If you find this podcast useful please give it a rating and review on iTunes by clicking here

Welcome back to our new podcast series Vox Screens Stocks featuring John Hughman, previous Editor of Investors Chronicle & now head of content at Vox Markets and the voice of Vox Justin Waite.

There are lots of ways of finding investment opportunities, but one of the most fruitful is to start your search by crunching stock market data. With thousands of listed companies, using tools to filter for certain financial characteristics can whittle the market down to a manageable number that you can use to focus your research efforts.

Each week we'll use a variety of stock screening approaches to come up with a list of stocks which fit the criteria of this week’s stock screener, then John & Justin will pick a stock from the list, explain what they like about it.

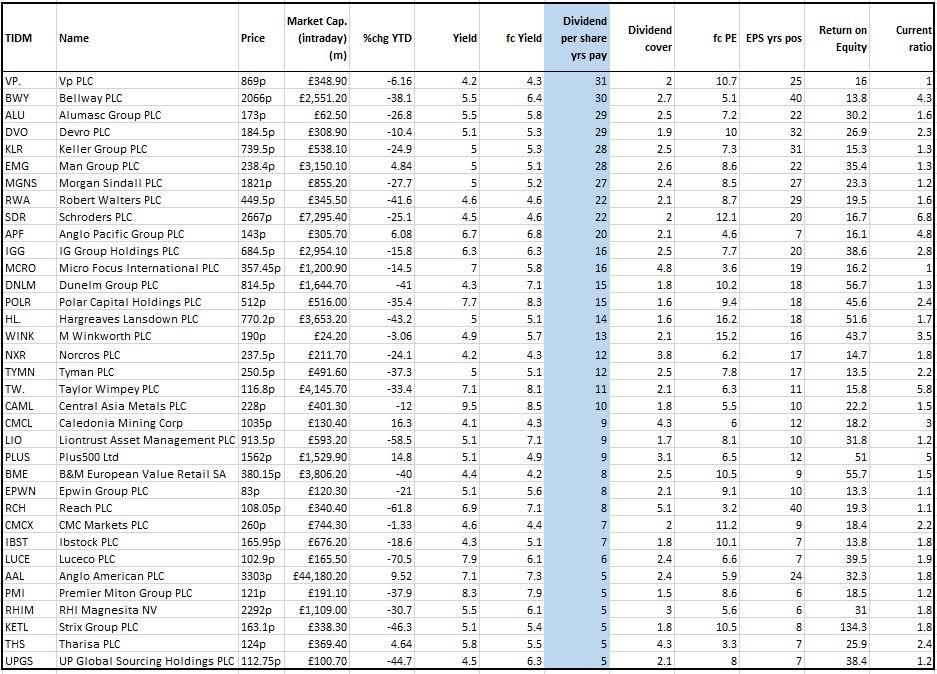

This week we are looking for safe dividend paying companies, which could prove good investments in a low-growth, inflationary environments when more of the market return is likely to come from dividends. We've run our screen using the following criteria:

- Trailing yield greater than market average (4%) but less than 10%, which could be a sign that it’s unsustainable

- Forecast yield greater than market average (4%) but below 10%

- In the top 50% of UK dividend yields

- 5+ years of consecutive dividend payments

- Dividend cover – which measures a company’s headroom to pay dividends - greater than 1.5

- Forecast PE less than 20

- 5+ years of consecutive positive EPS

- Return on equity – a measure which demonstrates a company’s ability to generate profit from its assets - greater than 12.5

- Current ratio – a measure of a company’s ability to meet its short-term liabilities - greater than 1

You should also look at the numbers in the context of recent commentary from the company, particularly the latest outlook statements. Always remember, numbers alone can mislead - stock screens are a starting point for further research.

Here are the results of this week's screen, sorted by the number of consecutive years of dividend payments:

John's Pick:

Devro #DVO one of the world's leading manufacturers of collagen products for the food industry.

Sausage skins may sound a niche business, but that's exactly why Devro could prove a good bet - a dominant global market position that's unlikley to attract new entrants means it's well placed to push through price increases to customers and offset input cost increases without damaging demand. Indeed, its volume growth remains steady, and the completion of major restructuring and capital investment programmes is shining through in steadily improving quality metrics including operating margins and returns on capital, even as it develops new products. And strong generation supports dividends even as it pays down debt.

Justin's Pick:

Taylor Wimpey #TW. a customer-focused homebuilder operating at a local level from 23 regional businesses across the UK.

Although there are concerns about the ongoing strength of the property market in the face of rising rates and an economic slowdown, the structural imbalance of supply and demand is likely to remain supportive of housing market activity to a large degree. Housebuilders like Taylor Wimpey have proven highly cash generative over recent years, and have already sold of sharply in response to a weakened outlook and the planned withdrawal of government support including Help to Buy.

Other Stocks mentioned: