Georgina Energy (GEX ) has signed a conditional deal with Central Petroleum (ASX: CPT) to acquire interests in three advanced re-entry targets in Australia’s Amadeus Basin, expanding its portfolio beyond Hussar and Mt Winter. The assets include interests in Mt Kitty (EP125 - 30% interest), Dukas (EP112 - 45% interest) and Mahler/Magee (EP82 - 60% interest).

The EPs are subject to existing joint operating agreements (JOAs) with Santos QNT Pty Ltd.

The targets have been previously drilled and flowed to surface with high concentrations of helium, hydrogen and hydrocarbons. Notably, Mt Kitty flowed 500,000 standard cubic feet per day to surface with up to 9% helium and 11% hydrogen, alongside around 40% hydrocarbon gases. At least one well in the basin has a recorded presence of Helium Isotope 3 (3He).

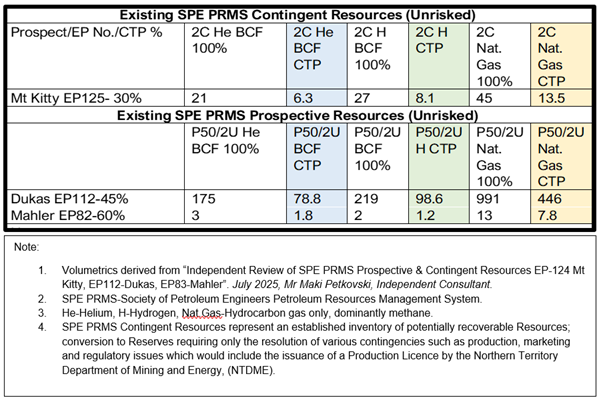

Dukas is described as a mega-structure and potentially the largest identified helium, hydrogen and hydrocarbon prospect to date in Australia. The company intends to convert existing contingent and prospective resources to proven and probable reserves where applicable.

At Mt Kitty, Georgina is evaluating a re-entry well that would incorporate a 500 metre horizontal section aimed at enhancing flow from naturally fractured basement and potentially intersecting the flanking Heavitree Sandstone play.

On completion of the transaction, Central Petroleum would hold 25% of Georgina Energy. The deal remains subject to Ministerial consent from the Northern Territory Department of Mining and Energy, Santos' consent under the relevant JOAs to the change of ownership, a shareholder vote and a fundraise of at least £7 million.

“We are delighted to sign a transformational transaction with Central Petroleum, which, if completed, would bring enormous upside for shareholders and longevity to our business,” said Georgina Energy’s Chief Executive Anthony Hamilton.

“A naturally fractured reservoir, Mt Kitty (EP125) already has drilled 2C Contingent Resources, which the Company plans to convert to Proven and Probable Reserves, adding valuable production barrels and cash flow to Georgina's portfolio. We're excited to explore Dukas, as a considered mega structure, as well as develop Hussar and Mt Winter, as planned. This transaction takes Georgina to the next level in achieving our strategy to become a leading producer of helium and hydrogen and we look forward to working with both Central Petroleum and Santos to take these assets forward.”

View from Vox

If completed, this acquisition would materially scale Georgina’s helium and hydrogen exposure with advanced, data-rich re-entry targets. Prior flows and strong gas compositions at Mt Kitty, plus the size case at Dukas, offer a pathway to reserves and potential near-term cash flow, though timing hinges on approvals and financing.