Welcome to taking stock on.... Monday 31th July 2023

Taking Stock: Is a look at today's top business news & investment views plus we cover the winners, losers, the most read company news & the most followed. Today this includes:

SUBJECT OF THE DAY

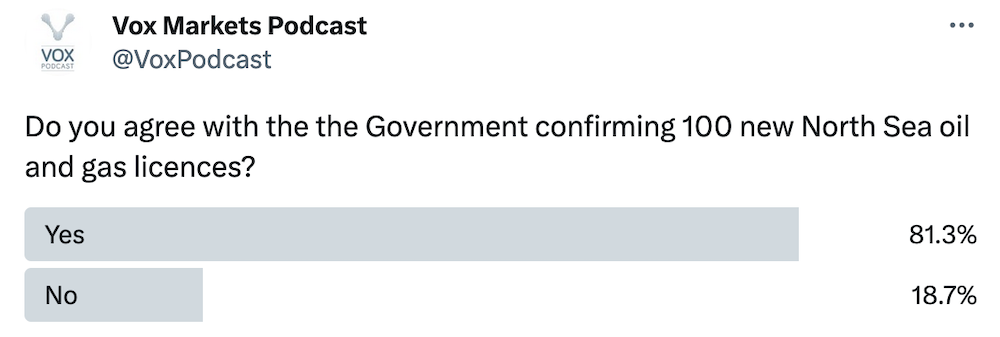

Do you agree with the the Government confirming 100 new North Sea oil and gas licences?

RISERS

Scancell Hlds - Modi-1 trial open for expansion in CPI combination

Modi-1 trial open for expansion in combination with checkpoint inhibitors

· Safety review committee has approved cohort expansion into renal and head and neck patients who receive CPI as standard of care alone and in the neoadjuvant setting

· Cohort 4 of the ModiFY trial showed that the higher dose Modi-1 in combination with CPI was well tolerated with no safety concerns

Scancell is a clinical stage biopharmaceutical company that is leveraging its proprietary research, built up over many years of studying the human adaptive immune system, to generate novel medicines to treat significant unmet needs in cancer and infectious disease.

The Company is building a pipeline of innovative products by utilising its four technology platforms: Moditope® and ImmunoBody® for vaccines and GlyMab® and AvidiMab® for antibodies.

FALLERS

Aptamer Group - Fundraise, Proposed Board Changes, RPT, GM Notice

Firm Placing, Conditional Placing and Subscription to Raise £3.6 million & Proposed Board Changes

Aptamer Group the developer of novel Optimer® binders to enable innovation in the life sciences industry, is pleased to announce that it has conditionally raised £3.6 million (before expenses), including approximately £0.3 million from Existing Directors, Proposed Directors and PDMRs, by way of a placing and subscription at an issue price of 1p per share for working capital purposes.

Dr Ian Gilham (Executive Chairman), Dr Rob Quinn (Interim Chief Executive Officer and Chief Financial Officer), Dr John Richards (Non-Executive Director) and Angela Hildreth (Non-Executive Director) have resigned and have agreed to forego payment in lieu of notice.

MOST READ RNS

Harland & Wolff - Letter of Intent – Major Vessel Refurbishment

Harland & Wolff Group is pleased to announce that it has been issued a Notice to Proceed for the mid-life upgrade and dry docking of a large vessel. Harland & Wolff was chosen by the client for its ability to execute on a complex mid-life upgrade utilising the Company's market leading drydock in Belfast, the largest in the UK.

Subject to formal execution of the contract, the vessel is expected to be in the dry dock for a period of five months through early 2024 and the contract value is expected to be in the region of £60 million - £70 million, dependent on the extent of final works undertaken.

As part of the overall project delivery, a sum of £5 million will be made available to the Company immediately to commence various workstreams in 2023 prior to the arrival of the vessel. Apart from the initial sum, this LoI is non-binding and will be subject to execution of a formal contract that is expected within 2-3 months.

Polarean Imaging - Clinical imaging with XENOVIEW in Missouri

University of Missouri Health Care to begin clinical imaging with XENOVIEWTM

Conversion is a key milestone in execution of commercial plan

Polarean Imaging plc (AIM: POLX), a commercial-stage medical device leader in advanced MRI scanning of the lungs, announces it has upgraded the University of Missouri Health Care ("MU Health Care") Department of Radiology's polariser system to a clinical configuration, and has delivered a gas blend cylinder for the production of XENOVIEW (xenon Xe 129 hyperpolarised).

RNS WORTH READING

Metals One - Admission to AIM & First Day of Dealings

Metals One, which is advancing battery metal projects at brownfield sites in Finland and Norway, is pleased to announce the admission of its entire issued share capital to trading on AIM.

Raising gross proceeds of £2.2 million.

Strategic Highlights

· European brownfield battery metals projects with approximately £9 million of exploration carry exposure through farm-in agreements

· Projects are either adjacent or analogous to other world-class high-purity nickel sulphate deposits

· Projects are well-located to supply Europe's major electric vehicle Original Equipment Manufacturers ("OEMs") and battery manufacturers

Venture Life Group - Trading Statement for the six months ended 30 June 2023

Group revenues for the Period of £23.5m, a growth of 24.4% over last year, comprising growth from both the VLG Brands and Customer Brands, including the recent acquisition of HL Healthcare Limited ("HLH").

On a proforma1 basis revenue performance was 10.4% ahead of H1 2022.

Cash generated from operating activities of £4.6m (H1 2022: £1.8m), an increase of 158% over last year and improved operating cashflow conversion of c.99%

Order book increase of c.30% since end of the previous year, providing strong visibility over second half revenue and in line with management expectations.

Top Business Stories

The prime minister has announced millions of pounds of funding for a carbon capture project ahead of a visit to the north east of Scotland.

Rishi Sunak emphasised the role the region will play in the UK's wider energy security plans as he confirmed 100 new North Sea oil and gas licences.

The UK government said Scottish schemes would help it grow the economy and meet its 2050 net zero commitment.

But opponents say the Conservatives are "doubling down" on fossil fuels.

Will interest rates rise this week and, if so, by how much? Economist predictions

On Thursday we'll learn whether the Bank rate will rise for the 14th time in a row.

The rate is currently 5% having been raised at every opportunity since the end of 2021 as the Bank of England has sought to slow spending and encourage saving in a bid to control prices/inflation.

This month's lower than expected inflation figure - it dropped to a still-high 7.9% - means the Bank's decision is not as clear-cut as might have been anticipated a few weeks ago.

Investec Economics predicts the Bank will opt for a bigger 0.5 percentage point increase, before pushing through a final quarter-point hike in September.

Royal Mail: Final day for people to use non-barcoded stamps

Time is running out for people to use any standard non-barcoded stamps as Monday is the last day they can be used to post items.

After Monday, customers sending mail with these stamps risk the recipient being given a surcharge of £1.10.

However, commemorative and non-barcoded Christmas stamps will still be valid.