88 Energy (88E), the Alaska-focused oil producer and explorer, has announced that the Hickory-1 ice pad construction – part of its 75%-owned Alaskan Project Pheonix acreage in the state’s North Slope - is almost complete, and pre-spud operations are on schedule.

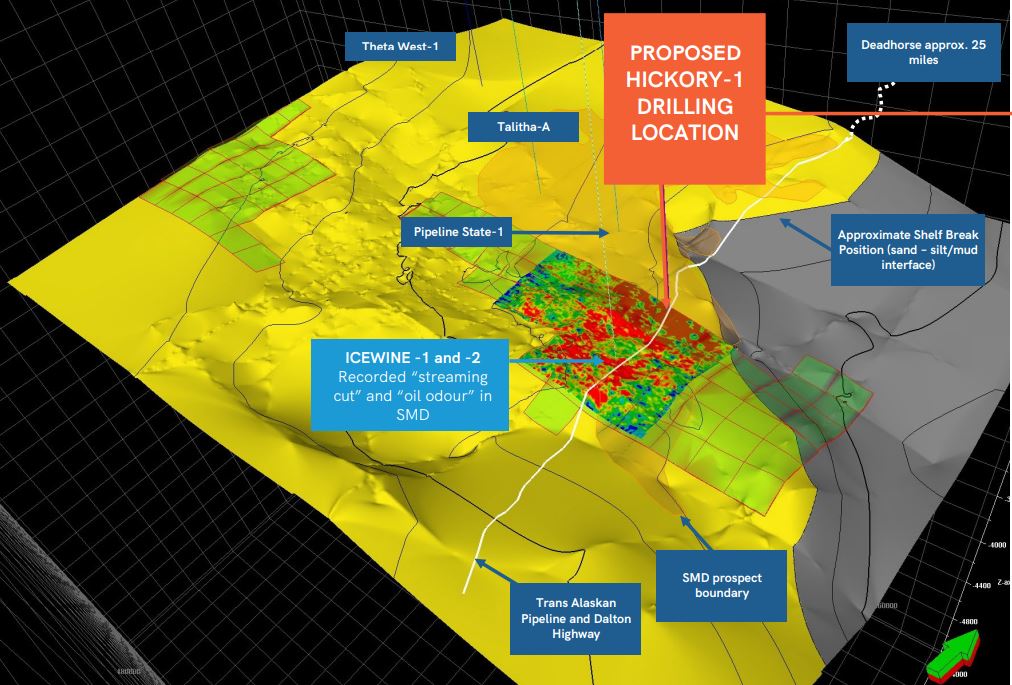

The well is designed to appraise up to six conventional reservoir targets within the SMD, SFS, BFF, and KUP reservoirs and is permitted to a total depth (TD) of up to 12,500 feet. The primary targets for the well are the 3 SMD reservoirs, with the SFS and BFF reservoirs considered secondary targets.

The KUP reservoir is a tertiary target and will be drilled subject to time remaining in the season, borehole conditions, and other technical considerations. The Hickory-1 spud is expected to occur in early March 2023, and flow testing of the well is planned to be undertaken during the 2023/24 winter season, subject to well results.

Separately, the company reported that the Alaskan Department of Natural Resources had approved the formation of 88’s Toolik River Unit covering the western and central leases of the Project Phoenix acreage and our plan of exploration, which the company’s managing director described as “further demonstration of the strong support that 88 Energy, and the broader industry, enjoys from the State of Alaska".

Following the approval, Accumulate Energy Alaska Inc – a wholly-owned subsidiary of 88 Energy -will review and analyse 3D data to determine optimal drilling locations for future exploration and appraisal wells, while drilling activities consist of drilling the Hickory-1 vertical exploration well during the 2022/2023 winter drilling season and performing a flow test in the 2023/2024 season.

If the Hickory-1 exploration well is successful, the Project Pheonix JV will consider re-entering the Icewine-1 well for short-term production tests or drilling and flow testing a new delineation appraisal well in a subsequent season. Additionally, plans may include drilling a horizontal production test well and acquiring new 2D seismic data over the eastern portion of the Project Phoenix acreage.

View from Vox

The latest news marks welcome progress after an oversubscribed A$17.5m (£10.1m) discounted placing was completed earlier this month to accelerate development of Project Phoenix . That leaves the company with sufficient funds to cover the next 12 months' activities, with a focus on the Hickory-1 drilling targeting 647m barrels of oil, as well as payment for the acquisition of the nearby 25,600-acre Project Leonis.

Like Phoenix, Project Leonis is strategically located adjacent to the Trans-Alaska pipeline system and Dalton Highway. Leonis targets the Upper Schrader Bluff (USB) reservoir, which has been successfully developed at the nearby Orion, Polaris, West Sak, and Milne Point oil fields. 88 Energy's seismic data indicates the USB prospect appears to be bound by faults on three sides, potentially trapping the oil resource.

Broker Cenkos has a target price of 1.3p, almost double the current share price.