If you find this podcast useful please give it a rating and review on iTunes by clicking here

Vox Screens Stocks: John & Justin pick a stock from the screen of screens

In this podcast we review the performance of the stocks we have picked from previous screeners, over the last six months, and pick a few companies from this list we believe should continue to perform.

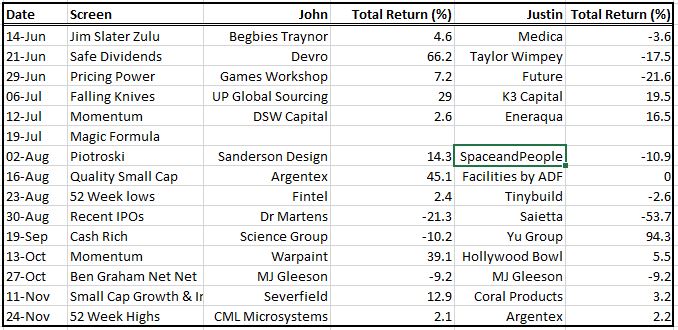

Here are the screens, with our picks and subesequent performance:

John's Picks for 2023 are:

Begbies Traynor is a provider of insolvency services, demand for which is set to rise as the economy slows down. In its last trading statement the company said revenues and profits in the six months to October were up 12% and 13%, respectively, leaving it on course to meet full-year expectations.

With little debt on the balance sheet even after the acquisition of property advisory business Budworth Haredcastle in June it's well-funded to tap into an expected wave of insolvencies, with the key indicator of County Court Judgements up 157% in the first quarter of the year according to Begbies Traynor's lates Red Flag Alert Report.

Severfield

Severfield is the UK's market leader in the design, fabrication and construction of structural steel, with a total capacity of c.150,000 tonnes of steel per annum. The Group has six sites, c.1,500 employees and expertise in large, complex projects across a broad range of sectors. The Group also has an established presence in the expanding Indian market through its joint venture partnership with JSW Steel (India's largest steel producer). Severfield is well positioned to capitalise on the need for major infrastructure investments in the UK and beyond, in particular the ongoing transition to renewable energy.

"Since our inception we’ve become internationally synonymous with quality, innovation and unrivalled expertise within the steel industry. Today, with multiple sites in the UK and our India factory, we have an annual capacity to produce around 300,000 tonnes of fabricated steelwork. You’ll find our legacy in infrastructure, transport, culture, the commercial sector and more; you’ll be surprised to see just how many of the iconic landmarks and buildings you know and love are part of our portfolio - see our projects for some examples of work we’re really proud of".

Justin's Picks for 2023 are:

Argentex

Argentex is a leading provider of foreign exchange services to financial institutions, corporates, and private clients globally.

"We are an FCA regulated, founder-led business listed on the London Stock Exchange. We have traded more than $75bn in over 70 currencies for our clients since 2012. Making and receiving payments on their behalf.

We are a profitable, debt-free, cash rich business and operate as a Riskless Principal broker for non-speculative and commercial currency transactions. Whether our clients' objectives are short or long-term, our sharp execution combined with expert analysis achieves material impact on both pricing and efficiency"

K3 Capital

K3 Capital Group plc is a multi-disciplinary and complementary group providing specialist advisory services to SMEs, incorporating Business and Company Sales, Restructuring and Insolvency and Tax Advisory services. The Group floated on the London Stock Exchange's Alternative Investment Market (AIM) in April 2017.

Here's a fuller dataset with key financial indicators for our 2022 picks:

Source: SharePad