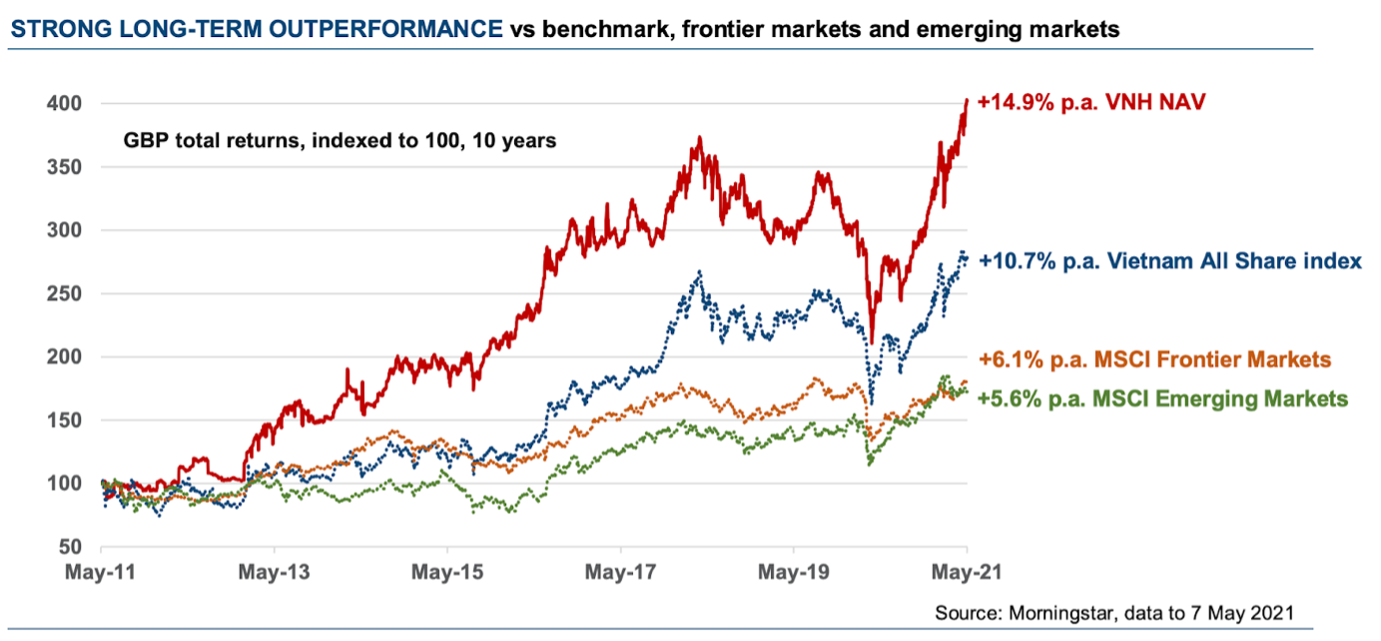

New research from the UK-based house broker finnCap says Vietnam Holding (VNH), the Vietnam-based fund manager, possesses the ‘solid fundamentals’ for long-term continued growth as Vietnam is set to remain one of the world’s highest GDP growth countries.

Vietnam Holding, the London-listed closed-end fund which is domiciled in Guernsey, aims to provide investors with long-term capital appreciation by investing in a concentrated portfolio of high-growth companies in Vietnam that demonstrate strong ESG awareness.

In February 2021, VNH reported a double-digit increase in its NAV for the month of February 2021 following a period of economic momentum and social stability in Vietnam.

Meanwhile, yesterday VNH reported that, at its close of business on 13 May 2021 its Estimated NAV was $171.8m or $4.012 per share and £122.3m or GBP 2.856 per share.

Commenting on its outlook, analysts at finnCap said the economy in Vietnam is in strong shape (2.9% 2020 GDP growth) following limited Covid-related domestic disruption, high domestic confidence (including in the stock market) and strengthened export position.

All data is sourced from the Company and Bloomberg, and is as of 31 March 2021, unless otherwise stated.

All data is sourced from the Company and Bloomberg, and is as of 31 March 2021, unless otherwise stated.

Recent research from QuotedData described Vietnam’s response to the pandemic as ‘very effective’, something reflected by the IMF’s latest prediction that it will post positive GDP growth of 1.6% for 2020, rising to 6.7% this year and averaging 7% for 2021 to 2025.

Dynam Capital, the partner-owned business which is Vietnam Holding’s manager, stated that it believes that Vietnam will be one the 20 largest economies in the world by 2050.

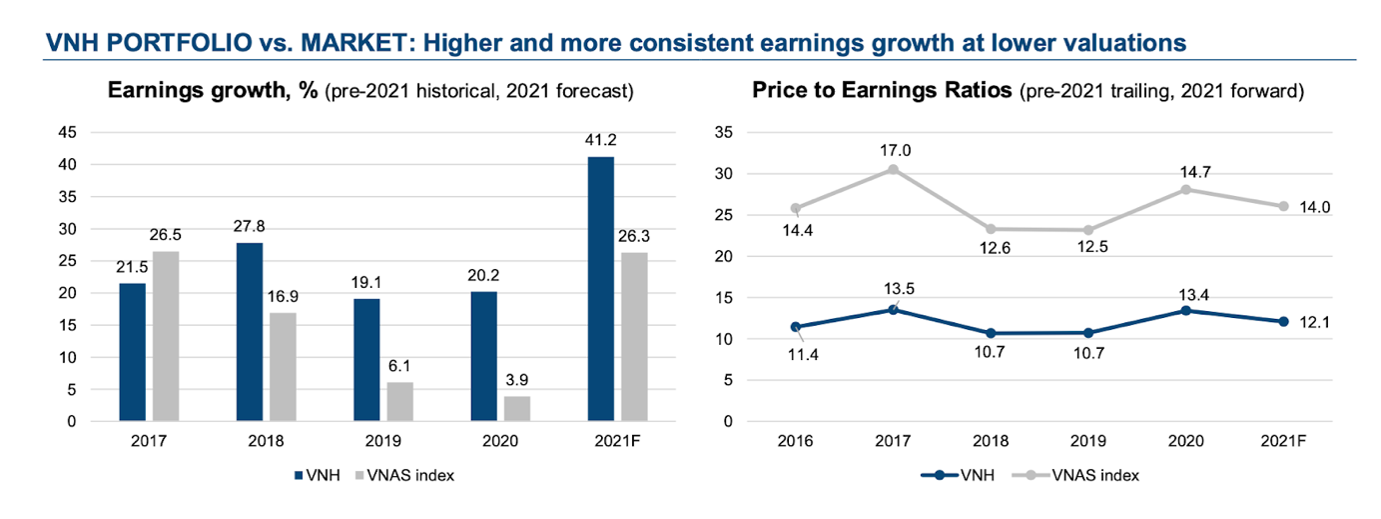

finnCap analysts highlighted that both the market cap and number of companies for VNH ‘continues to grow, and liquidity has improved markedly.’ It said its portfolio holds higher and more consistent EPS growth than the benchmark (2017-2020 average 22% vs 13%, 2021F 41% vs 26%), at consistently lower valuations (VNH portfolio 2021F PE 12x vs index 14x).

Analysts added that this improved market liquidity has also been supported by Vietnam’s strong currency. It noted that the Vietnamese Dong has been reported as stable for around the last three years, ending the 20-year depreciation trend of around 2.4% p.a. Meanwhile, trade surpluses are also set to continue to support and reaffirm the local currency.

Shares in Vietnam Holding have increased by over 15% in value since the beginning of 2021. The stock was trading 0.45% lower this morning at 220p following finnCap’s research note.

Follow News & Updates from Vietnam Holding here: