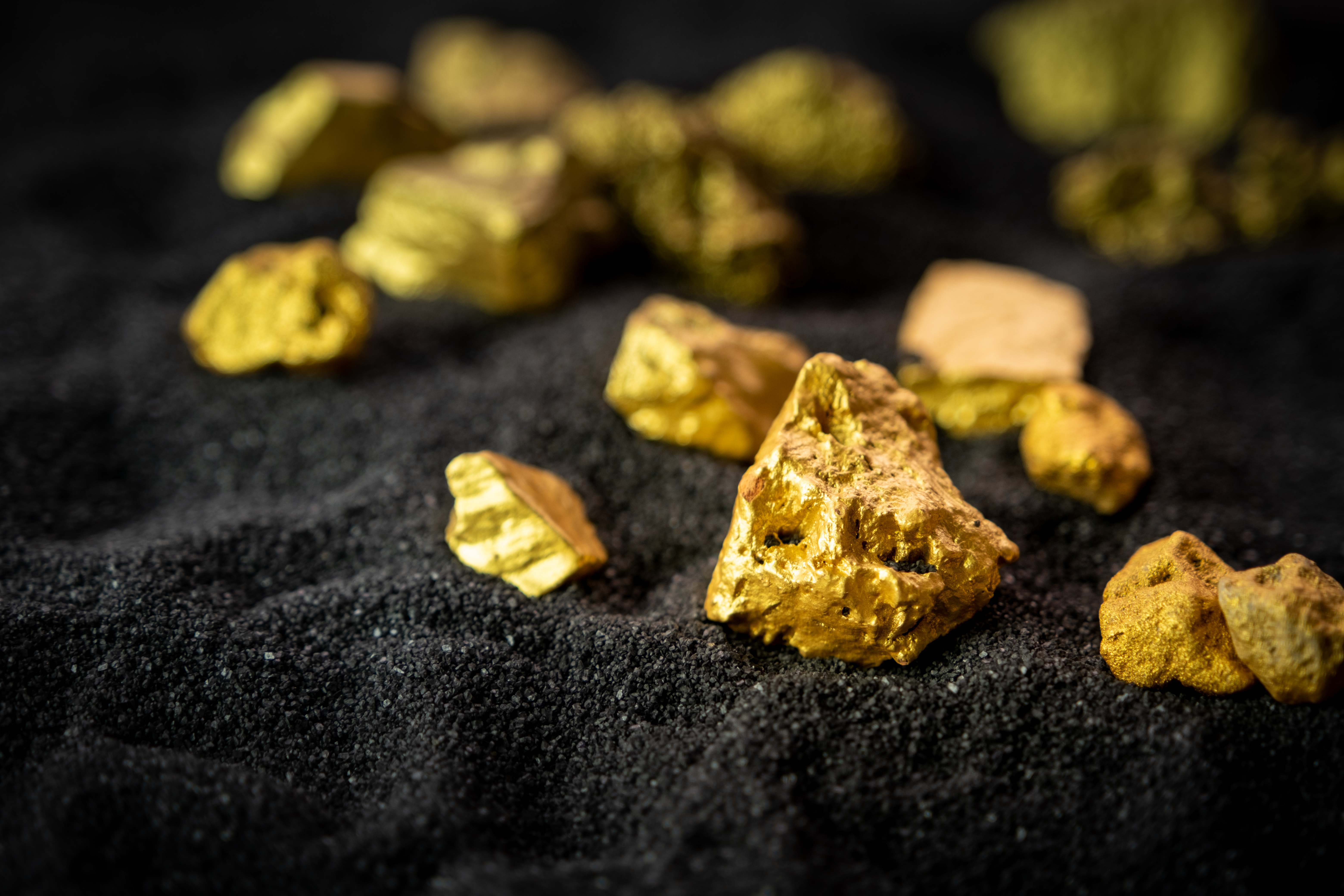

Hummingbird Resources (HUM ), an Africa-focused gold explorer, announced first gold pour at its Kouroussa gold mine in Guinea. Kouroussa was commissioned in early May 2023, and having achieved first gold pour, the mine is now expected to ramp up to commercial production during H2 2023.

Kouroussa is Hummingbird's second operating gold asset in West Africa, expected to produce an average of 120,000 to 140,000 oz of gold in the first 3 years of commercial production, and an average of 100,000 oz per year over the current life of mine (LOM) at an AISC profile of c. US$1,000 per oz.

With Kouroussa operational, Hummingbird's production is more than doubled to 200,000+ oz per year, transforming it into a multi-asset, multi-jurisdiction gold producer. With first gold pour achieved ahead of Q2 schedule, Hummingbird is now focused on ramping up to name plate production, expected in H2 2023.

Underpinned by a US$17.1m fundraise completed in March, further exploratory drilling is taking place at Kouroussa with potential LOM upside expected in H2 2023. A more detailed update on company-wide FY 2023 guidance is expected later this year.

At Yanfolila, Hummingbird's other West African asset in Mali, performance improved significantly in Q4 2022 and Q1 2023 following production challenges last year. Yanfolila is now cashflow positive with a view to bring online its underground mine by year end for a full year of production in 2024.

Earlier in the week, Hummingbirds announced full-year results for FY 2022. Hummingbird generated sales of US$143.3m (FY21: US$156.6mn) from 80,445 oz of gold sold in FY22 at an average price of US$1,782/oz (FY21: 87,553 oz sold at an average price of $1,788/oz), with additional US$7.0m (FY21: US$6.2m) of revenue generated from sale of Single Mine Origin (SMO) gold. Gold production was 28,264 oz at an AISC profile of US$1,248 per oz, leading to a materially improved group EBITDA of c. US$11m for Q4 2022.

Hummingbird's reserves increased significantly to 4.13 million ounces (Moz), compared to 1.12 Moz in FY21, following extensive drilling campaigns completed at Yanfolila and Kouroussa in 2021 being converted into Reserves, and the completion of a Definitive Feasibility Study (DFS) in June 2022 on Dugbe in Liberia.

The DFS at Dugbe was completed by JV partners Pasofino Gold. The DFS showcased a high pre-tax NPV of US$690m (US$530m post tax), a significant 2.76Moz reserve base, long life of mine of 14 years, with upside given material exploration potential available, and a low AISC profile of US$1,005 per oz.

With Yanfolila's performance materially improving and Kouroussa operational, Hummingbird is at a value inflection point. After a tripling of its reserves to 4.1Moz last year, the company has strong momentum into H2 2023 and beyond.

Follow News & Updates from Hummingbird Resources: