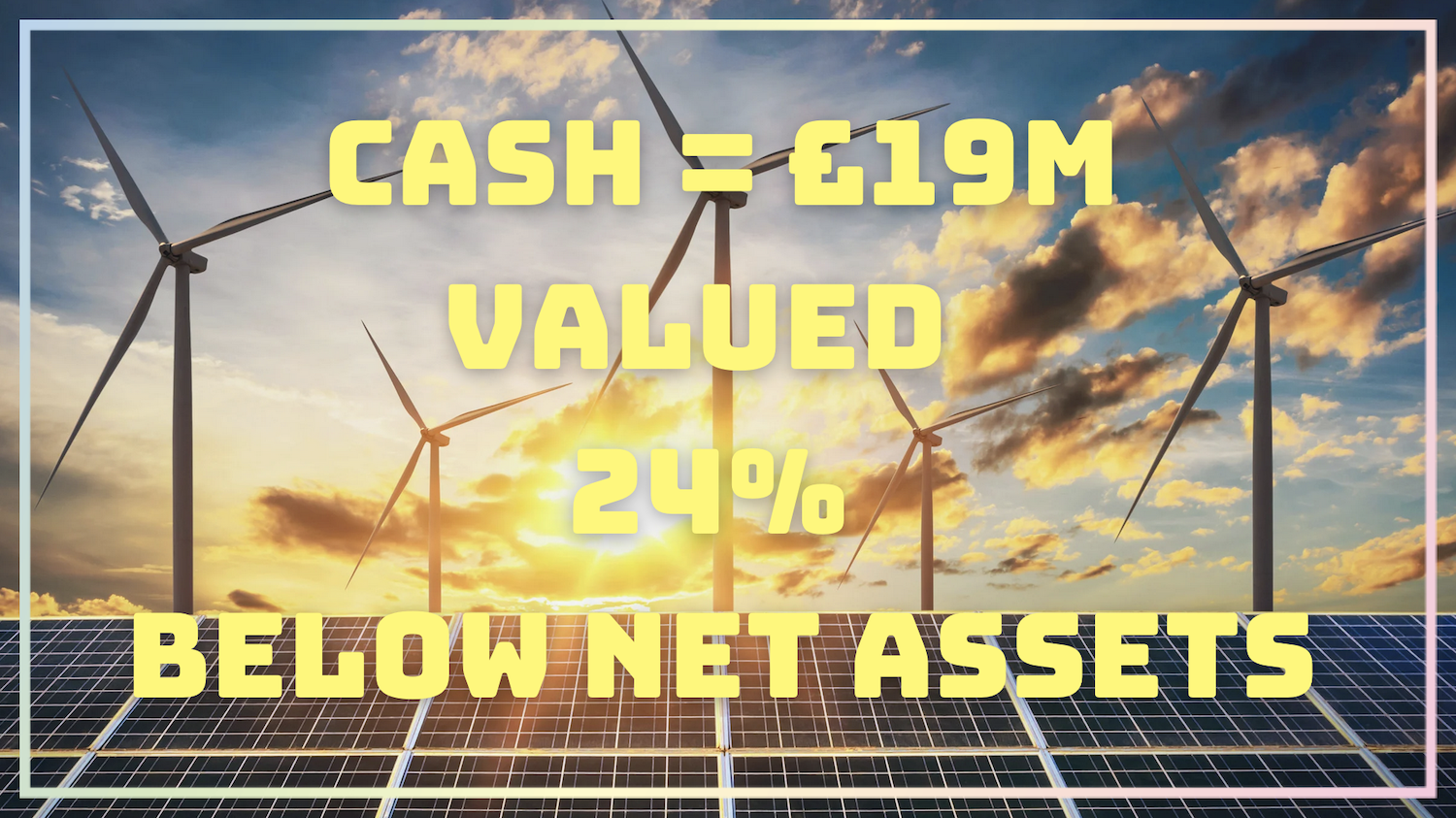

Good Energy has just released a trading update where they stated their cash and restricted deposits at the end of May increased to £38m, higher than their current valuation. Their Net Asset Value is greater than their current market capitalisation plus they are profitable and exist in a hot growing sector. In this video I look at the company’s valuation, broker forecasts and workout if there’s potential upside.

Good Energy #GOOD is a supplier of 100% renewable power and an innovator in energy services. It has long term power purchase agreements with a community of 1,700 independent UK generators.

Since it was founded 20 years ago, the Company has been at the forefront of the charge towards a cleaner, distributed energy system. Its mission is to power a cleaner, greener world and make it simple to generate, share, store, use and travel by clean power. Its ambition is to support one million homes and businesses to cut carbon from their energy and transport used by 2025.

Good Energy is recognised as a leader in this market, through green kite accreditation with the London Stock Exchange, Which? Eco Provider status and Gold Standard Uswitch Green Tariff Accreditation for all tariffs. In this video I look at the company’s valuation, broker forecasts and workout if there’s potential upside.