If you find this podcast useful please give it a rating and review on iTunes by clicking here

In this episode of Vox Screens Stocks, John Hughman & Justin Waite pick two stocks from the Momentum Screener.

Welcome back to our new podcast series Vox Screens Stocks. There are lots of ways of finding investment opportunities, but one of the most fruitful is to start your search by crunching stock market data. With thousands of listed companies, using tools to filter for certain financial characteristics can whittle the market down to a manageable number that you can use to focus your research efforts.

Each week we'll use a variety of stock screening approaches to come up with a list of stocks which fit the criteria of this week’s stock screener, then John & Justin will pick a stock from the list, explain what they like about it.

This week we are looking at Companies that are considered "momentum" plays.

Momentum is the approach of simply buying companies that are rising, because evidence shows that once an uptrend is established it tends to continue. There's no agreement as to why it works, given that it seems to fly in the face of the widely-accepted efficient markets hypothesis, but it is nevertheless one of the most powerful factors in investment returns.

The problem investors face when trying to follow momentum strategies are, essentially, twofold. Firstly, the strategy requires regular rebalancing of portfolios to target the shares most recently demonstrating momentum, which means lots of dealing costs which can potentially damage returns. Secondly, momentum can stop suddenly, as we've seen recently as lots of popular shares found themselves looking unattractive in the face of soaring inflation.

What's more, much of the evidence that supports the idea of targeting momentum as a strategy has come in bull markets - periods of potentially irrational exhuberance.

We may no longer be in bull market territory, but it still seems like a good time to take a look at what's been shrugging off the bad market market and economic news to see what's been rising recently, and hopefully find companies that have what it takes to withstand a sell off. The criteria for the screen are as follows:

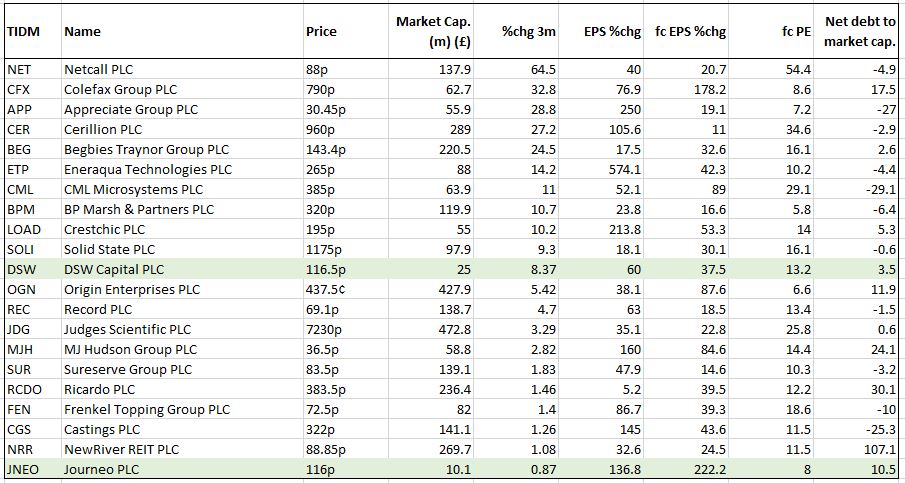

- Market capitalisation of between £10m and £500m

- Positive share price movement in the last 3 months

- Positive EPS growth last year

- Forecast EPS growth of more than 10% next year

We've also added columns showing the forecast PE ratio and proportion of Net Debt to Market Capitalisation to give a feel for valuation and balance sheet health - in both cases the lower the better. And you should also look at the numbers in the context of recent commentary from the company, particularly the latest outlook statements. Always remember, numbers alone can mislead - stock screens are a starting point for further research.

Here are the results of this week's screen, sorted by 3-month share price momentum:

CLICK HERETO SEE A MARKET HEATMAP FOR THE STOCKS IN THIS SCREEN

DSW Capital, owner of the Dow Schofield Watts brand, is a profitable, fast growing, mid-market, challenger professional services network with a cash generative business model and scalable platform for growth. Originally established in 2002, by three KPMG alumni, DSW is one of the first platform models disrupting the traditional model of accounting professional services firms. DSW now operates licensing arrangements with 20 licensee businesses with 88 fee earners ("FEs"), across eight offices in England and one in Scotland. These trade primarily under the Dow Schofield Watts brand.

DSW's vision is for the DSW Network to become the most sought-after destination for ambitious, entrepreneurial professionals to start and develop their own businesses. Through a licensing model, DSW gives professionals the autonomy and flexibility to fulfil their potential. Being part of the DSW Network brings support benefits in recruitment, funding and infrastructure. DSW's challenger model attracts experienced, senior professionals, predominantly with a "Big 4" accounting firm background, who want to launch their own businesses and recognise the value of the Dow Schofield Watts brand and the synergies which come from being part of the DSW Network.

DSW aims to scale its agile model through organic growth, geographical expansion, additional service lines and investing in "Break Outs" (existing teams in larger firms). The directors are targeting high margin, complementary, niche service lines with a strong synergistic fit with the existing DSW Network.

Justin's Pick (s):

Eneraqua Technologies (AIM:ETP) is a specialist in energy and water efficiency. The group designs and delivers improved energy and water systems which utilise its wholly owned intellectual property, the Control Flow HL2024. Energy was the first market the company entered and this is the larger sector, with the company focused on clients with end of life gas, oil or electric heating and hot water systems. The group provides turnkey retrofit district or communal heating systems based either on high-efficiency gas or ground/air source heat pump solutions that support Net Zero and decarbonisation goals.

Journeo plc is a leading information systems and technical services business focussed on public transport and related infrastructure within towns, cities, airports, and local authorities. The company works extensively with local government departments, combined authorities, and many of the largest multinational transport operators, supporting them as systems converge towards a more efficient and sustainable smarter-cities future.

The business currently comprises two segments:

· Fleet operator solutions: CCTV video surveillance to improve passenger & driver safety, telematics for vehicle and driver performance monitoring, real-time communications for remote condition monitoring and automatic passenger counting.

· Passenger infrastructure solutions: design, manufacture, installation, and management of hardware and software for electronic public transport information systems, in and around towns, cities, ferry terminals and airports which includes smart-ticketing and wayfinding.