Investing can be brutal, even at the best of times. So amid today’s ‘Bear Market’, are there any relatively ‘safer’ places to put one’s money?

One sector that’s historically proved resilient during recessions is consumer healthcare, thanks to its:

- Loyal user base

- Attractive margins

- Robust pricing power.

All important qualities in a slowing economy, suffering from supply chain issues & high inflation.

Enter Venture Life VLG , owner of niche OTC brands Balance Activ, Lift, Dentyl, Ultra Dex, Glucogel & Pom-T.

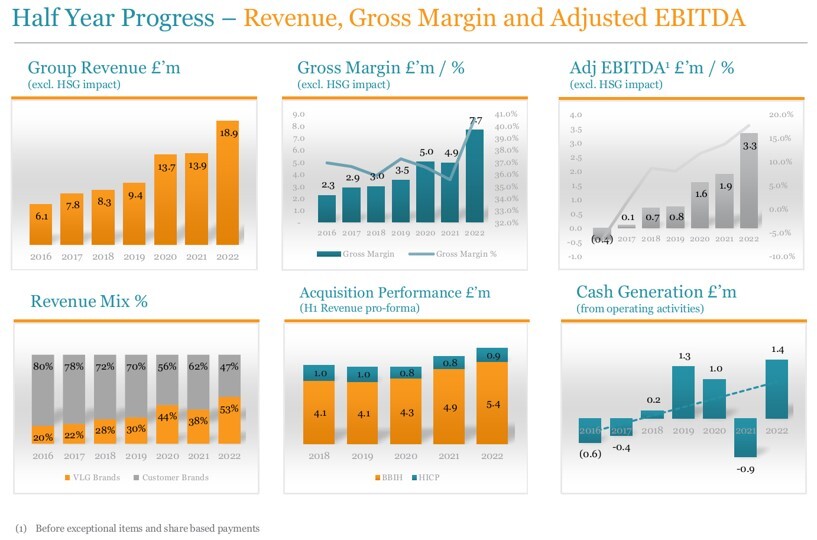

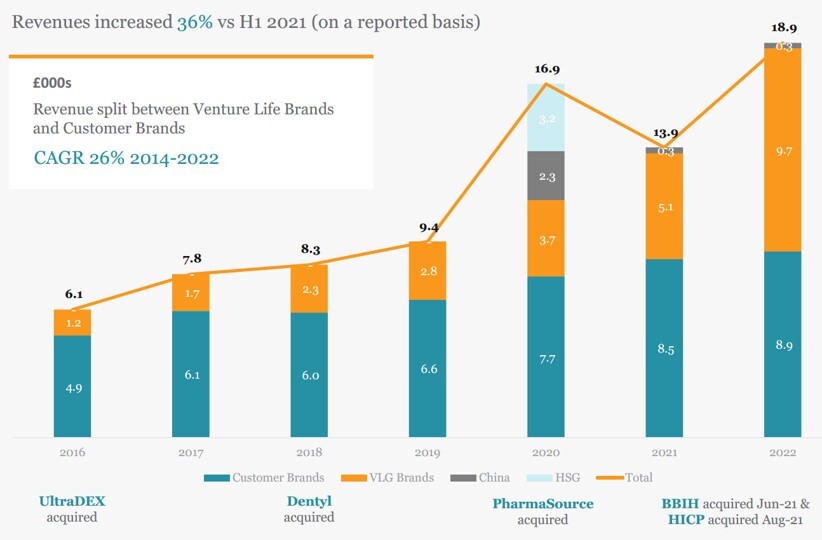

This morning the company reported ‘in line’ H1 results with turnover & adjusted EBITDA climbing to £18.9m (+36%, or 1.7% LFL) & £3.3m (+74%) respectively. Ending June with net debt flat at £3.1m vs £3.2m Dec’21 - after deciding proactively to build inventory in order to help protect customer supply.

Wrt the top line, standout performances came from the acquisitions of BBIH & HICP in 2021 (LFL up 9.5%), albeit neutralised by softness in mouthwash (-8.0% LFL) & women’s intimate health (-9.4% LFL). The latter being impacted by the Ukraine/Russia war, alongside consumers down-trading in response to the cost of living crisis.

All told, LFL revenues from VLG’s own brands were steady at £10m, and now represent 53% of the group (36% LY) vs 3rd party products at 47%, that were up +4.6% to £8.9m. Together delivering improved gross & EBITDA margins of 40.6% (35.6% LY) & 17.6% (14.0%). Thanks to product mix (+5.35%), price increases (+1.4%) & efficiency savings (+0.5%), which more than offset elevated input/energy costs (-2.5%).

Better still, H2 has started well, underpinned by an orderbook 30% higher than last year (re customers securing volume) and further upside likely, when China fully reopens after a period of persistent covid lockdowns.

Elsewhere, there are also M&A opportunities, supported by VLG’s £30m RCF and plenty of available manufacturing capacity (57%) to extract substantial integration synergies.

CEO Jerry Randall commenting: "Whilst we all face uncertainties in the coming months, the Group has traded well in H1, & expects to deliver FY’22 revenue (Singers Est £40.5m) and adjusted EBITDA (£8.2m) in line with market expectations”.

View From Vox

To us, based on what we know already, the stock trading at 28.5p appears significantly undervalued.

Trading on compelling EV/EBITDA, PE and PEG ratios of 4.8x, 12.9x and <0.3x respectively

Furthermore, Singers having a 65p/share target price.