If you find this podcast useful please give it a rating and review on iTunes by clicking here

In this episode of Vox Screens Stocks: John & Justin pick two stocks from micro caps at 52 week lows

There are lots of ways of finding investment opportunities, but one of the most fruitful is to start your search by crunching stock market data. With thousands of listed companies, using tools to filter for certain financial characteristics can whittle the market down to a manageable number that you can use to focus your research efforts.

Each week we'll use a variety of stock screening approaches to come up with a list of stocks which fit the criteria of this week’s stock screener, then John & Justin will pick a stock from the list, explain what they like about it.

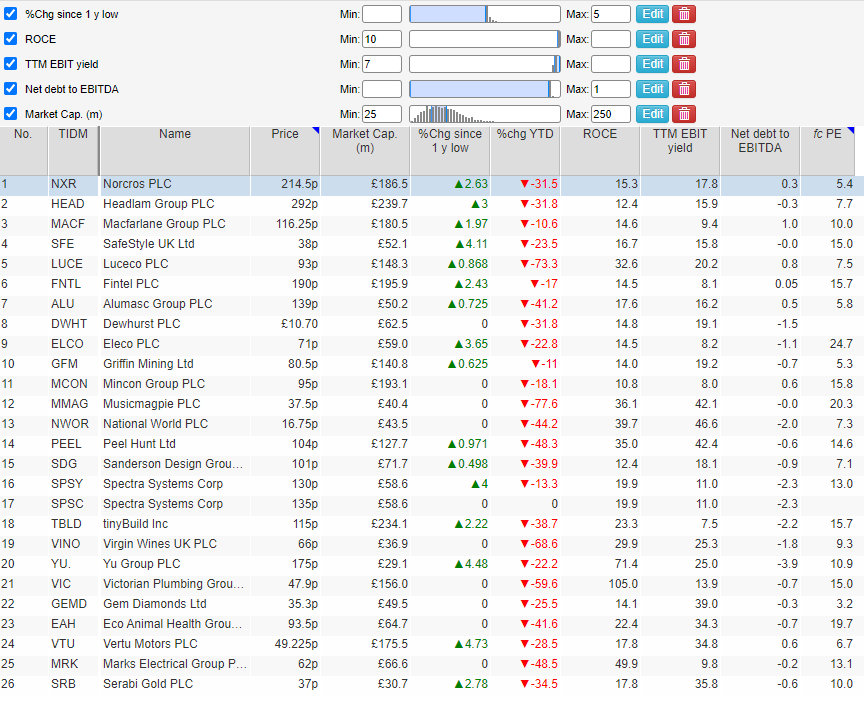

This week we are filtering for small caps at 52 week lows that demonstrate quality characteristics that could support a share price recovery. Specifically, we're looking at companies valued at between £25m and £250m that meet the following criteria:

- A return on capital employed (ROCE) greater than 10, which shows how efficiently a company is using its capital to generate profits

- An EBIT or earnings yield greater than 7. Calculated by dividing operating profit or EBIT by enterprise value, the ratio is the inverse of the PE but takes into account debt/cash, and helps us determine whether an investment is attractive relative to prevailing interest rates.

- Net debt to EBITDA less than 1 to ensure we exclude companies that are overly leveraged.

Here's the full list of results, screened using SharePad:

John's Pick is:

Fintel #FNTL

Fintel is the UK's leading fintech and support services business, combining the largest provider of intermediary business support, SimplyBiz, and the leading research, ratings, and Fintech business, Defaqto.

Fintel provides technology, compliance and regulatory support to thousands of intermediary businesses, data and targeted distribution services to hundreds of product providers and empowers millions of consumers to make better informed financial decisions.

Justin's Pick is:

tinyBuild #TBLD

Founded in 2013, tinyBuild is a global video games publisher and developer, with a catalogue of more than 70 premium titles across different genres. tinyBuild's strategy is to focus on its own intellectual property (IP) to build multi-game and multimedia franchises, in partnership with developers.