Record 1H Results with upgraded expectations at Argentex

Behavioural finance is often viewed as ‘mumbo jumbo’ by many investors.

However given that losses are typically 4x more stressful than the joys from gains. Then it’s easy to see why this emotional asymmetry has scared even some of the most hardened professionals from buying top quality, GARP stocks at attractive prices.

Take Argentex AGFX , a specialist provider of foreign exchange services (re spot, forward, future & option transactions) to corporates, asset managers and HNW individuals.

Today this £136m market cap firm posted record 1st half results & upgraded expectations - with H1 adjusted EBIT & EPS coming in 55% & 59% higher at £7.3m & 5.1p respectively - on revenues up 75% to £27.4m.

View from Vox

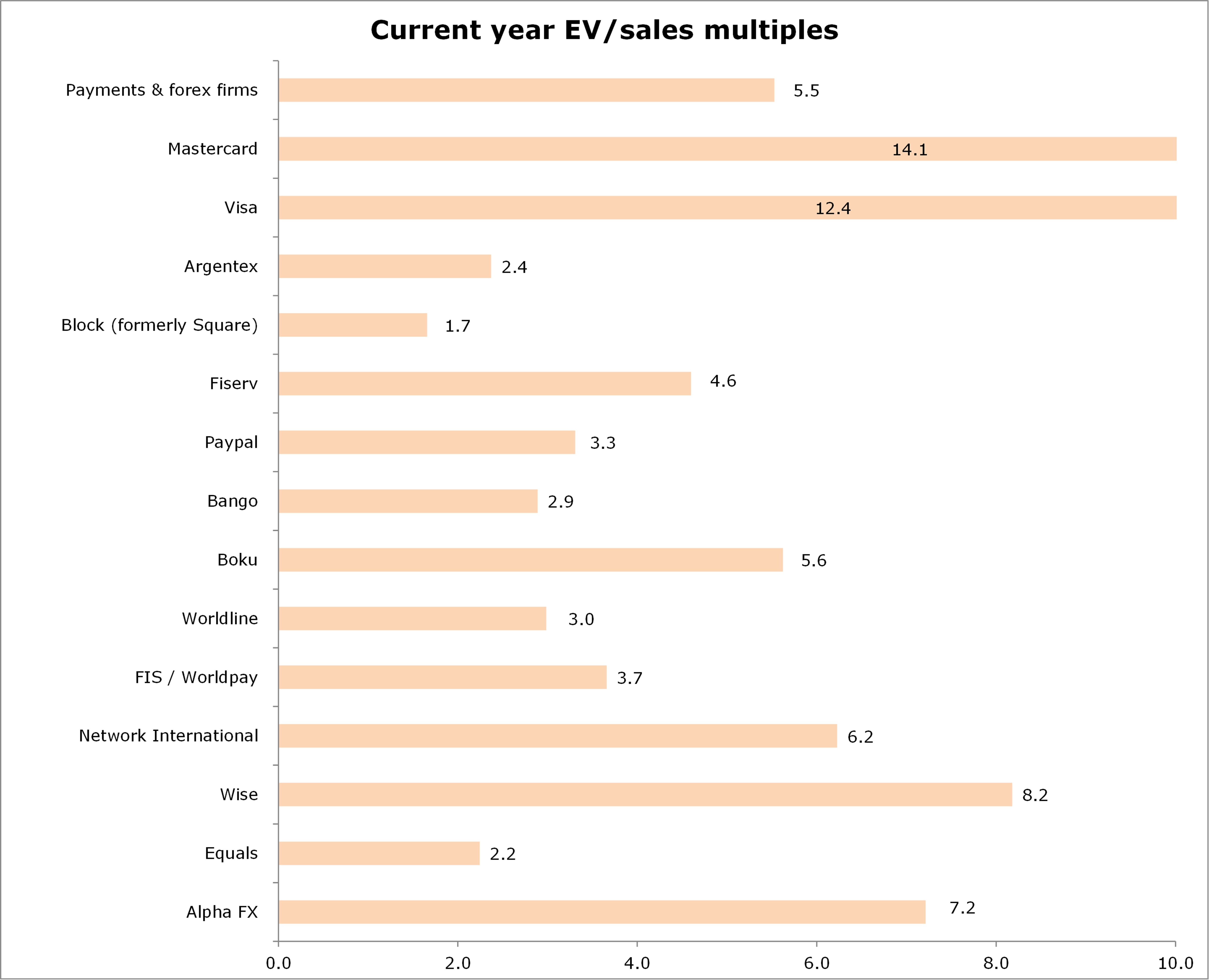

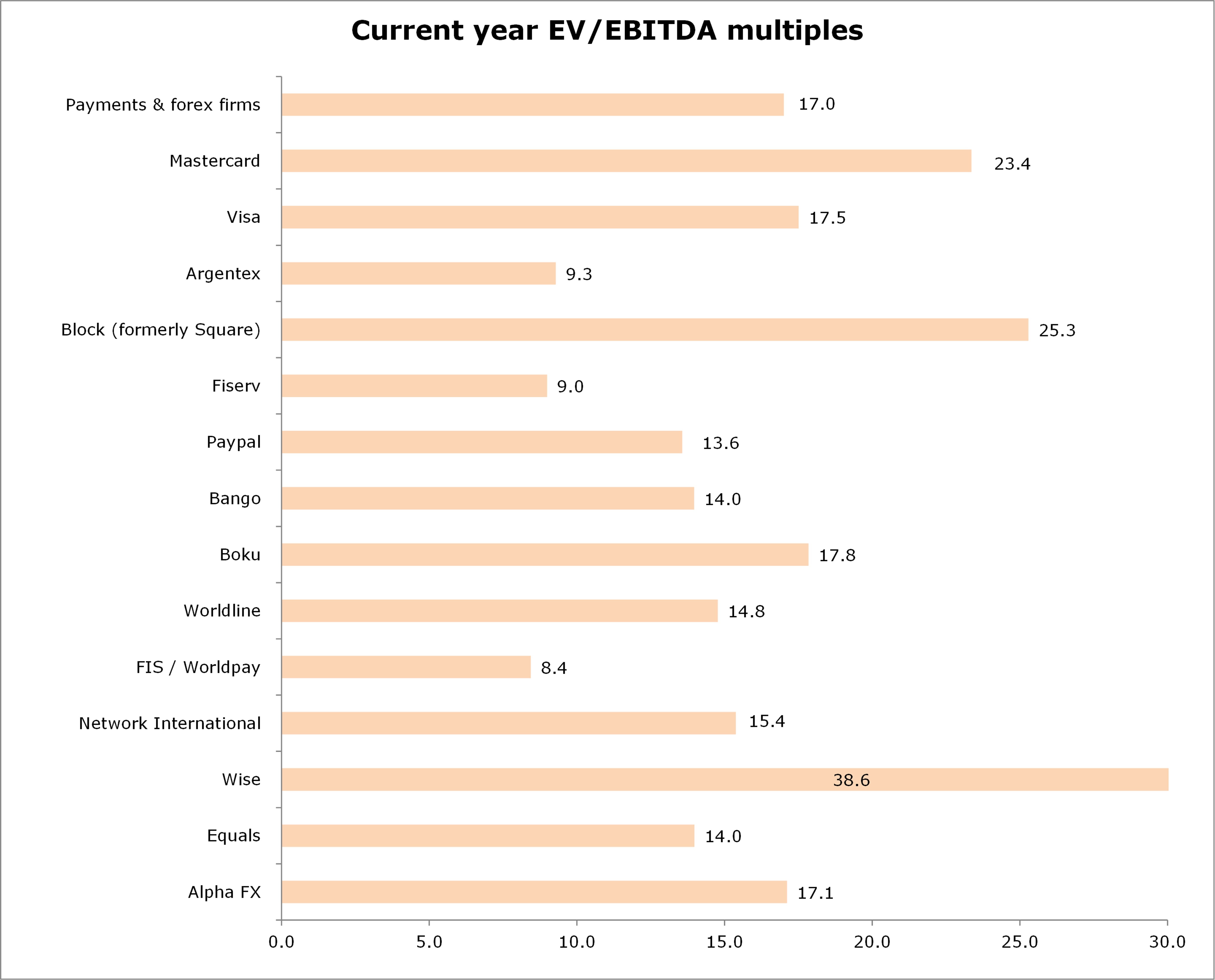

Illogically the stock at 120p, still trades on modest, forward multiples of 9.3x EV/EBITDA and 2.4x EV/sales compared to peers at 17.0x & 5.5x.

Despite underlying FY turnover set to rise more than 50% faster than the sector average. Ok, but how’s #AGFX’s generating this best-in-class growth?

Well first & foremost, the company is winning share (re client count up 12% YoY to 1,393) from the mainstream banks (representing 85% of the $6.0bn UK market) – thanks to its more personalised approach, lower costs, greater agility & often superior x-border settlement.

Next, it continues to scale, add new functionality (eg mass payments, multi-currency IBANN accounts, etc), expand overseas (eg Holland & Australia) & invest in its rapidly expanding online platform (H1 revs up 225% to £0.9m). Thus further delighting clients and increasing its ‘share of wallet’ with the ultimate objective to create a specialist, full line, global forex/payments platform.

Sure the H1 numbers were boosted a little by Sept’s forex volatility. Yet equally, the group has a fortress balance sheet (£25.8m net cash, or 22p/share), robust revenue visibility (Est 60% repeat), gold plated regulatory approvals and generates 2/3rds of its revenues from a wide range of non-financial sectors, such as FMCG, manufacturing, machinery & industrials.

I’ve therefore hiked my adjusted FY EBITDA (pre-IRFS16) & EPS forecasts to £12.0m & 6.3p respectively, on revenues up 36% YoY to £47.0m (£34.5m LY). Which assuming a 15x EBITDA multiple & adding back the cash pile, would theoretically deliver a valuation of 180p/share.

Likewise, Singer Capital Markets have a new price target of 160p with a BUY rating.

CEO Harry Adams adding “I am delighted Argentex has delivered another record performance, underpinned by our new growth strategy. Our core business goes from strength to strength, resulting in high double-digit revenue and profit growth. All pillars of our growth strategy have exceeded expectations, driving strong momentum into H2. The Board expects that the full year will again exceed current market expectations."

Lastly, although no interim dividend was declared, a final one (say 2.5p) is planned for the yearend figures.