Vietnam Holding (VNH ) unveiled that its estimated net asset value (NAV) was $153.2m or $3.571 per share and £110.1m or £2.566 per share (GBP/USD = 1.3916) as of yesterday.

The London-listed closed-end fund, which is domiciled in Guernsey, aims to provide investors with long-term capital appreciation by investing in a concentrated portfolio of high-growth companies in Vietnam that demonstrate strong ESG awareness.

Last week, VNH reported to investors a double-digit increase in its NAV for the month of February 2021 following a period of economic momentum and social stability in Vietnam.

It noted in its statement that Vietnam's ‘road to recovery continues to stand out compared with other countries around the world’ with retail sales seeing a 8.2% year-on-year climb while manufacturing has maintained a strong gain for the first two months of 2021.

This was demonstrated through exports and imports which rose 24.7% Y-o-Y and 26.4% Y-o-Y, respectively, according to Vietnam's General Statistics Office. In particular, exports grew across all major markets, including the US, China, EU, ASEAN, Japan and South Korea.

VNH said Vietnam's now ‘more visible vaccination rollout plan’ which started recently, is likely to boost the hospitality and tourism sectors in coming months as the government opens borders to foreign travellers with proven vaccinations and the Ministry of Health distributes the 150 million doses it has said will arrive by the end of 2021 or early 2022.

Research from institute QuotedData has described Vietnam’s response to the pandemic as ‘very effective’, something reflected by the IMF’s latest prediction that it will post positive GDP growth of 1.6% for 2020, rising to 6.7% this year and averaging 7% for 2021 to 2025.

In fact, Dynam Capital, the partner-owned business which is Vietnam Holding’s manager, believes that Vietnam will be one the 20 largest economies in the world by 2050, it stated.

According to the research, Dynam has already tilted the portfolio towards sectors such as banking - where exposure has moved from around 10% to 25% - and in higher-quality real estate, which the group believes are well-positioned to capture the benefits of this growth.

‘This strategy has already reaped some rewards, as VNH’s banking stocks have been amongst its stronger performing holdings as markets have recovered,’ it told investors.

Specifically, the report highlighted that VNH’s portfolio of high-growth companies in Vietnam ‘should come at an attractive valuation and demonstrate strong ESG awareness.’

It said the company achieves this by investing primarily in publicly-quoted Vietnamese equities, but stated that ‘it can also invest in unlisted companies and can hold the securities of foreign companies if a majority of their assets and/or operations are based in Vietnam.’

(Source: Vietnam Holding – Leveraging Asia’s rising star by QuotedData)

(Source: Vietnam Holding – Leveraging Asia’s rising star by QuotedData)

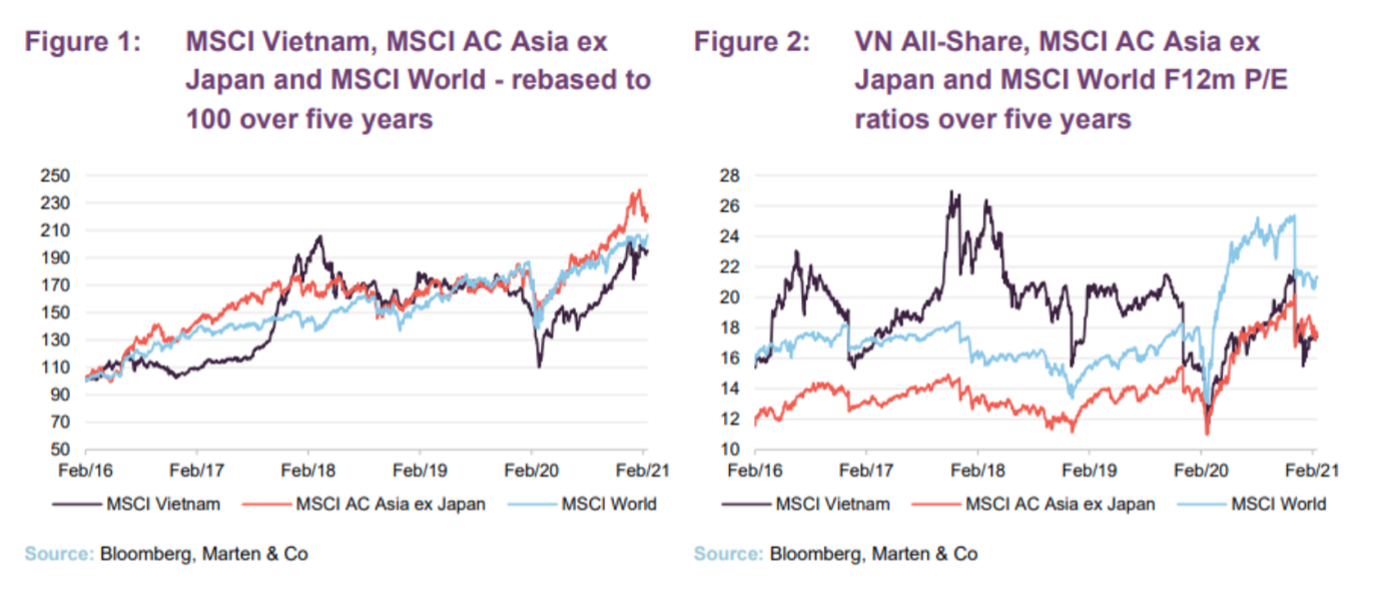

Figure 1 shows Vietnam, emerging Asia and global equity markets to have provided strong returns over the last five years. Figure 2 identifies that the Vietnamese equity market is cheaper than broader global equities and emerging Asian equities on an F12m p/e basis.

The research said Vietnam benefits from ‘a number of structural growth drivers’ that suggest it is well-positioned for further economic expansion for years to come. These factors include Vietnam’s increasingly open economy and its well-diversified foreign trade partners.

Dynam said the fund’s largest holding, FPT Corp, had “grown impressively”. VNH said it continues to benefit from overweight positions in selected banks, including, inter alia, Vietin Bank and VP Bank where it said its sees “high growth potential for 2021 and beyond.”

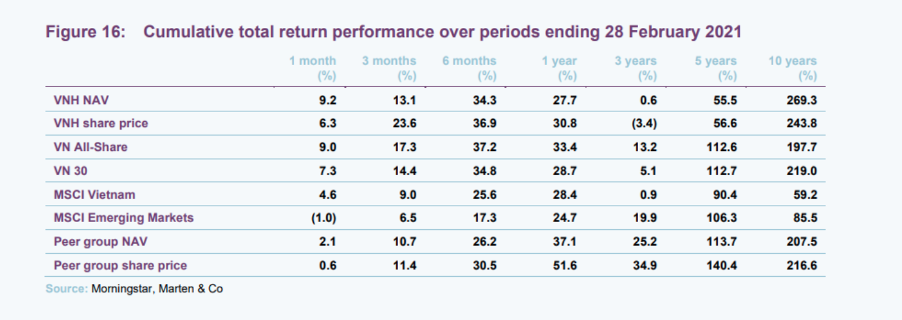

As shown below, over six months, VNH’s performance is particularly strong relative to the broader indices and its peers. QuotedData said this is a period where VNH has reduced the portfolio's bias to small-to-mid-cap stocks in favour of larger companies, particularly banks.

(Source: Vietnam Holding – Leveraging Asia’s rising star by QuotedData)

“We are now one year on from when the World Health Organisation named COVID-19 a Global Pandemic: the world is still adjusting to life (and sadly death) as a result of the virus. 2021 has started strongly for Vietnam and the Fund's NAV and share price have touched all-time highs,” the company told investors last week.

Shares in Vietnam Holding have increased by nearly 9% in value since the beginning of 2021. The stock ticked up 1.07% in value this morning to 211.24p following the group’s statement.

Follow News & Updates from Vietnam Holding here: