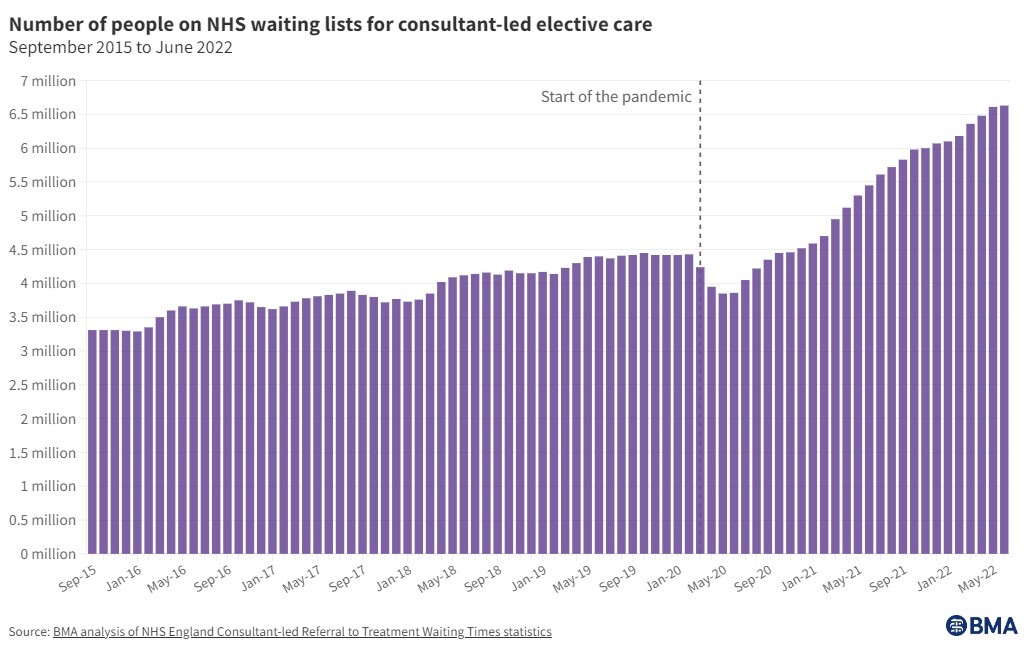

Newly elected UK Prime Minister Liz Truss has a lot on her plate. Not only tackling the cost-of-living crisis, but also having to urgently reduce the NHS’ Himalayan waiting lists (6.7m & climbing) and improve patient care, whilst equally dealing with an acute shortage of doctors, nurses & other hospital staff.

Enter SourceBio International SBI , a leading medical diagnostics & laboratory services firm, that is proving to be a vital partner to the UK’s over-burdened healthcare system.

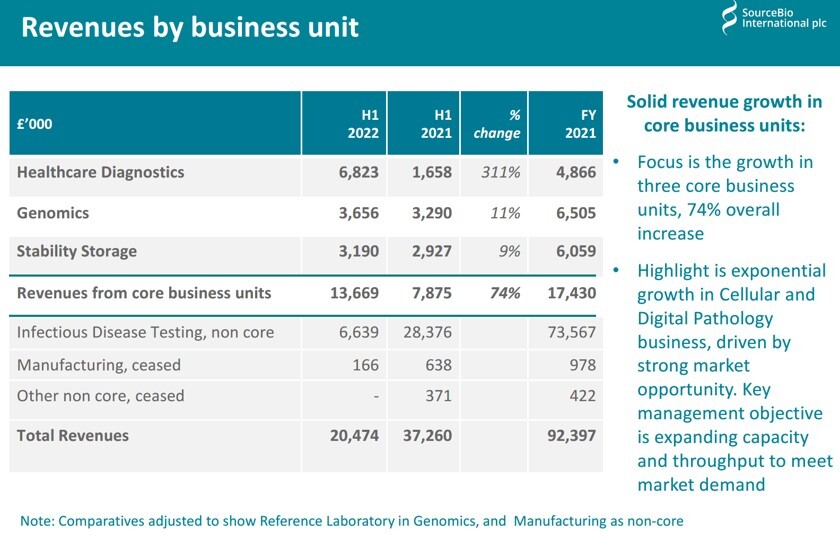

Today SBI posted impressive H1 results within its core business - delivering gross profit up 58% to £5.9m (margin 43%) on sales 74% higher at £13.7m (Est 50% LFL), alongside continued buoyant conditions.

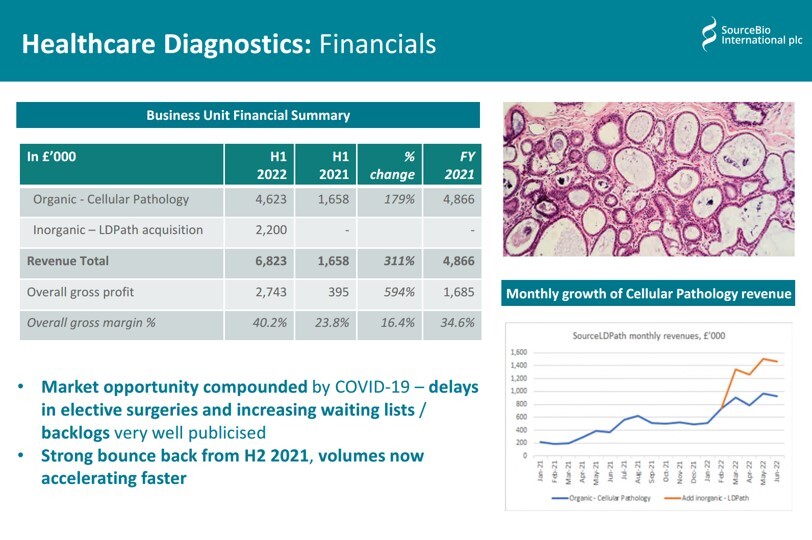

In fact, revenues at the enlarged cellular/digital pathology division (re testing tissue samples/biopsies for cancer) are going like a train. Soaring 311% to £6.8m in H1 (179% LFL), as it helps alleviate the chronic shortage of pathologists and mountain of elective surgeries.

Moreover, the transformational £18.5m acquisition of LDPath (+82% LFL & 14% ahead of budget) on 8th March, is bedding down well. Meaning with another 2 months of trading in 2H22 – I reckon this unit on its own should generate 2H22 turnover of c. £3.5m (vs £2.2m 1H22).

Not to be out done either, revenues at Genomics and Stability Storage also expanded strongly. Here by 11% and 9% respectively to £3.7m and £3.2m.

Operationally though, the challenge is to rapidly increase capacity to satisfy the unprecedented demand.

With good progress already being made via a combination of productivity improvements, new technology and larger premises in London. The latter of which should be “up & running by Q4”.

Exec chairman Jay LeCoque commenting: “We are encouraged with progress and growth delivered in the three core business units in H1’22. Our operational focus remains the continued further scale-up of Cellular Pathology and Digital Pathology volumes through the rest of the year and beyond. We expect a very busy H2 and look forward to updating the market in due course.”

View from VOX

So, with PCR testing adding a further £6.6m in 1H22 (vs £28.4m LY), the group’s total 1H21 turnover and adjusted EBITDA came in at a “solid” £20.5m & £2.1m.

Similarly leaving net cash in June at £15.2m (20p/share) and providing ample firepower to further accelerate organic & acquisitive growth.

But that’s not all..........

Significant cost savings (re post Covid restructuring) should flow through into 2H22, which augmented by greater operating leverage are set to drive margins higher going forward. In turn, underpinning Liberum’s FY’22 expectations for adjusted EBITDA & EPS of £6.4m & 2.0p respectively, on revenues of £39.5m.