By Kathleen Brooks, research director at XTB.com

Thursday’s ECB interest rate decision was as expected, and the three main interest rates were unchanged. This meeting was always going to be about what comes next from the ECB; however we did not get much clarity. The path for future rate cuts could be in place, after a symbolic cut to both the headline and core inflation forecasts for this year. However, the ECB President said that the picture regarding disinflation is still not strong enough or durable enough, which has tempered the market reaction to this meeting, and put a floor in the euro’s decline. The main message from the ECB is unchanged, they want to cut rates, but wages remain a roadblock.

Symbolic cut to inflation forecast leaves Lagarde unruffled

This is a similar message from other central banks, who are calling for patience when it comes to rate cuts. However, the economic backdrop is weaker for the currency bloc, compared to other countries like the US. The ECB Staff forecasts include a 0.1% reduction in the rate of core inflation to 2.6% in 2024 down from 2.7% in December. The Eurozone is expected to reach the 2% inflation target next year, and fall below target in 2026, which supports rate cuts in the second half of this year.

German economy weighs on the currency bloc

The ECB Staff forecasts also predict weaker growth in 2024, the GDP forecast was revised down to 0.6% for this year, down from their previous forecast of 0.8%. Growth in the currency bloc is expected to rise to 1.5% next year. These are some of the weakest growth forecasts in the G10, and GDP has most likely been dragged lower this year by Germany. Its economy contracted in the final quarter of 2023 and is showing signs that it continues to struggle as we move through Q1. Forecasts can be wrong but compared with the OBR forecasts for the UK economy included in the Budget on Wednesday, the outlook for the UK is rosier than it is for the Eurozone and this could play out in the financial markets.

The euro initially fell sharply on the ECB decision and was weaker across the board, however, it has clawed back some earlier losses after Lagarde seemed to confirm that a rate cut would not happen next month, and instead later this year seems more likely. EUR/GBP is also weaker, and is close to the bottom of its recent range, but it found good support at 0.8520, which could limit this pair’s downside from here. Euro area bond yields are also lower, the 2-year German bond yield initially fell 7 basis points along with the 10-year yield, however, both are now paring some of those losses, although yields are lower on the day.

Rate cut fluctuations

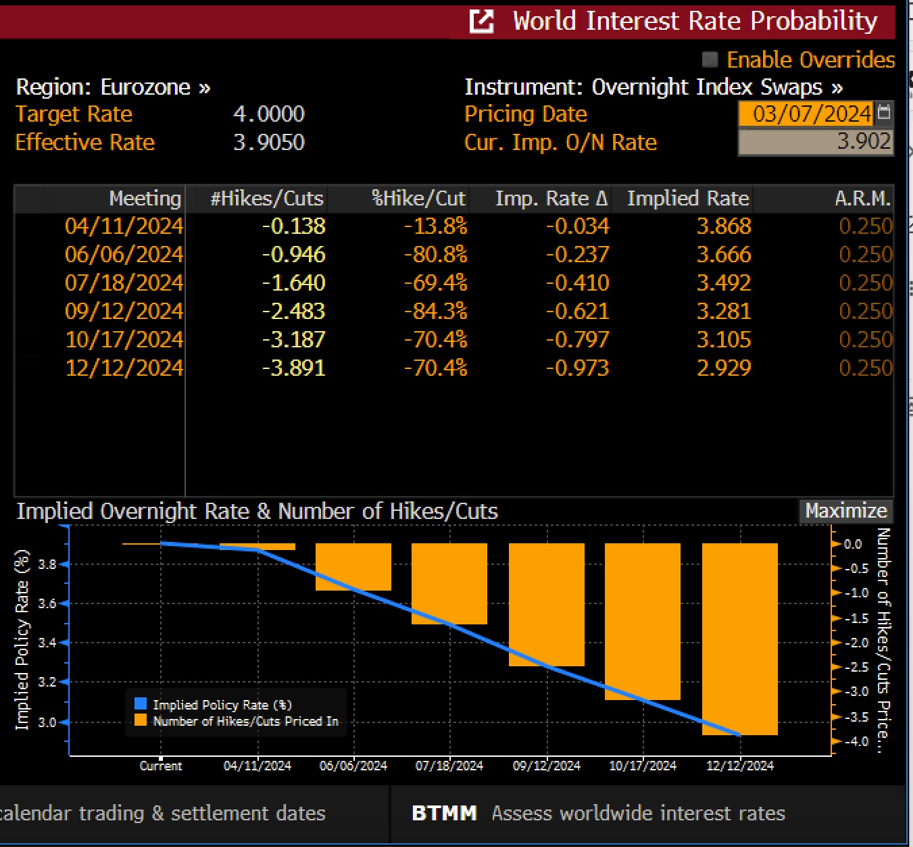

The interest rate futures market has also been volatile around the ECB rate decision. It has pounced on the symbolic cut to the inflation and growth forecasts for this year. The market has not shifted its expectation that the first rate cut will come in June, however, it has increased the number of rate cuts that it expects in the second half of the year. There are now nearly 4 full rate cuts expected, and 96 basis points of cuts priced in. Previously there had only been 3.5 cuts priced in.

Chart 1: Interest rate expectations from the ECB

Source: XTB and Bloomberg

The market may have changed their expectations about the extent of cuts this year, but it’s worth remembering that the ECB remains data dependent, and that they remain concerned about domestic price pressures caused by high wage growth. This is why we think that the ECB will remain firm in their view that rates can’t come down until there are clear signs that wage growth is moderating. Christine Lagarde said that the ECB has a ‘laser focus’ on wage growth. Q1 wage growth will be released with the final reading of Q1 GDP in early June, if this figure is significantly higher than expected, and if the labour market has not shown signs of loosening in the intervening period, then the ECB may choose to delay rate cuts until later in 2024.

Lagarde keeps tight lipped on timing

Overall, Lagarde has not given too much away at this meeting, although the staff forecasts are for a slightly lower path for inflation, and a weaker growth outlook. There is still no clarity on when the first-rate cut will come, except that it is extremely unlikely to happen before June. The market now expects the first rate cut from the Fed to come in July, so even though the growth outlooks for the US and the Eurozone are very different, they are still set to cut monetary policy at the same time. Some think that this is nonsense, and the ECB should cut sooner, however, no central banker wants to cut rates and then see inflation rise shortly after. Thus, there will be no rate cuts from the ECB until 1, there is a clearer trend of disinflation and 2, wage growth moderates. These conditions for the first ECB rate cut could support the euro, and indeed, at the time of writing, EURUSD is back testing the 1.09 handle.

XTB CY-RISK DECLARATION: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

XTB UK-RISK DECLARATION: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with XTB Limited UK. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

XTB is a trademark of XTB Group. XTB Group includes but is not limited to following entities:

X-Trade Brokers DM SA is authorised and regulated by the Komisja Nadzoru Finansowego (KNF) in Poland

XTB Limited (UK) is authorised and regulated by the Financial Conduct Authority in United Kingdom (License No. FRN 522157)

XTB Limited (CY) is authorized and regulated by the Cyprus Securities and Exchange Commission in Cyprus. (License No.169/12)

Clients who opened an account from the 1st of January 2021 and are not residing in the UK, are clients of XTB Limited CY.