One common mistake made by novice investors during market turbulence, is to sell good companies and hang on to bad ones - as the saying goes, “cut the flowers, but keep the weeds.”

Not so for canny long term shareholders, who instead use volatility as a way to increase their stakes in high quality stocks like Equals (EQLS) an international payments and fintech platform focused on the business-to-business market (80% of revenues).

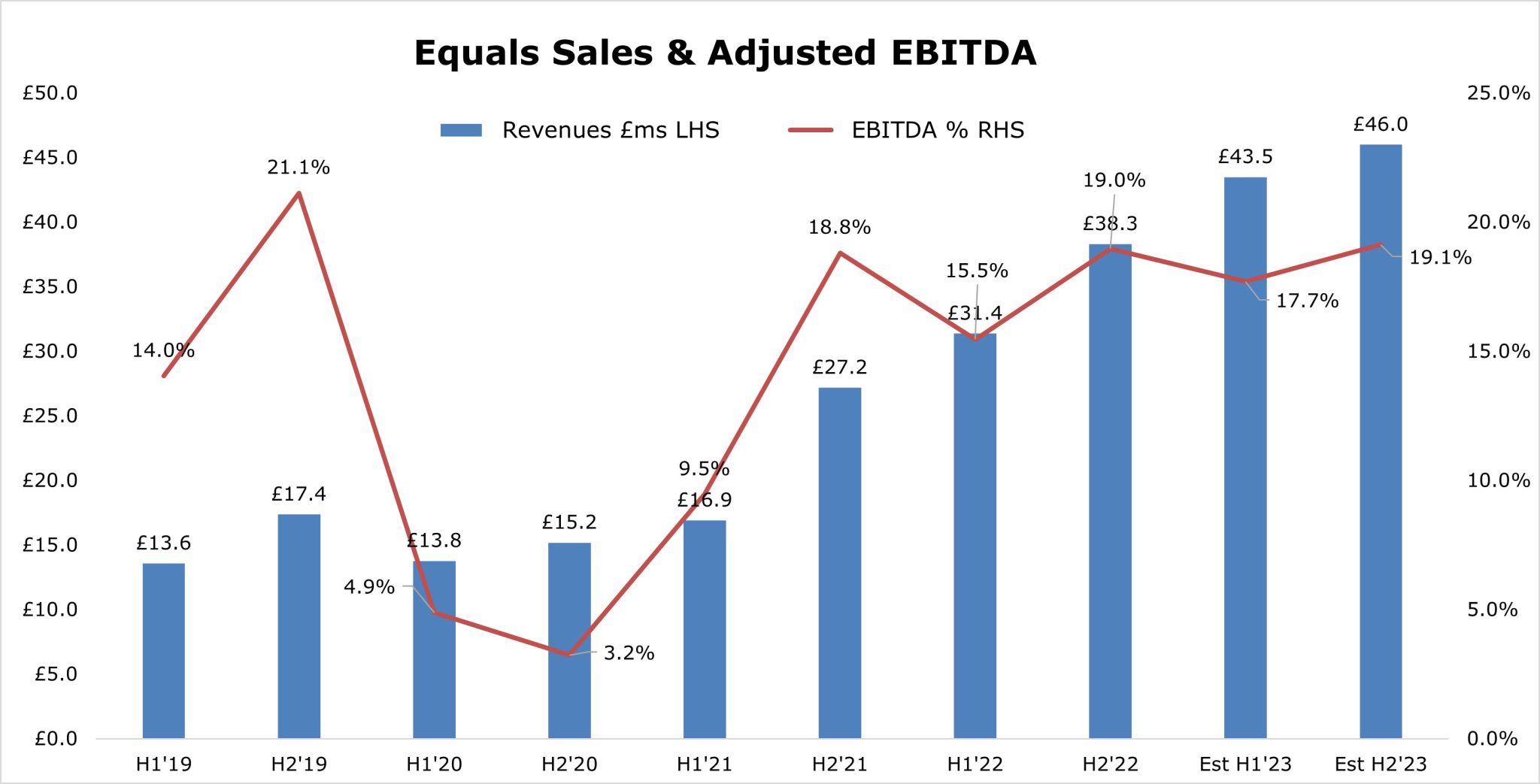

Today, the company released hat-tipping FY22 results, with adjusted EBITDA up 81% to £12.1m on turnover 58% higher at £69.7m.That was driven by standout performances from Solutions (+336%, £15.6m) and forex payments (+33%, £34.4m).

Equals has also enjoyed an impressive start to 2023, with revenues climbing 54% so far in 2023 to £20.2m (from £13.2m last year). That's thanks to continued momentum at Solutions, and more SMEs/corporates reaping the rewards of using its bank grade straight-through-processing technology.

Elsewhere, FY 2022 EBITDA margins rose 1.0% to 18.4%, on the back of higher sales per working day (up 52% year on year to £342k in the quarter to date) and improved operating leverage. Similarly FY22 adjusted EPS came in at 3.0p from breakeven last year - that's delivered year-end net liquidity of £14.3m and £1m/month of positive cashflow on average in Q1 2023.

Management have been busy too on the M&A front, not only integrating the £2.25m strategic acquisition of open banking platform Roqqett with FairFX, but also disposing of the legacy travel cash division (revenues of £1m) for up to £350k, and buying UK forex broker Hamer and Hamer Ltd (sales £1.5m) and Belgiam payments processor OONEX Belgique. The latter was announced alongside results in a £4.1m all-stock deal at 81p, plus the assumption of £3.5m of net liabilities and a £0.7m working capital injection.

Although currently loss-making (2022 PBT -£2.2m), OONEX could transform Equals’ growth trajectory from H2 2024 onwards. In fact, once completed and fully integrated, OONEX should enable the enlarged group to offer its best-in-class services right across Europe, expanding the total addressable market by an order of magnitude in one fell swoop.

Even without the transaction, Equals is firing on all cylinders. I’ve upgraded my 2023 turnover, adjusted EBITDA and EPS forecasts to £89.5m, £16.5m and 4.9p respectively. At the current 81p, that puts the stock on attractive EV/EBITDA, PE & PEG multiples of 8.3x, 16.4x and 0.3x – comfortably supporting my 160p/share valuation.

CEO Ian Strafford-Taylor commented: “Having developed a platform with superior & wide-ranging capabilities, we are attracting larger volumes from a broader array of businesses. [These] benefits of scale [have also] enhanced operational leverage and profitability. Equals Money remains focused on achieving further profitable growth, & we now expect FY'23 trading to be ahead of expectations.”