Vast Resources (VAST ) updated markets on Q4 2022 production at its Baita Plai Polymetallic Mine in Romania.

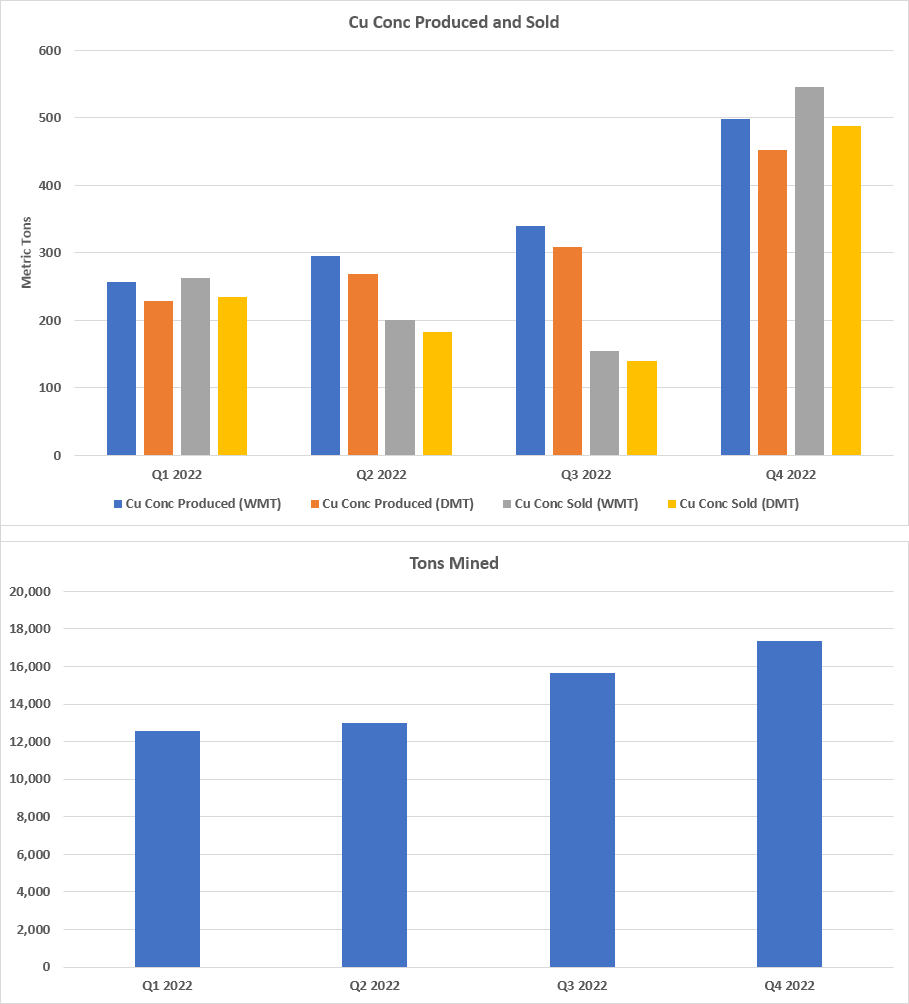

Vast reported a 47% overall increase in copper concentrate (Cu Conc) production, a 248% increase in Cu Conc sold, and a 35% increase in Cu Conc grade from Baita Plai, all quarter-on-quarter compared to Q3 2022.

Further to the interim production update Vast issued last month, the company reported today that it has exceeded the forecast figures announced on 16 December 2022, and that its December shipment was delivered as stated.

Andrew Prelea, Chief Executive Officer at Vast Resources PLC, commented:

"Q4 2022 production has seen a significant increase in mining and concentrate production as a result of the changes that have been implemented at Baita Plai during the course of H2 2022.

Management strongly believes in Baita Plai’s increasing performance and to achieve our goal of heading towards name plate capacity in H1 2023. Based on current production trends we have seen another significant increase in production and sales in Q4 2022 and we expect to see the trend continue into Q1 2023 and beyond."

View from Vox

Vast delivers yet another quarterly production increase at Baita Plai. Q1-Q3 2022 saw an incremental yet steady build up of production and sales, whereas in Q4 the company delivered a significant uplift across the board (see chart below). As well, tons mined increased to a record 17,343 tons.

Vast also reported production at Baita Plai continuing during the Christmas and New Year period with minimal down time, supporting the company's target of moving towards name plate capacity of 14,000 tonnes per month in H1 2023. Vast confirmed continued scheduling of Cu Cons sales, with the next shipment planned for the second half of January 2023.

Baita Plai's production increase in 4Q follows a 20% production increase in 3Q, which followed a 17% production increase in 2Q, all quarter-on-quarter. Should the trend continue into 2023, there is significant upside potential for the company whose shares suffered in the 2022 mining sector downturn.

We see no reason that the trend will not continue. Since 30 April, Vast has continued to implement a transition to mechanised mining at Baita Plai, and the mine is now active in four separate high productivity areas utilising Long Hole Stope methodology. The completion of Spiral number 3 will further increase production from Q2 2023. The presence of bismuth and molybdenum at Baita Plai further underscore its strategic value.

Overall, the economic fundamentals for Vast's polymetallic business remain strong. Increased demand for copper and tightness in supply have significantly lifted copper prices. The forecast global growth in EVs will keep pressure on supply over the next decade, exacerbated by declining grades, water supply issues, and community resistance. Demand for other critical metals used in renewable tech will follow a similar trajectory.

Vast's bullish outlook on polymetallics is therefore justified. Moreover, a continued reduction in Romanian and Zimbabwean country risk premiums has the potential to provide significant medium-term growth for the company. In both countries, Vast holds further mining claims and other interests, which are under appraisal.

Investors should stay tuned for a possible upgrade of Baita Plai's resource in 2023. The company has engaged a 3rd party technical contractor to review and reprofile the mine resources at Baita Plai, for an updated resource report expected in 1H23.

Follow News & Updates from Vast Resources: