In order to win championships, every great sports team needs resilience, adaptability and be proficient at both attack and defence. It’s no different for business either, adjusting quickly as economic conditions ebb & flow.

Similarly, Cake Box CBOX ,the UK’s ‘go to provider’ of specialty, fresh cream cakes , has successfully transitioned through the pandemic & is doing the same amid the cost-of-living crisis.

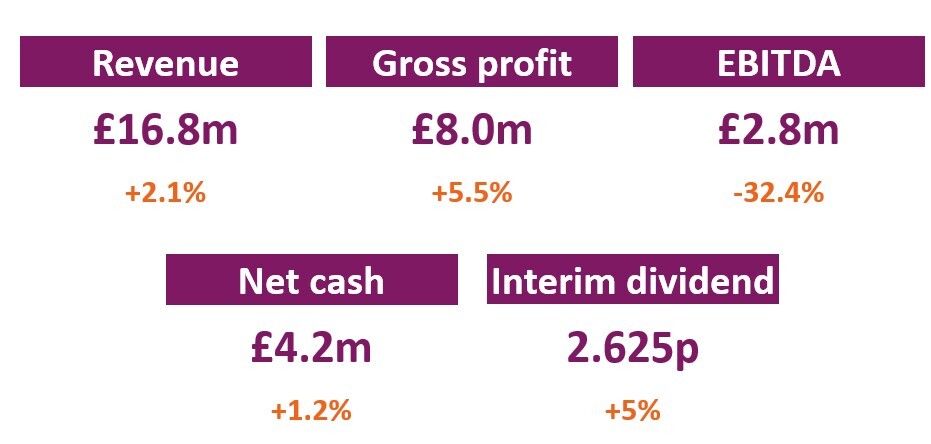

Indeed despite being buffeted by an un-seasonally hot summer, tough YoY comparatives, consumer belt tightening, elevated input costs and more overseas holidays, the company today still managed to report a 2.1% rise in H1’23 sales (LFL -1.1%) to £16.8m, higher gross margins (47.7% vs 46.2%), £2.0m adjusted PBT and a 5% increase in the interim dividend to 2.625p from £4.2m of net cash (£5.2m Mar’23).

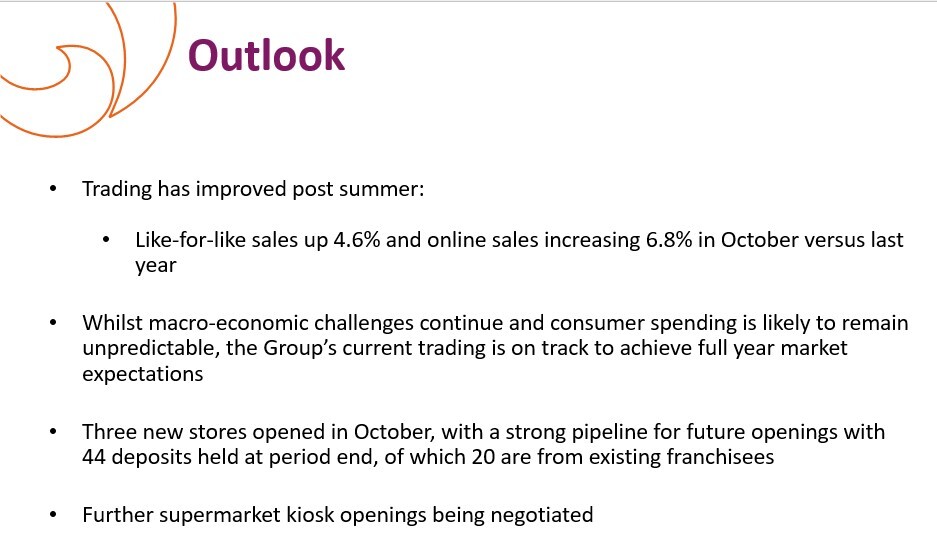

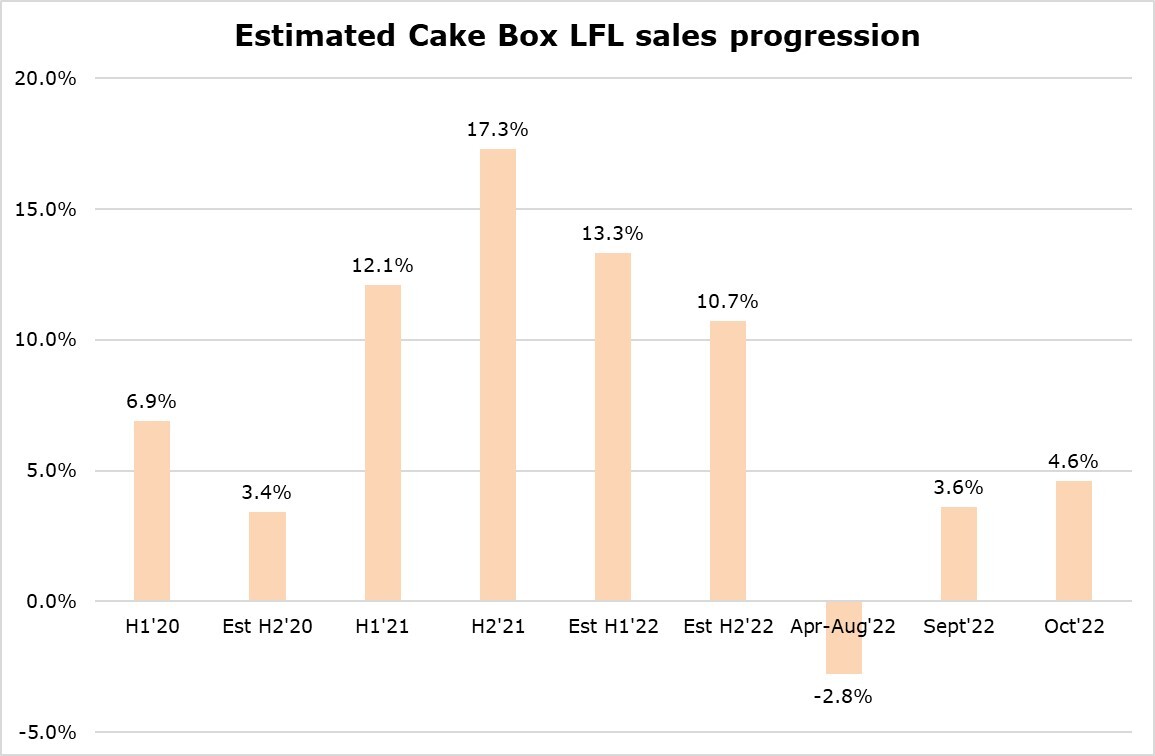

Better still, LFL revenues (see chart) have begun to accelerate from -2.8% between Apr-Aug’22, to 3.6% Sept and 4.6% in October (Online +6.8%) after positive digital marketing campaigns.

CEO Sukh Chamdal adding: “Encouragingly, the improvement in trading seen towards the end of H1’23 has continued into October. Whilst the Board remains cautious in light of the uncertain economic climate and the unpredictability in consumer spending, the Group’s current trading is on track to achieve full year market expectations”.Lastly as a sign of confidence, Mr Chamdal purchased 375k shares in Sept at an average price of 128.7p (£482.7k)

View from VOX

The Board’s FY’23 outlook remains on track to hit analyst expectations of adjusted PBT & EPS of £5.5m & 10.9p respectively on turnover of £35.1m (Shore Capital).Likewise, I suspect CBOX might even be winning market share, as smaller ‘mom & pop’ rivals suffer more in the austere environment. Longer term too, the firm continues to increase its geographic reach, invest in quality growth (eg refrigerated vans, new cheesecake production line, reduced waste, etc) along with having a strong pipeline of potential new franchisees and site deposits (44).

So, putting all this together, I would value the stock on a 12x-14x FY’23 EV/EBIT multiple. Which, adding in the cash, generates an intrinsic value between 180p-205p/share (vs 110p currently), together with paying a healthy 5.5p dividend (5.0% yield).

Elsewhere Liberum have a 250p price target.