Savannah Energy (SAVE ) delivered today an upbeat financial and operational update for the 11 months ended 30 November 2022.

Financial performance

Savannah reported total revenues up 27% year-on-year to US$256.7m for the period with cash as of 30 November of US$193.1m Vs US$149.5m a year ago with net debt down to US$310.1m from US$370.2m.

As a result of the improved financial performance YTD, Savannah updated its guidance for 2022:

Savannah's new FY22 guidance for total revenues is US$270m or more (up from US$215m), and for capital expenditures up to US$35m (reduced from US$85m).

Savannah kept is guidance for operating + administrative expenses at US$75m as well as group depreciation, depletion and amortisation at US$21m fixed for infrastructure assets plus US$2.3/boe.

Operational highlights

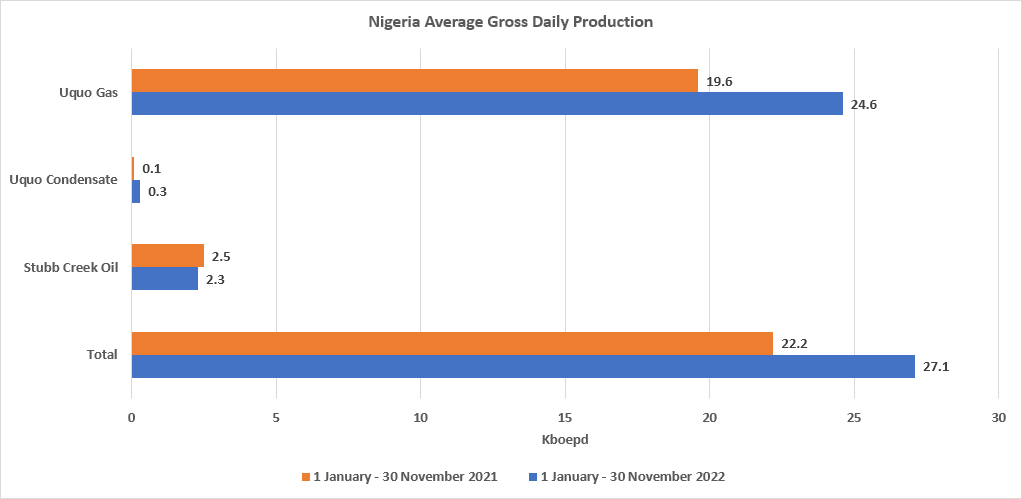

Savannah reported average gross daily production in Nigeria in the YTD to 30 November at 27.1 Kboepd, a 22% increase from the same period last year.

Of the 27.1 Kboepd, 90% was gas, including a 25% increase in production from the Uquo gas field compared to the same period last year (from 19.6 Kboepd to 24.6 Kboepd).

Andrew Knott, CEO of Savannah Energy, commented: "We are pleased to be updating our 2022 financial guidance this morning, driven by the significant year-on-year increase in production volumes that has been delivered in Nigeria - the fourth year in a row. Looking forward to 2023 we are excited by the opportunities available to the business in all the four countries in which we operate in across Africa in both the hydrocarbon and renewable energy sectors and look forward to updating investors further next year."

View from Vox

A welcome FY22 guidance upgrade from Savannah as the company continues to ramp up production in Nigeria, with 2022 marking the fourth consecutive year that production volumes have increased. It is a good day for SAVE investors as the company lifted its revenues forecast by 25% while reducing its capex forecast by 58% to US$35m or less.

Additionally, Savannah continues development of its Chad and Cameroon assets following acquisition of ExxonMobil's upstream and midstream asset portfolio in the two countries. On 9 December 2022, Savannah assumed operatorship of Exxon's former upstream assets, and today reported production in Chad continuing uninterrupted at an average daily rate of c. 28 Kbopd.

Savannah also expanded in customer base in 2022, signing gas sales agreements with three new customers - Central Horizon Gas Company, TransAfam Power Limited, and Notore Chemical Industries - as well as agreeing a contract extension with First Independent Power Limited to supply three of its power plants, FIPL Afam, Eleme, and Trans Amadi.

As a result, Savannah now supplies gas to 24% of Nigeria's thermal power generation capacity.

Savannah is also growing its renewable energy division, with several new large-scale greenfield opportunities under review and negotiation in Chad and Niger. In Chad, the company has signed a deal with the Ministry of Petroleum and Energy for the development of up to 500 MW in renewable energy projects. In Niger, Savannah is developing the 250 MW Parc Eolien de la Tarka Project. CEO Andrew Knott sees Africa's transition to renewable energy as playing a significant role in Savannah's future growth.

Overall, Savannah's business is growing in all four countries where it operates. The growth trend of the past 4 years is expected to continue in 2023, especially as the company's renewable portfolio begins to add value.

Follow News & Updates from Savannah Energy: