How many online retailers are thriving amidst some of the most challenging conditions in a generation?

Marks Electrical MRK is one, who today said that it had seen growth accelerate during August & Sept (est 16.7% LFL) vs 13.7% in the 1st 4 months.

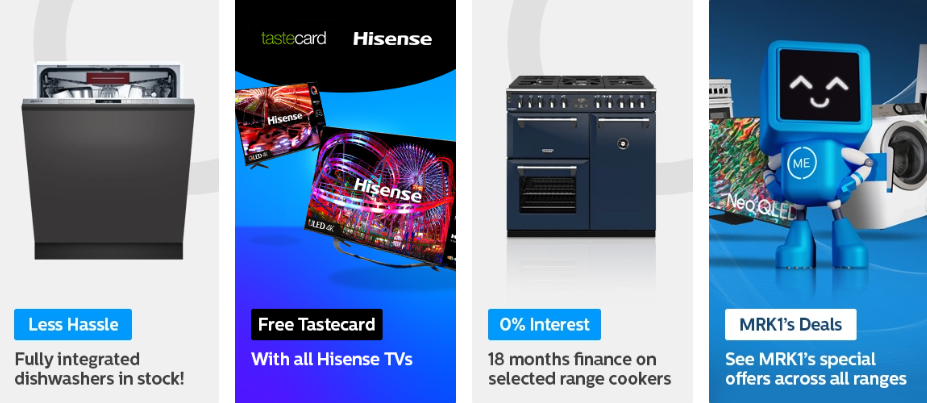

All told, posting H1’23 sales up 15.1% to £43.1m vs £37.5m LY, alongside taking market share ‘hand over fist’ from rivals such as John Lewis, AO World & Currys - after standout performances from TVs, cookers, vacuums & smaller appliances.

Better still, this is bang in line with FY’23 revenue, EBITDA, PBTA & adjusted EPS expectations of £92.1m, £7.3m, £6.1m & 4.7p respectively (source: Panmure Gordon).It's not difficult to see why either. Indeed, I purchased a Bosch dishwasher from #MRK in June and was delighted with the fabulous customer service (re Trustpilot score of 4.8). The machine was fully installed in around 30mins by trained experts (Lee & Allan no less). Not only removing & recycling the old ‘broken' device at a terrific price - but also fitting the new one 2 days earlier than I'd originally planned.

Elsewhere, H1’23 cash generation was strong too, with net funds (ex IFRS16) closing Sep’22 at £7.7m (7.3p/share) - or almost double March’s £3.9m balance - thanks to disciplined working capital management (e.g. faster stock turns).

Sure H1’22 profit margins were impacted due to greater discounting by competitors, & higher digital advertising costs. Yet equally, this is anticipated to ease in H2 - which combined with tight cost control - should further enhance operating leverage over the important Xmas period.

Mr Smithson commenting: “After a solid 1st 4 months, the Group’s positive trading momentum has continued in August & September, as we continued to harness our market-leading customer service proposition and build brand awareness. Enabling the Group to deliver continued revenue growth and market share gains.”

“The strong competitive activity we saw in pricing during Q1’23 has begun to ease more recently. And despite the margin pressure this has had in H1’22, we remain focused on controlling our overhead base and confident of achieving our full year targets.”

View from Vox

This could be just the beginning of the recovery story for Marks, post a macro driven sell-off for anything consumer related.

Ultimately CEO & founder Mark Smithson want to lift turnover to £540m - equivalent to a 10% market share vs circa 2.1% currently. Which, assuming a sustainable 8% EBITDA margin and a 10x-12x multiple, would generate a hypothetical 400p-490p/share valuation.

Lastly at 56p, the stock trades on attractive EV/EBITDA & PE multiples of 7.0x & 11.9x - with house broker Panmure Gordon having a target price of 120p/share, offering investors a >110% potential upside for today's patient investors.