Taking Stock on Tuesday 5th December 2023

If cash is King, then this small cap is British Royalty

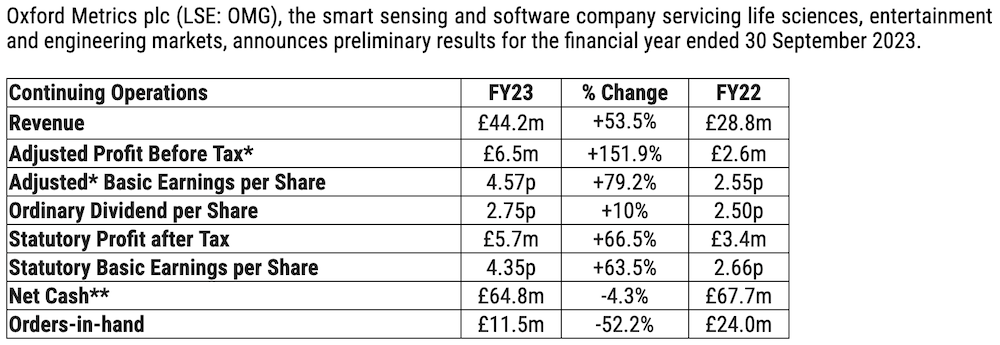

Oxford Metrics #OMG

Market Cap = £118.68

Cash = £64.8m

Roughly 55% of their market cap is cash.

Companies discussed on “Taking Stock” today:

02:50 & 19:59 BT Group #BT.A

04:30 Barratt Developments #BDEV

09:50 Oxford Metrics #OMG

12:29 Water Intelligence #WATR

15:57 & 20:25 Premier Miton #PMI

21:20 Fintel #FNTL

23:05 Diversified Energy #DEC

23:28 Valrix #VAL

24:10 Helium One Global #HE1

24:25 Gfinity #GFIN

24:40 On the Beach #OTB

27:15 SSP Group #SSP

28:20 TinyBuild #TINY

30:10 Team17 #TM17

31:55 Quiz Plc #QUIZ

34:53 Solid State #SOLI

36:25 CML Microsystems #CML

37:30 Gooch & Housego #GHH

39:50 Velocys #VLS

40:30 Marstons #MARS

46:15 Future #FUTR

TOP BUSINESS STORIES

Britain's dominant services sector rebounds, cost burdens persist

Activity in Britain's services sector grew in November after three months of declines, a survey showed on Tuesday, but companies reported an uptick in prices charged, a potential concern for the Bank of England ahead of its interest rates decision next week.

The final UK Services Purchasing Managers' Index (PMI) rose to 50.9 from 49.5 in October, above the 50 threshold for growth, and stronger than the 50.5 provisional estimate for November.

UK grocery inflation slows again

Market researcher Kantar said annual grocery inflation was 9.1% in the four weeks to Nov. 26, down from 9.7% in last month's report. It said grocery sales rose 6.3% year-on-year over the same period, with 28.4% of sales made on promotion, the highest in over two years.

The researcher said the average cost of a frozen turkey Christmas dinner for four with all the trimmings, Christmas pudding and sparkling wine was up 1.3% at 31.71 pounds ($40.00), with Brussels sprouts and the pudding cheaper year-on-year.

UK pub group Marston's says Christmas bookings ahead of year-ago levels

Marston's said Christmas bookings were ahead of year-ago levels after the British pub group posted a lower-than-expected jump in annual profit.

Shares in the FTSE midcap company, which operates more than 1,400 pubs and bars, fell more than 2% in early trading.

The industry is hoping to usher in customers as Britons gear up for the holiday season in a year blighted by a prolonged cost-of-living squeeze and gloomy macroeconomic outlook.

"We anticipate an improving outlook in which cost headwinds are largely abating and like-for-like sales are up over 7% since the year-end," Chair William Rucker said in a statement.

The pub chain, which has not declared a dividend since 2020, forecast 2% margin growth in the medium term after posting an underlying operating margin of 14.3% for the 2023 fiscal year.

Peel Hunt analysts wrote in a note that the company continued to "outperform the market", adding that energy costs and a significant proportion of food and drink costs were fixed for the current fiscal year.