By Kathleen Brooks, research director at XTB.com

UK wage growth was weaker than expected for January, falling to its lowest level since July 2021. The 5.6% 3 month-on -month annual rate, might be well above the Bank of England’s 2% target rate for inflation, but it highlights a clear disinflation trend in wage growth. This has caused traders to reassess their bet that the Bank of England will delay cutting rates until August, and there are growing expectations that the first BOE rate cut will come in June, and that there will be three cuts from the Bank this year. Excluding bonuses, wage growth was also weaker than expected at 6.1%, but this is also the lowest level since October 2022.

UK jobs market shows signs of slowing down

There could be further declaration in wages down the line, as the jobs data showed signs that the UK labour market is loosening. The unemployment rate rose to 3.9% in the three months to January, from 3.8%, potentially reversing the deceleration we saw in the unemployment rate from mid-2023. The number of employed people fell by 21k in the three months to January, which is the first decline in the number of employed people since September last year. The number of new jobs created was also weaker than expected, rising by 20k, analysts had expected a 25k increase. The number of employees rose by 386,000 between January 2023 – January 2024, according to the Office for National Statistics. This is a 1.3% increase. However, while growth was strong in the past year, the ONS said that there were signs it was slowing. This could feed into weaker wage growth.

The economic activity conundrum

The economic inactivity rate increased in the three months to January, rising to 21.8%, higher than the previous quarter, and above pre pandemic levels. This is the reason why the BOE remains nervous about the impact of the UK labour market on inflation trends. If these people returned to the workforce, there would be jobs for them. However, this may not stand in the way of BOE rate cuts as the ONS has urged caution when interpreting the inactivity rate in the UK, since the sample size remains small.

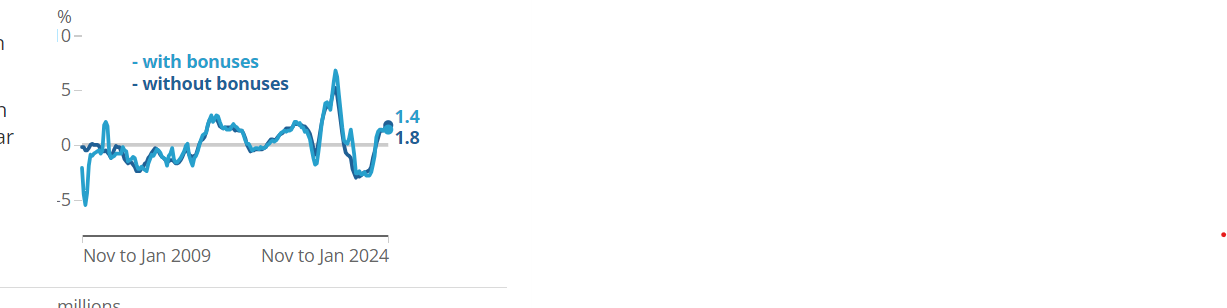

Real wage growth on an uptrend as inflation falls

Headline pay growth may be lower than expected, however, real pay growth, when adjusted for inflation, has been rising, as inflation falls. Real pay growth including bonuses was 1.4%, excluding bonuses it was 1.8%. However, with inflation set to fall further this year, then real pay growth could rise. This is one reason why the BOE may take a cautious approach to cutting rates later this year, however the market is not listening to this right now.

Chart 1:

Source: ONS

Overall, the UK’s wage and labour market trends are inline with global trends. A moderate increase in the unemployment rate is expected, although the UK labour market remains tight. On balance, this is mildly dovish for the BOE.

Sterling is vulnerable to a pullback

As the market recalibrates its expectation for the first BOE rate cut from August to June, sterling is coming under downward pressure. GBP, which has been the best performing currency in the G10 in 2024, but GBP/USD has slipped on the back of this data and is below $1.28. The dollar is staging a comeback this week, which is also weighing on the pound. Gilt yields are also lower, which may add pressure on sterling in the short to medium term.

XTB UK-RISK DECLARATION: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with XTB Limited UK. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

XTB is a trademark of XTB Group. XTB Group includes but is not limited to following entities:

X-Trade Brokers DM SA is authorised and regulated by the Komisja Nadzoru Finansowego (KNF) in Poland

XTB Limited (UK) is authorised and regulated by the Financial Conduct Authority in United Kingdom (License No. FRN 522157)

XTB Limited (CY) is authorized and regulated by the Cyprus Securities and Exchange Commission in Cyprus. (License No.169/12)

Clients who opened an account from the 1st of January 2021 and are not residing in the UK, are clients of XTB Limited CY.