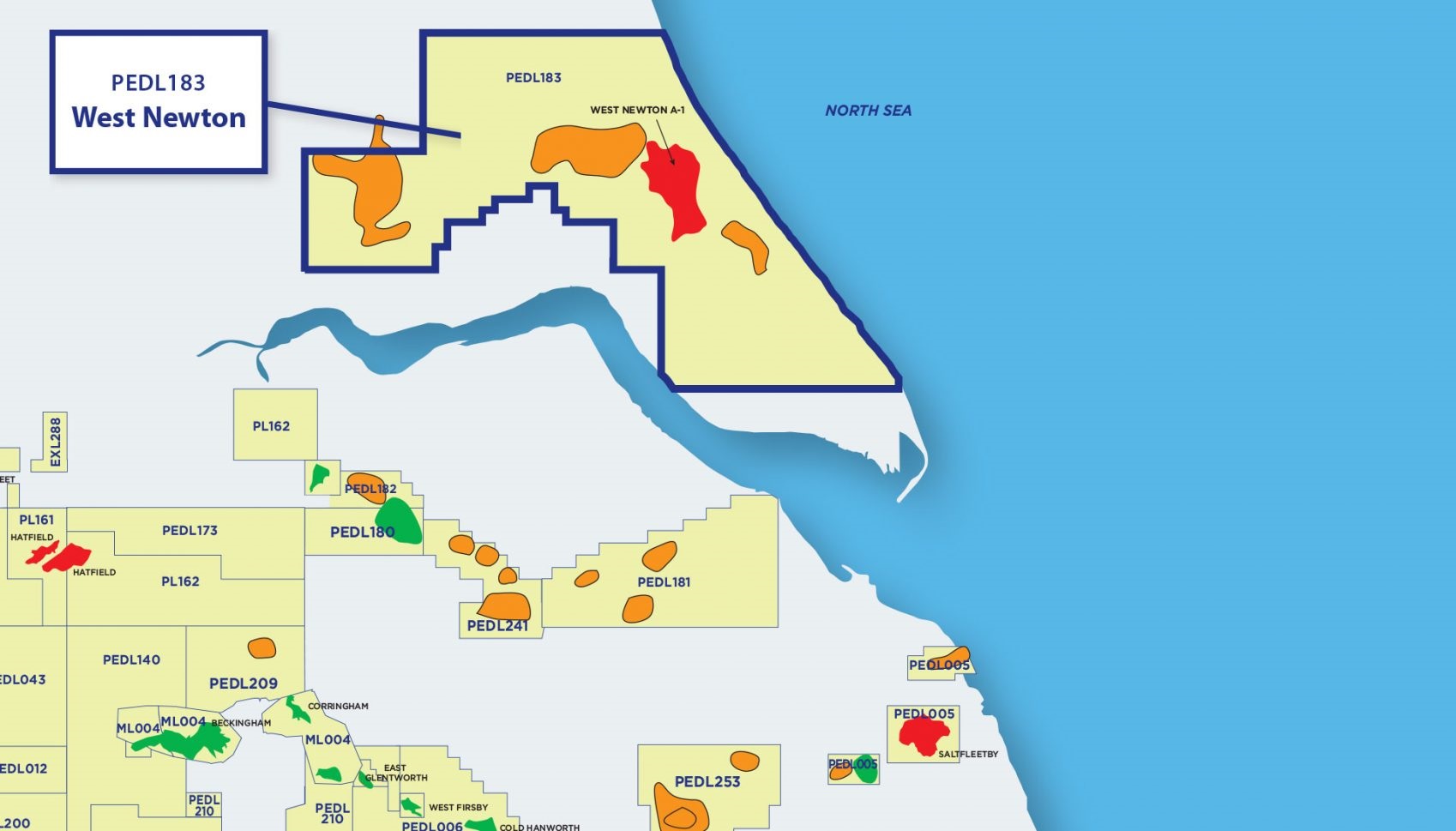

Union Jack Oil (UJO ), a UK-focused onshore conventional explorer, has provided highlights from a Competent Person's Report (CPR), dated 22 September 2022. The report was prepared by RPS Energy Canada and covers PEDL183, containing the West Newton project. Union Jack holds a 16.665% interest in PEDL183.

The report estimates best-case gross unrisked contingent technically recoverable sales gas from West Newton's Kirkham Abbey reservoir to be 197.6 billion cubic feet. The geological chance of success of Kirkham Abbey was estimated at 85.5%.

The gross post-tax NPV10 risked value of Kirkham Abbey's contingent gas resource is US$396.1m.

The report also noted substantial additional prospective resource figures for Ellerby, Spring Hill and Withernsea, with best estimate prospective gross recoverable gas of 132.2 bcf, 122.6 bcf, and 68.7 bcf respectively, and geological chance of success of 43.2% for all three.

Union Jack remains fully funded for testing and drilling of a horizontal well at West Newton in 2023.

David Bramill, Executive Chairman of Union Jack, commented:

"The conclusions of the CPR signal a highly valuable onshore project with resources comparable to those usually reported from offshore developments and at a time when forward gas pricing is higher than oil. Such a significant domestic onshore gas resource as West Newton will be an important transition fuel in helping the UK achieve its 2050 Net Zero targets."

View from Vox

The CPR's estimated 85.5% geological chance of success for Kirkham Abbey is highly encouraging and yet another major milestone in derisking West Newton ahead of next year's horizontal well drilling and testing.

RPS have now modelled wells extending 1500m horizontally through Kirkham Abbey. Using this orientation, the wells will have a much greater likelihood of encountering significant sections of the reservoir with open natural fractures, translating to higher production capacity. Large-scale drilling of the horizontal well is on schedule for 2023. Commercial production from West Newton could start as early as 2026.

Further good news is the discovery that the reservoir is predominantly gas (90% methane + 5% ethane), leading to lower trucking requirements. This will put less strain on the surrounding road network, leading to less interference with local residents and businesses, as well as allow for the installation of a pipeline to deliver natural gas directly to the National Grid.

Based on analysis to date, West Newton has the potential to become a second major win for Union Jack. Its flagship Wressle project is now one of the most productive conventional-producing UK onshore oilfields, set to become second only to Perenco's Wytch Farm. To date, Wressle has produced over 225,000 barrels of oil with zero water cut, with an average rate of 300 bopd and instantaneous rates of over 1,000 bopd achieved.

West Newton's anticipated recoverable resource will be enough to meet the daily gas demands of over 380,000 homes in the UK for years to come. Domestically produced natural gas will remain a necessary part of the UK's energy mix as it seeks to reduce its reliance on Russian gas and ocean-transported LNG. This is also important for meeting the UK's 2050 net zero target as domestic UK gas production has less than half the carbon footprint of imported LNG.

Union Jack has had a good year so far with shares currently up 110% YTD despite challenging economic and market conditions. Shares continue to trend upwards despite heightened volatility over the past couple of weeks in anticipation of the new Government rules on fracking.

Union Jack remains fully funded for drilling operations at West Newton.

Follow News & Updates from Union Jack Oil: