When a top-notch investor like Richard Staveley of Harwood Capital is stake building, I take note.

Not only because he runs a highly concentrated fund, where only the very best ideas make the cut. But also, because Richard is laser-focused on spotting undervalued GARP stocks, offering substantial long-term returns (min 15% pa).

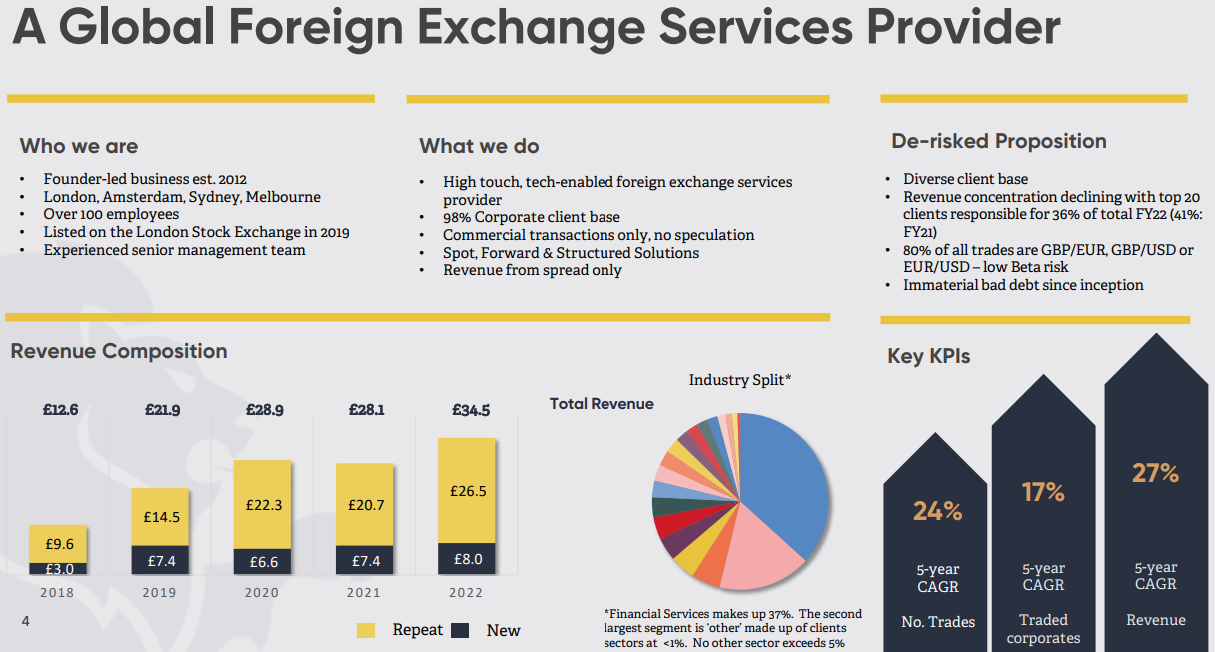

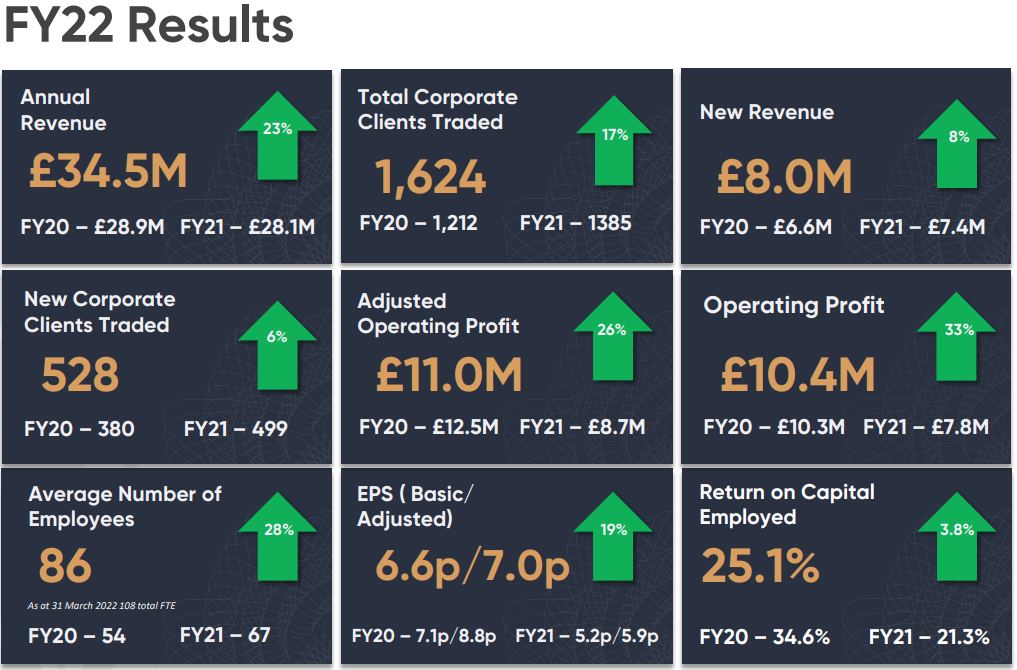

Enter Argentex AGFX a rapidly expanding, highly profitable (25% ROCE) & cash generative specialist of forex services (eg spot, futures, options & forward contracts) to institutions, corporates & high net worth individuals.

Better still, AGFX has a fortress balance sheet, solid revenue visibility (60% repeat), gold plated regulatory approvals and is quickly transitioning into a full service, international payments platform.

Where it continues to scale, expand overseas (eg Holland & Australia) & invest in its custom-built IT systems in order to add new cutting-edge functionality to further accelerate growth.

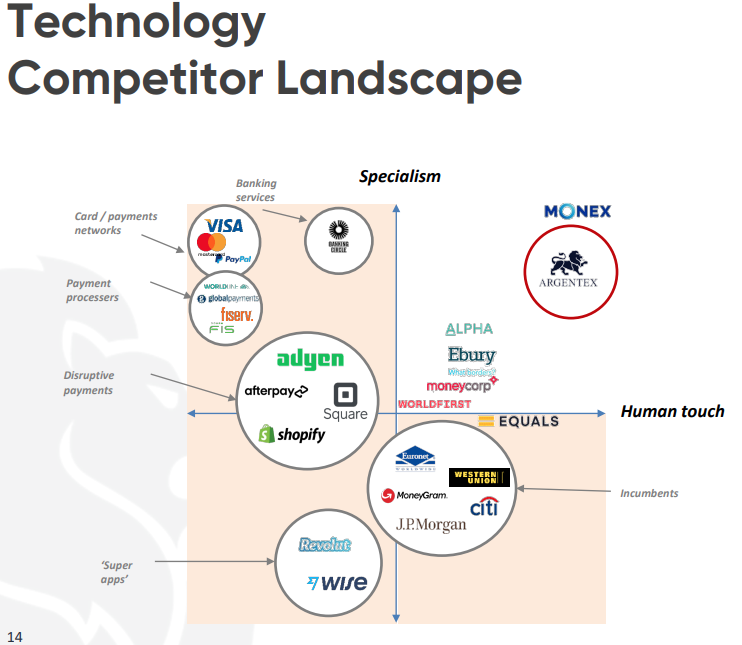

Similarly, the company is winning share from the mainstream banks – together representing 85% of the $6.0bn UK market – thanks to its personalised service, lower costs, greater agility & often superior x-border settlement. Importantly too, operating as a ‘riskless principal’ by fully matching all its forex book on both sides of the trade.

The only residual exposure being, if one of its clients were ever to default on their positions. Which rarely occurs anyway, since speculative positions are banned, and sufficient collateral/margin is required from customers before ‘hedged’ positions can be opened. Plus 63% of revenues come from a wide range of non-financial verticals, such as FMCG, manufacturing, machinery, industrials, etc.

The common thread being that these clients typically convert between £1m-£500m annually into another currency - but want a premium, forex advisory & execution service that is transparent, safe & reliable.

View from VOX

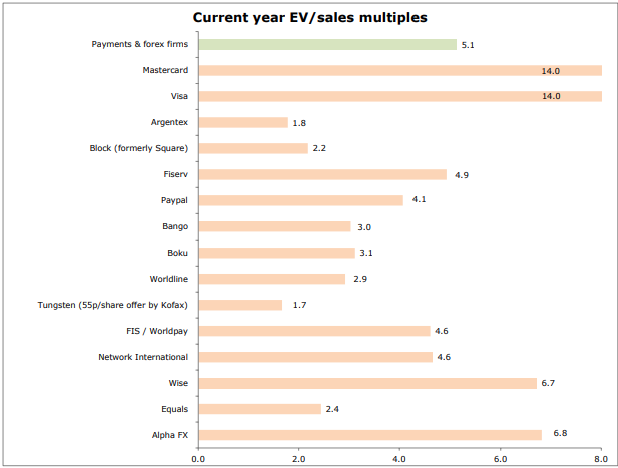

Well to me, the stock at 83p looks far too cheap. Paying a 3% dividend yield, whilst equally trading on a bargain basement PEG ratio of 0.55x & modest 1.8x EV/sales multiple (see below) vs its nearest fintech rival Alpha FX on 6.8x.

Sure, the latter presently has a wider international footprint and a more advanced IT platform, yet equally AGFX is catching up fast, & hence this price gap should ultimately close - & perhaps quickly in the event it attracts predatory interest from say either private equity or industry buyers.

Furthermore, house broker Singers have a target price of 121p/share, and are predicting revenues, adjusted EBITDA, and EPS to be:

| FY1 | FY2 | |

| Revenue | £39.0m | £47.4m |

| EBITDA adj | £9.9m | £12.6m |

| EPS | 4.9p | 6.4p |