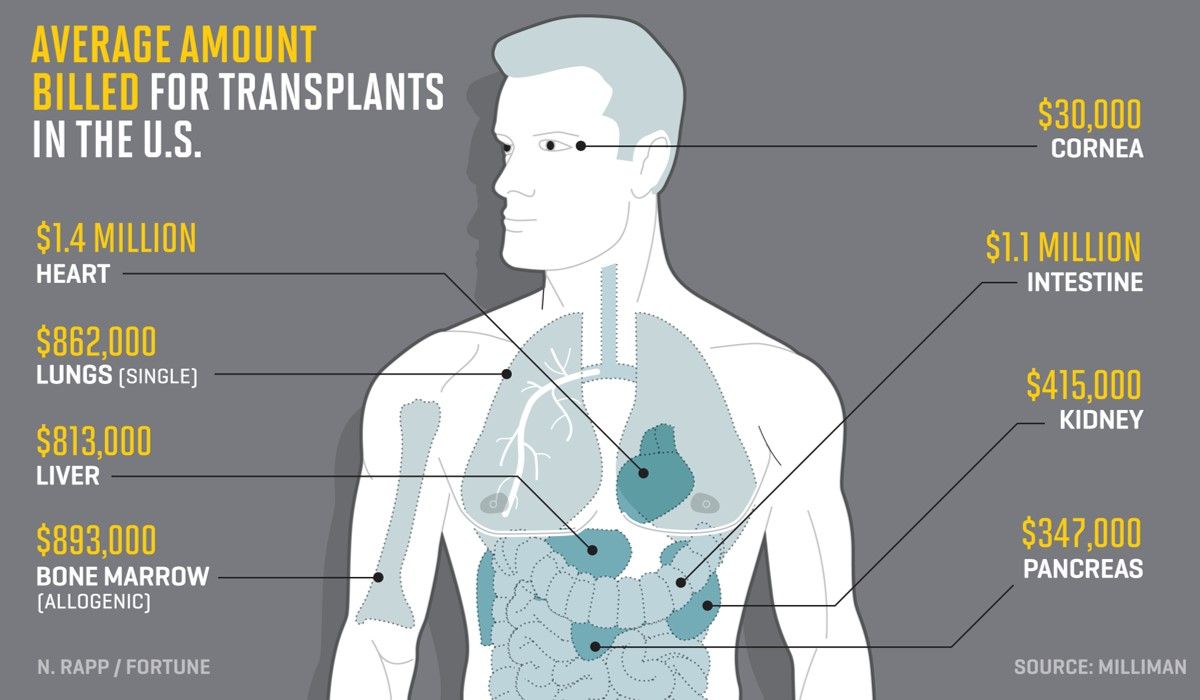

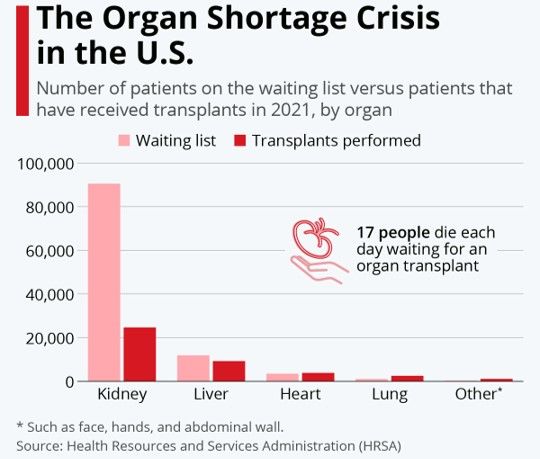

Billions is spent every year treating desperately sick people with acute kidney disease, who are often tied to dialysis machines - at an estimated cost per patient of $90k a year - and awaiting transplants. Worse still, rejection rates of donor parts are around 35%-50%, caused primarily by adverse immune responses.

Enter Verici Dx (VRCI), which launched its next-generationTutivia immuno-diagnostic in January this year. The treatment materially enhances treatment regimes and reduces healthcare costs by improving acceptance rates and extending organ longevity.

The AI-powered company reached another milestone this week, being awarded a CLIA Certificate of Compliance by the Centers for Medicare & Medicaid (CMS) for its clinical operations across 45 US states. This comes after successfully passing a thorough audit of its clinical procedures and laboratory in Tennessee.

This important news means Verici can now apply for full CMS/insurance cover, which should accelerate Tutivia’s sales. And the certification provides a further validation of the business across the wider medical community, alongside paving the way to obtain accreditation in the remaining five states.

As it's rolled out further, Tutivia is a potential game-changer for doctors, transplant patients and clinics, since it has already passed an extensive ‘real world’ trial with flying colours, hitting a 60% positive predictive value and an 80% negative predictive value.

And while it may take a little while to ramp up volumes, as procurement departments within transplant centres familiarise themselves with the technology, once full healthcare cover has been granted, I’d expect revenues to materially scale in the second half and beyond. In terms of the global total addressable market, there are an estimated 100,000 sufferers who undergo kidney transplants annually, of which approximately 25% are in the US.

Elsewhere, Verici's highly complementary pre-graft sister test Clarava is also slated for launch in Q4 2023 or Q1 2024 after completing its extended data collection study to expand usage and broaden the addressable market, expected in the second quarter.

And with the efficacy of the platform now proven, these two tests should hopefully open the door to similar scientific break-throughs in relation to other products. That could perhaps start with Protega, a treatment that aims to predict the risk of fibrosis and long-term graft failure – first revenues are slated for 2025.

At the last count in September 2022, broker Singer Capital Markets was predicting FY23 turnover of $0.9m climbing to $6.1m in 2024, with a 79p risk-adjusted target price - a theoretical 'ten-bagger' from the current 7.5p share price. And it's got plenty of cash to back its growth, with $10m in the bank at the end of December which should last well into 2024.

CEO Sara Barrington commented: “This milestone is an enabling step in our ability to offer our novel diagnostics, Tutivia and Clarava, on a national basis to patients and their clinicians. We expect to achieve additional milestones in 2023 that will support our unique products offerings.”