As night follows day, cash strapped consumers are on the hunt for bargains to help them through the cost of living crisis. So, rather than going without everyday essentials, many are choosing more affordable varieties.

This is where FMCG brand license owner (70% of sales) and distributor Supreme (SUP) fits in. Its manufactures and promotes products aimed at the more budget-conscious end of the market, including its lower-priced own-brand vaping products (88vape and Liberty Flights) and sports nutrition & wellness brands (Battle Bites, SCI-MX and sealions). It also distributes other brands, some licensed in, such as Duracell and Panasonic batteries and Energizer, Eveready and JCB lights.

The nutrition and lighting divisions were impacted last year by Covid-induced input cost inflation and retailer overstocking. But overall group trading is now back on track, as evidenced by January’s in line Q3 2023 update.

Better still, the balance sheet is rocket solid, with estimated proforma net debt of just 0.4x EBITDA. That was bolstered in February by the disposal of its T-Juice vaping brand to LVP, in return for a €4.5m upfront fee and an exclusive manufacturing agreement worth a minimum of €15m over 5 years.

Elsewhere Supreme possesses an enviable UK distribution network (see chart), a rapidly expanding online direct-to-consumer platform with revenues of around £10m a year, and robust pricing power across Vaping, sports & wellness - all sectors which are growing at double digits. Likewise, management are laser focused on driving supply chain efficiencies, with a new state-of-the-art distribution hub in Trafford Park, Manchester set to open in mid-2023.

So what does all this add up to? House broker Berenberg is forecasting full-year turnover for the year ending March 2023 of £136m, delivering EBITDA and adjusted EPS of £18m and 10.1p, respectively - that £22m and 11.6p the following year on sales of £151m.

With the shares currently trading at 95p, that leaves this classic ‘baby and the bathwater’ stock on attractive FY24 PER, EBIT and EBITDA multiples of 8.3x, 6.3x & 5.4x, respectively, whilst also offering a 3.1% dividend yield (or 2.9p).

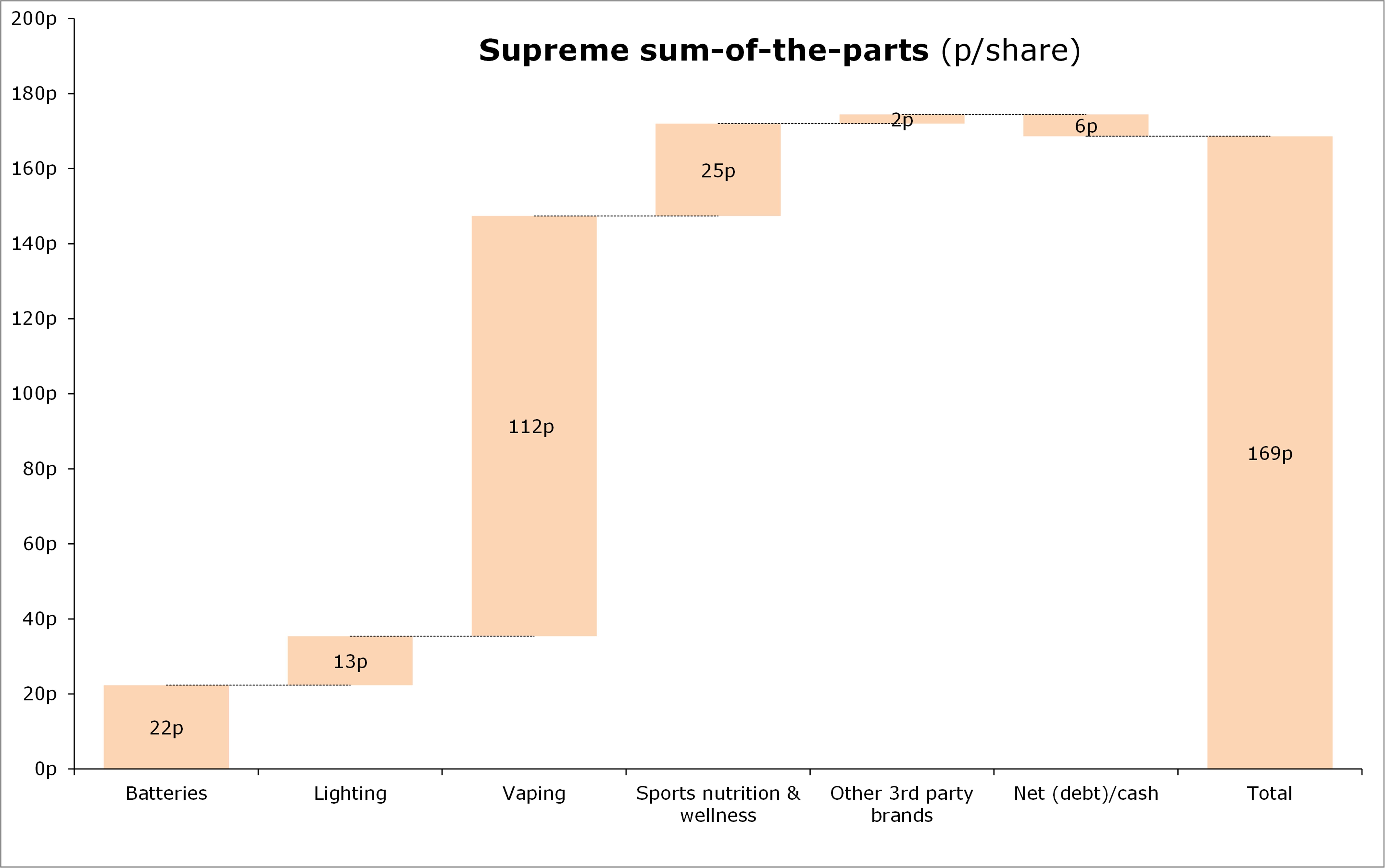

That seems like compelling value for an economically resilient and primarily repeat revenue consumer-facing business. My sum-of-the-parts valuation comes out at 169p a share (see chart), which compares to similar price targets from Berenberg (170p) and Equity Development (180p).

Watch out for the FY23 trading update towards the end of April.