One of the hallmarks of best-in-class enterprises is operational excellence. Marks Electrical MRK , a rapidly expanding online retailer of premium household appliances, has this in spades.

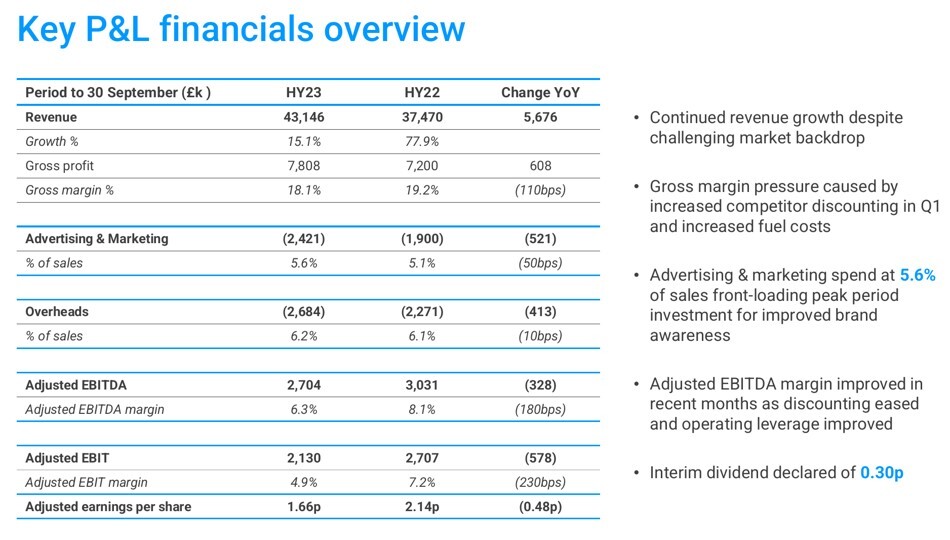

Today the company posted H1’23 sales up 15.1% to £43.1m, alongside industry leading profit margins, 189% cash conversion, 49% ROCE and an improved market share. All in all, a outstanding achievement across every metric, especially against tough YoY comparatives and a market that contracted more than -10%.

Mr Smithson commenting: “Our focus on operational excellence, customer service, and improving brand awareness has enabled us to continue to gain share in a very competitive market, where our share grew from 1.6% to 2.1% of the overall MDA market, and from 2.6% to 3.9% in the online segment.

As more people across the UK come into contact with our proposition and become customers, we are able to harness our highly efficient, single-site operational model to drive profitable market share growth.”

View from Vox

So, what’s the secret?

Well the growth is coming from numerous sources:

Not least geographical expansion, improved brand awareness, product selection (eg energy efficient washing machines & tumble dryers) and outstanding customer service (re Trustpilot score 4.8).

With “momentum continuing to build”, after an “acceleration in October & a strong start to November”. How many other retailers can say that?Elsewhere, net cash (ex IFRS16) closed Sep’22 at a healthy £7.7m (7.3p/share) vs £3.9m in Mar’22, thanks to tight working capital management.

Sure H1’22 EBITDA margins slipped slightly to 6.3% vs 8.1% LY, due to greater competitive discounting & higher digital advertising cost. Yet equally, 6.3% is still twice the level of its closest rivals (eg AO World & Currys), and besides promotional activity has since eased. Which combined with disciplined expense control, should further drive operating leverage over the important Xmas period.

Meaning that altogether, MRK remains on track to hit Panmure Gordon’s FY’23 revenue, EBITDA, PBTA & adjusted EPS forecasts of £92.1m, £7.3m, £6.1m & 4.7p respectively.

Plus at 70p, the stock trades on a modest PEG ratio of 0.5x - highlighting the upside potential.

Indeed, Panmure have a 120p/share Target Price, with CEO Mark Smithson aiming to ultimately lift turnover to £540m - equivalent to a 10% market share.