Tens of $bns is spent every year treating desperately ill people with lung cancer.

However, one missing tool in the doctor's bag that could literally transform survival rates - is the safe & accurate diagnosis of patients at the early stage of this awful disease.

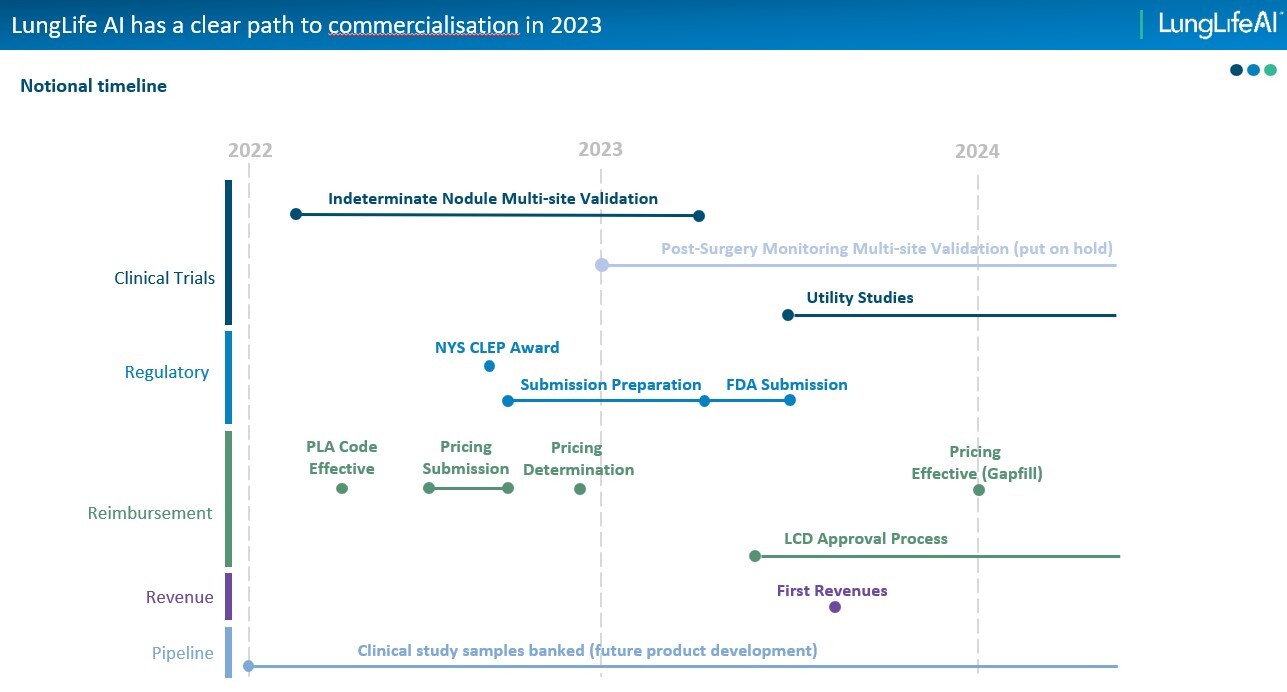

Step forward LungLife AI LLAI who today said it was bang on track for the US launch of its revolutionary new LungLB test sometime in H2’23.

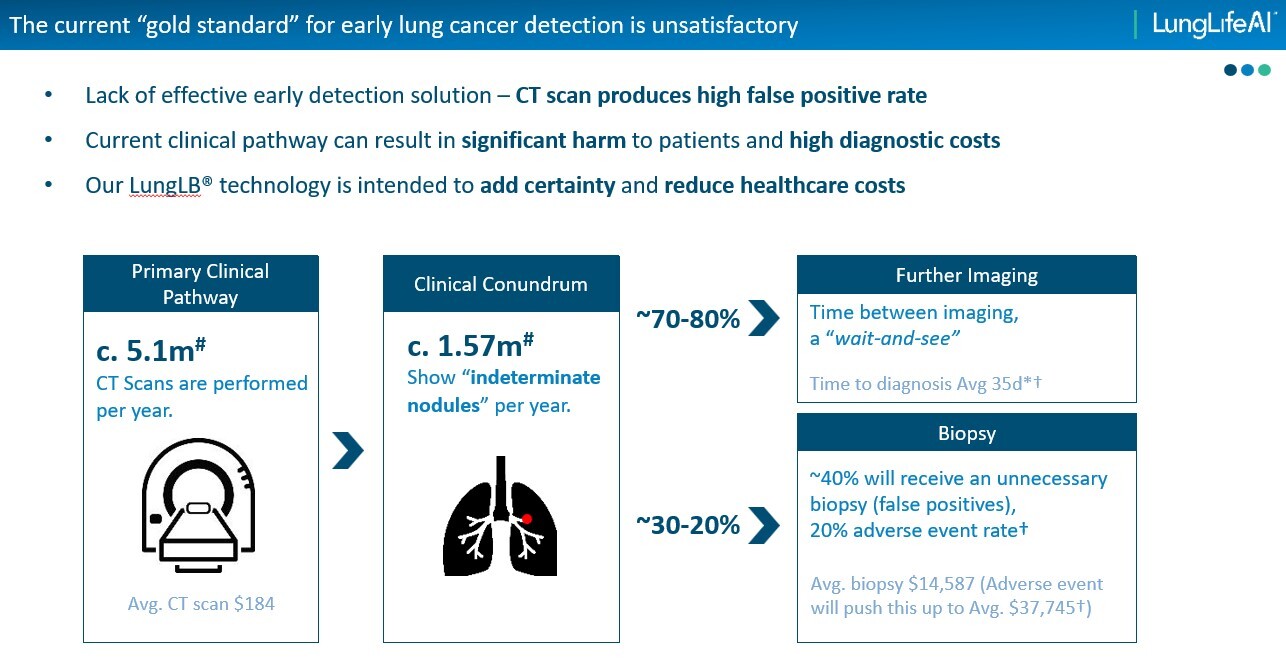

The beauty being that this simple blood based diagnostic works by harvesting circulating tumour cells (CTCs) and has a Positive Predictive Value of 89% vs the existing standard of care (ie CT scans) at 60%.

Indeed, assuming this significant improvement in performance is confirmed by the ongoing 425 patient validation trial - then it could ultimately open up a $3bn market in the US alone.

Elsewhere, #LLAI also has ample net cash ($10.6m June’22) to fund development well into 2024.Elsewhere, New York State approved LungLB for commercial use only 4 weeks’ ago – adding to its other 46 state authorisations.

The next key milestones being to obtain insurance/Medicare cover, alongside submitting the study results to the FDA. Albeit, formal approval is not actually required in order to sell diagnostic in the US. Instead, authorisation is planned to build on the diagnostics’ positive clinical data, industry credibility and regulatory backing. All helping to accelerate future adoption rates.

CEO Paul Pagano commenting: “Our validation study is well underway, having enrolled our first participant in February, and we remain on track to complete the study in Q1’23. Over the remainder of the year we are focused on progressing towards commercial reimbursement.” Chairman Roy Davis adding: Thereafter “Once enrolment is complete, we will then start the process of evaluating the results which we expect to be concluded by June 2023. With our CLIA license and CLEP permit, we expect to be able to begin commercialisation of LungLB in parallel with our preparation and submission to the FDA.”

View from VOX

So what might this mean in terms of potential upside?

Well, if eventually LungLife AI captured say a 5% share (or revs $150m) of the US market. Then on a hypothetical 5x EV/sales multiple, this would equate to a theoretical valuation of $750m, or >2,500p/share vs 120p today.

Lastly as another major endorsement of the science, LungLife AI is backed by Mount Sinai Health System (9.7% stake), and a “who’s who” of lung cancer experts on the advisory board. Together offering long term risk tolerant investors a stock with 'break-through medical science at a rock bottom price'.