If you find this podcast useful please give it a rating and review on iTunes by clicking here

In this episode of Vox Screens Stocks, John Hughman & Justin Waite pick two stocks from a quality small cap screener

Welcome back to our new podcast series Vox Screens Stocks. There are lots of ways of finding investment opportunities, but one of the most fruitful is to start your search by crunching stock market data. With thousands of listed companies, using tools to filter for certain financial characteristics can whittle the market down to a manageable number that you can use to focus your research efforts.

Each week we'll use a variety of stock screening approaches to come up with a list of stocks which fit the criteria of this week’s stock screener, then John & Justin will pick a stock from the list, explain what they like about it.

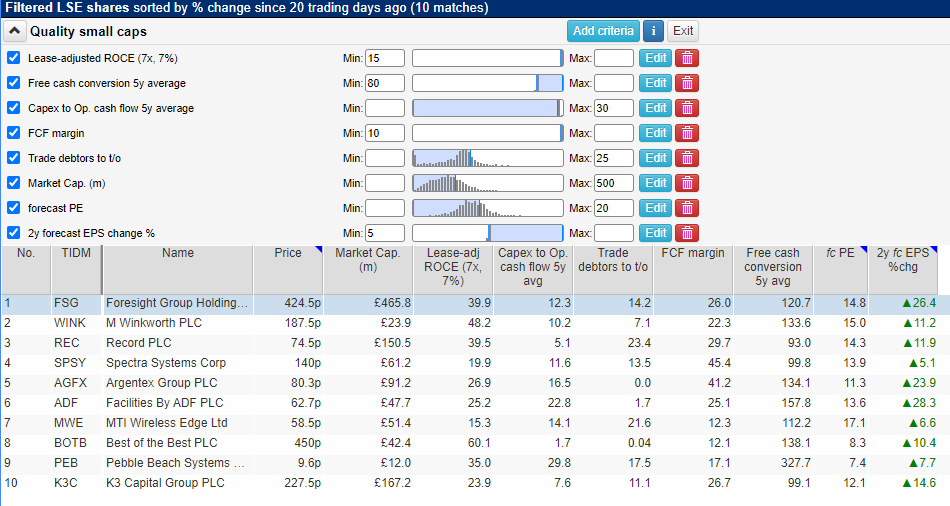

This week we are filtering using a Quality Small Cap screener adapted from a SharePad filter. We're using it to find businesses that demonstrate quality characterstics, filtering with the following criteria:

- A lease adjusted return on capital over 15%, which shows how efficiently a company turns its invested capital into profit.

- A minimum 80% average free cash flow conversion over 5 years, which shows how effective a company is at turning reported profits into cash available to shareholders

- A free cash flow margin over 10%

- A 5-year average capital expenditure-to-operating cash flow ratio of less than 30 - a lower number is better as it means a company isn't having to use its cashflow to service its infastructure

- A trade debtor-to-turnover ratio of less than 25 - again, lower is better as it means a company is good at collecting payment from its customers

- A maximum forecast PE of less than 20, to ensure we're not overpaying for the shares, a significant risk when using the quality investing approach.

- A 2-year forecast EPS of greater than 5%, to make sure a business is in fact growing.

Here are the full screen results:

Source: SharePad

John's Pick is:

Argentex Group #AGFX

Argentex is a leading provider of foreign exchange services to financial institutions, corporates, and private clients globally. As a middle man it doesn't take on investment risk, and it's benefiting from the current weakness of sterling and the euro as clients try to protect themself from currency weakness with hedging. That saw it grow sales by 23% in its last year, around a quarter of which came from new clients. And investment in headcount and new technology is driving growth, too.

Justin's Pick is:

Facilities by ADF is a leading provider of premium serviced production facilities to the UK film and HETV industry. The Group has grown significantly since being established in 1992 and is now profitable, cash-generative and offers a suite of over 500 vehicles and trailers to its customers. The Group aims to increase its vehicles and trailer count to over 700 by the end of 2023.