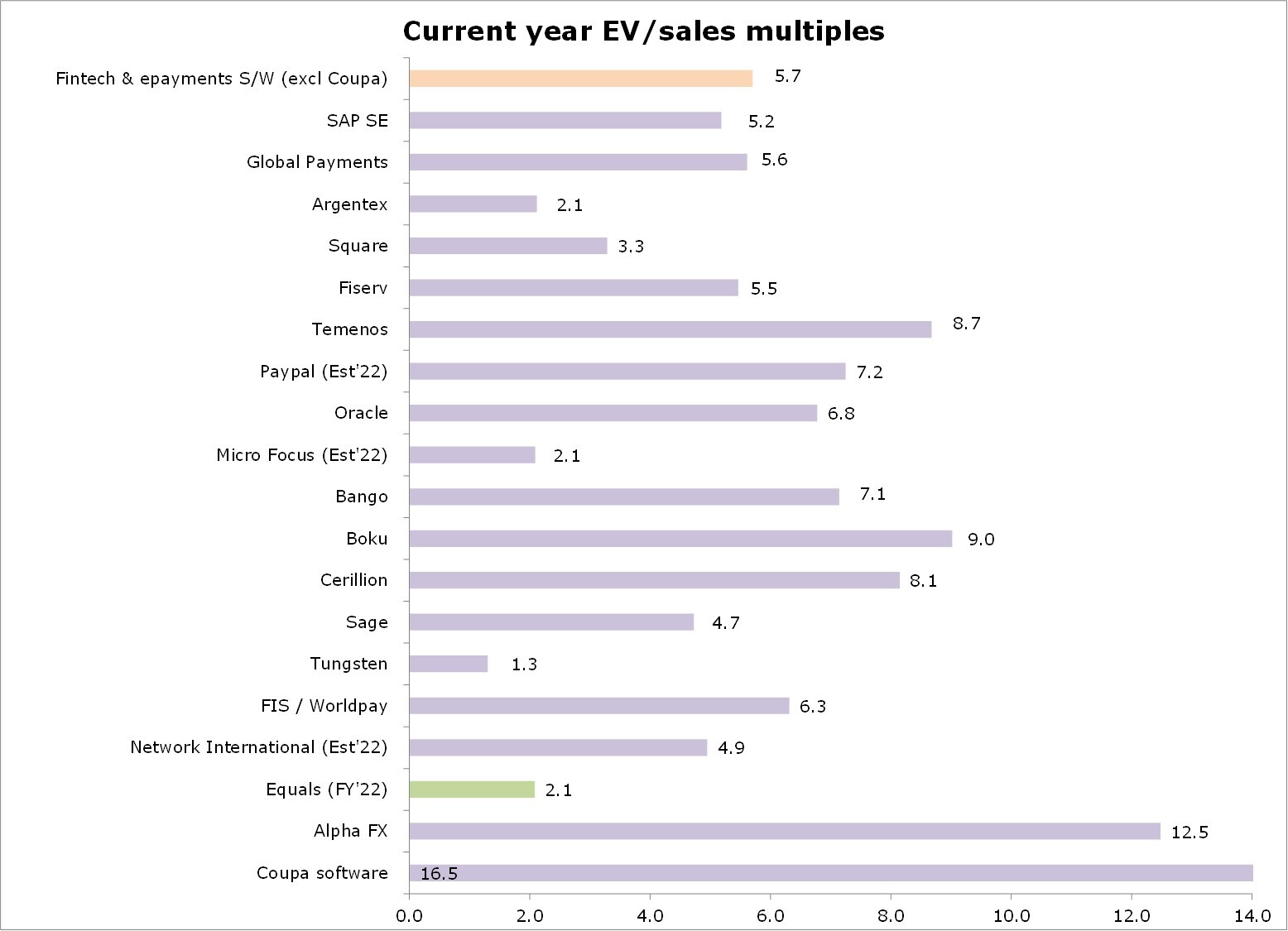

In fact, I’ve upgraded my FY22 sales forecast by 9% to £52.5m (+19% vs £44.1m FY21) producing an adjusted EBITDA of £8.4m (Est FY21 £6.2m) - despite absorbing an extra £1m-£2m of planned growth investment (re S&M, tech, etc).

Similarly lifting the valuation to 128p/share vs 112p before – equivalent to potentially 90% upside vs 67p today. A figure interestingly not too dis-similar either to what Judith MacKenzie of Downing LLP indicated (ie 80%) yesterday.

Plus these numbers could even prove conservative, particularly if the Board manages to maintain the momentum, consumer travel comes back (re overseas holidays) & EQLS ultimately becomes one of the few ‘go-to challenger platforms’ for all things’

B2B forex & international payments’ related.