Finding the next Winner based on a Previous Winner

Taking Stock: Friday 12th January 2024

Companies discussed on “Taking Stock” today:

00:45 JD Sports Fashion #JD.

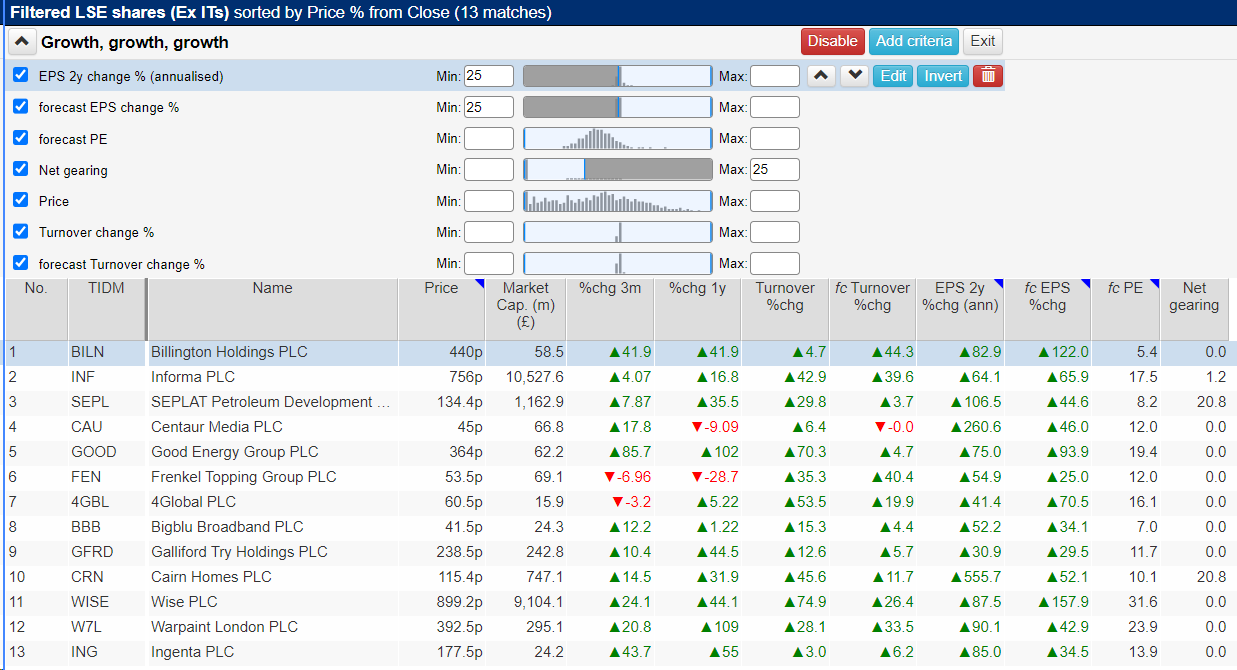

03:00 & 29:50 Warpaint London #W7L

07:30 Ingenta #ING

09:05 Billington #BILN

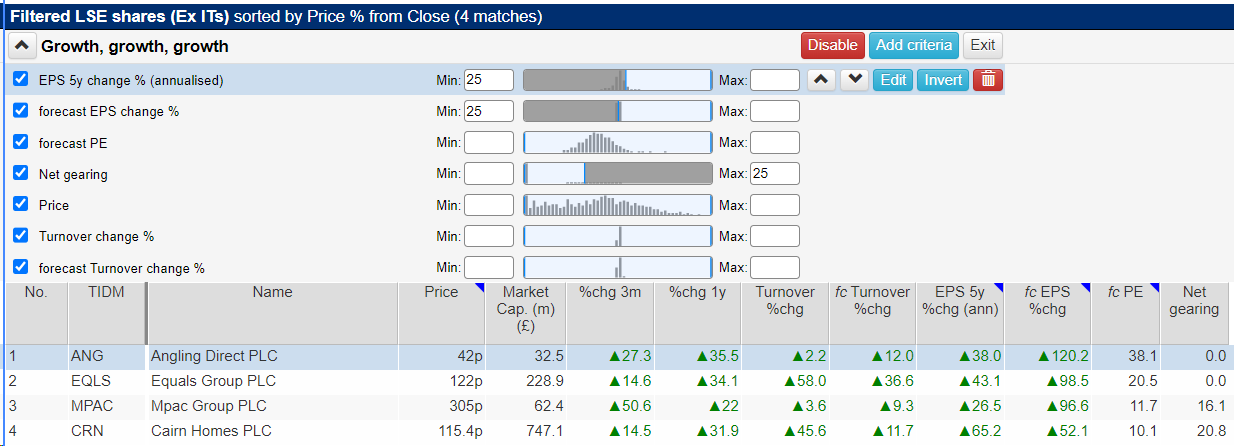

09:50 & 31:38 Angling Direct #ANG

10:50 Equals #EQLS

11:10 Cornerstone FS #CSFS

11:30 Cairn Homes #CRN

12:20 Canadian Overseas Petroleum #COPL

12:50 UK Oil & Gas #UKOG

13:10 Predator Oil & Gas #PRD

15:30 Vistry #VTY

17:46 Burberry #BRBY

30:50 Marks & Spencer #MKS

32:10 Hvivo #HVO

33:45 Focusrite #TUNE

37:20 Journeo #JNEO

48:15 Nichols #NICL

49:14 Ensilica #ENSI

50:50 Premier Miton #PMI

TOP BUSINESS STORIES

Stronger retail sales helped the UK's economy to rebound in November, but the risk of recession remains.

The economy grew by 0.3% in November, official figures show, after it shrank during the previous month.

The Office for National Statistics said the services sector led the rebound, as Black Friday sales boosted retailers.

But it said the economy had shown "little growth" over the past year and economists said it was a close call as to whether the UK can avoid a downturn.

While monthly growth was stronger than expected, the UK economy is in a fragile state and the ONS figures showed that in the three months to November, the economy shrank by 0.2%.

What do Red Sea assaults mean for global trade?

Global supply chains could face severe disruption as a result of the world's biggest shipping companies diverting journeys away from the Red Sea.

What is the impact on consumers?

It is inevitable that supply chains will be affected due to ships being diverted away from the Red Sea, but consumer goods "will face the largest impact", according to Chris Rogers, head of supply chain research at S&P Global Market Intelligence, though he does note the current disruption has occurred "during the off-peak shipping season".