Tekcapital (TEK ), an intellectual property investment group, announced audited results for FY22 ended 31 December 2022. Tekcapital is set up for long-term value growth, with portfolio companies achieving significant milestones during the period. However, due to unrealised reductions in the end-period valuations of Lucyd and Belluscura, Tekcapital's profitabilty, net assets, and net assets per share were negatively impacted.

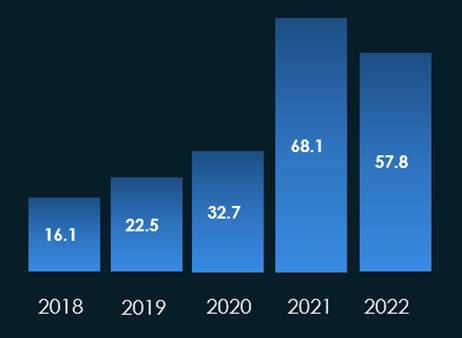

Net assets were US$57.8m, compared to US$68.1m in FY21, and NAV per share was US$0.38, down from US$0.48m in FY21. The portfolio valuation stood at US$45.9m, compared to US$62m the year prior. After-tax loss was US$12.7m from a US$26.4m profit in FY21, resulting primarily from a net unrealised fair value reduction of US$11m. US$2.5m of share placings were completed during the period, compared to US$9.7m in FY21.

Tekcapital's four portfolio companies made steady progress in FY22 with further milestones expected in FY23. Lucyd's Innovative Eyewear completed a floatation on NASDAQ, raising US$7.3m. The company recently launched the world's first ChatGPT-enabled eyewear.

Guident signed on its first customer, the Jacksonville Transportation Authority, for its remote monitoring and control (RMCC) service for autonomous vehicles. A second customer, the Boca Raton Innovation Campus, has signed a letter of intent. Guident also made significant progress in bringing to market its regenerative shock absorbers (RSA), currently in testing with several Tier-1 companies.

MicroSalt also outperformed after growing its revenues, signing up additional customers, and launching its low sodium saltshakers to an increasing number of US supermarkets, including Kroger. MicroSalt's share value doubled during the period, and the company is targeting an IPO for 2023.

Tekcapital's results were negatively impacted by a reduction in the closing share prices of Innovative Eyewear and Belluscura at the end of last year. These are highly disruptive companies in their initial growth phase, and as such vulnerable to risk-off climate and unfavourable macroeconomic conditions such as we saw last year. MicroSalt's more robust and proven offering bucked the trend, however, doubling in share price in FY22.

As a result of the above, Tekcapital is significantly undervalued at the moment compared to its NAV. TEK's NAV per share was adjusted to US$0.38 (31p) at the end of FY22 while its current share price is 13.5p. There is significant potential for growth therefore, with MicroSalt's upcoming IPO a possible value inflection point for the company.

The overall trend for Tekcapitals' portfolio is clearly up with steady increases in valuation each year since initial investment in 2018 (see chart below). From a technical standpoint, some consolidation was expected at this point, and the wide discount to NAV offers an attractive entry point.

Tekcapital historical net assets (US$m)

TEK shares were up 2% on the news.

Follow News & Updates from Tekcapital: