Tekcapital (TEK), an intellectual property investment group, said it has raised £2.0m in a placing from existing and new shareholders via the issue of 13.3 million new shares at 15p a share.

It said the net proceeds would be used primarily to accelerate the growth of two of its portfolio companies - MicroSalt and Guident.

MicroSalt is the developer and manufacturer of a proprietary low-sodium salt, claiming to achieve the same taste as regular table salt at half the sodium content. Guident is the developer of remote monitoring and control software employed to improve the safety of autonomous vehicles, as well as regenerative shock absorber systems to improve EV efficiency.

Of the £2.0m raised, £1m will go toward building inventory for MicroSalt in order to satisfy substantial forthcoming orders. £0.5m will go toward facilities for Guident's new Remote Control Monitoring Centre, and for fabrication and testing of its regenerative shock absorbers for prospective clients. The remaining £0.5m will be additional working capital.

Tekcapital owns 97.2%-owned of MicroSalt and 100% of Guident.

The placing was facilitated by SP Angel Corporate Finance. It is expected that the new shares will be admitted to AIM on or around 20 April 2023.

View from Vox

This is a welcome capital injection into two of Tekcapital's successful ventures. The proceeds from the oversubscribed placing will support MicroSalt's capacity to meet growing demand, and Guident's facilities and R&D to improve its offering. The shares were issued at an approximately 15% discount to Friday's closing price, explaining today's price movement.

MicroSalt continues its expansion across the US ahead of an anticipated 2023 IPO. The company has made headlines with its disruptive salt product that has now been rolled out at scale in the US. It is currently available as a standalone product in major US retail chains, including Giant and Hannaford, as well as in the ready meals market through a partnership with Presty! Foods, and as the key ingredient in MicroSalt's SaltMe! brand of crisps, sold at Kroger in the US.

What distinguishes MicroSalt's product is that it is not a substitute, but actual salt. The company's patented technology produces salt crystals that are 100 times smaller than normal table salt, so they deliver the same intensity of taste at 50% the sodium content. It is a potentially disruptive technology, and the company's aggressive rollout has proven the food industry is interested.

MicroSalt said it is exploring product line extensions with sea salt and Himalayan salt as well as geographic expansion into the UK, Europe, and Canada in 2023. The company also received its first bulk B2B ingredient order in July 2022. MicroSalt's CEO says interest is "very high" for bulk B2B MicroSalt sales internationally.

According to a recent report published by Coherent Market Insights, the global sodium reduction ingredient market is projected to reach around US$2.2bn by end of 2027, growing at a CAGR of 12.2% between 2020-2027.

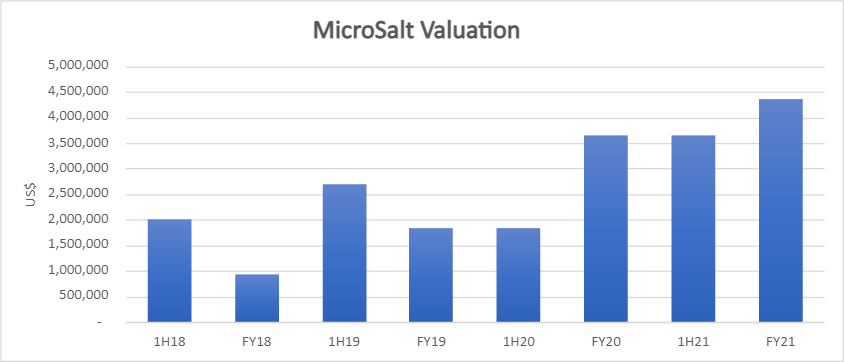

The valuation for MicroSalt has been on the rise since FY18 with a most recent recorded book value of US$4.3m in the November 2021 accounts:

Guident remains on track to monetise its disruptive R&D this year. Both its technologies - remote monitoring (RMCC) of autonomous vehicles and regenerative shock absorbers (RSA) - have seen increased interest from prospective partners and customers, reflected in the company's growing sales pipeline:

The company is on schedule to deploy its RMCC service for the Jacksonville Transportation Authority and expects the first purchase order from the contract in the coming months. Its management visited JTA in February and defined actions for the deployment of the company's RMCC by May 2023.

Additionally, Guident has signed a letter of intent with Auve Tech, a developer of autonomous transportation systems, to deploy turn-key solutions using its teleoperation software, to be included with Auve Tech's level-4 autonomous vehicles in the US, Europe, and Asia.

It's also finalising its contract with the Boca Raton Innovation Campus (BRiC) to provide autonomous vehicle shuttle services.

Lastly, Guident partnered with Novelsat in February to provide space connectivity for AVs under the Space Florida project. The partnership should give Guident a competitive advantage over systems that rely on terrestrial connectivity only by adding an always-on, low earth orbit monitoring solution for its remote monitoring and control centres.

According to Triton Market Research, "the last mile AV autonomous vehicle delivery market is expected to reach US$41.7bn by 2028 with a CAGR of 19%". Contactless delivery has been in high demand since the Covid-19 pandemic, which Guident believes will accelerate the rollout of land-based delivery drones where its Remote Monitor and Control Center (RMCC) system can shine.

Additionally, Guident's patented RSA technology can make vehicles more sustainable, including ICE, hybrid, and EVs. It increases the energy harvesting efficiency by c. 70% over existing energy-harvesting shock absorbers, and can deliver extra EV range of 6-12 miles per charge.

Guident has so far filed for 8 patents in the US, and its value has increased steadily since Tekcapital's initial investment in 1H 2018, reaching £20m in just 4 years:

The combined value of Tekcapital's four portfolio companies has grown steadily since initial investment in 2018, from £8.4m in 1H18 to £62.5m in FY21. Tekcapital most recently reported a 13% increase in net assets in 1H22 to a record US$76.9m, with NAV per share increasing 6% HoH to US$0.51. Previously, TEK had announced a 108% net asset increase and a 243% increase in income YoY for FY21.

Tekcapital's companies are well-positioned for continued near-term growth, supporting significant upside potential for investors. SP Angel estimates NAV for TEK based on current share prices for BELL LN and LUCY US, as well as the updated value of MicroSalt and the increased share count from the fundraise, to be approx. £0.305/shr with new cash of £0.013/shr, an uplift of over 80% to the current stock price.

Follow News & Updates from Tekcapital: