If you find this podcast useful please give it a rating and review on iTunes by clicking here

Welcome to the first in a new podcast series Vox Screens Stocks featuring John Hughman, previous Editor of Investors Chronicle & now head of content at Vox Markets and the voice of Vox Justin Waite.

There are lots of ways of finding investment opportunities, but one of the most fruitful is to start your search by crunching stock market data. With thousands of listed companies, using tools to filter for certain financial characteristics can whittle the market down to a manageable number that you can use to focus your research efforts.

Each week we'll use a variety of stock screening approaches to come up with a list of stocks which fit the criteria of this week’s stock screener, then John & Justin will pick a stock from the list, explain what they like about it.

There are countless ways of screening stocks, but we're going to start with one called the Zulu Screen. There are lots of ways of finding investment opportunities, but one of the most fruitful is to start your search by crunching stock market data. With thousands of listed companies, using tools to filter for certain financial characteristics can whittle the market down to a manageable number that you can use to focus your research efforts.

The first screen we’re going to use is based on the investment principles of the legendary Jim Slater, who first outlined the approach in his book The Zulu Principle. Jim was a great believer in the Growth at a Reasonable Price approach, especially in the small cap market – because, as he put it, “elephants don’t gallop”.

A key component of the approach is the so-called PEG ratio, which compares the valuation of the company based on the PE ratio and the rate of earnings growth. The idea is that we can find fast growing companies whose prospects are being undervalued by the market. As a rule of thumb, a PEG of less than 1 – the PE divided by the rate of EPS growth - suggests a company could be undervalued.

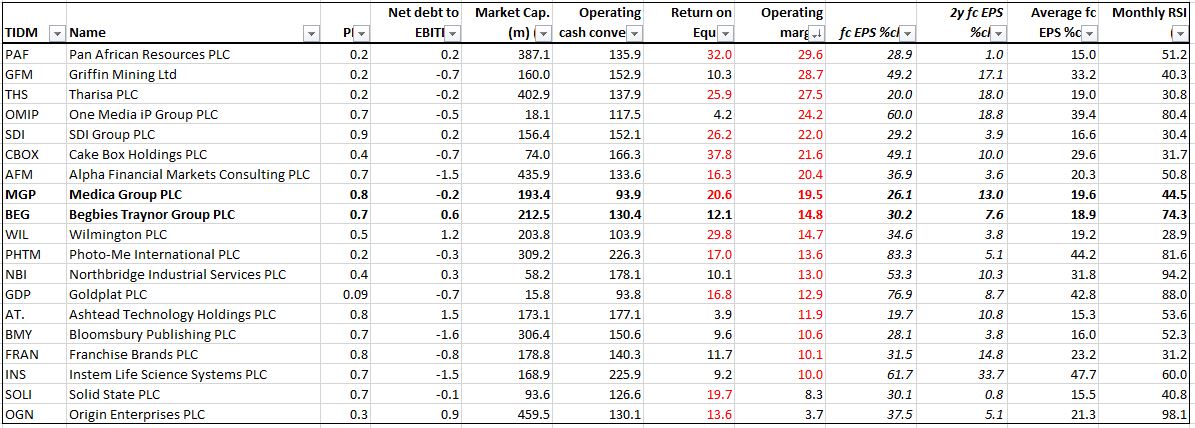

As with any screen, cheapness alone isn’t enough to warrant buying a share, so we assess the PEG in the context of other factors that might indicate its quality. The full criteria are as follows:

- A PEG below 1

- Net debt to cash profits of less than 1.5

- Return on equity or operating margins above 10%

- Positive forecast EPS growth over 2 years averaging 10% or more

- Operating ash conversion above 90%

- Positive momentum above the media market, as measured by the RSI

You should also look at the numbers in the context of recent commentary from the company, particularly the latest outlook statements. Always remember, numbers alone can mislead.

Here are the results of this week's screen:

John's pick is Begbies Traynor #BEG

Begbies Traynor is a provider of insolvency services, demand for which is set to rise as the economy slows down. In its last trading statement the company said results in the year to April would be "comfortably ahead of market expectations", which means revenues and adjusted pre-tax profits are expected to increase by 30% and 55% respectively.

With net cash on the balance sheet it's well-funded to tap into an expected wave of insolvencies, with the key indicator of County Court Judgements up 157% in the first quarter of the year according to Begbies Traynor's lates Red Flag Alert Report.

Justin's pick is Medica Group #MGP

Medica is the market leader in the UK and Ireland for the provision of teleradiology services, providing outsourced interpretation and reporting of MRI (magnetic resonance imaging), CT (computerised tomography), ultrasound and plain film (x-ray) images. Medica also offers diabetic retinopathy screening in Ireland.

Medica contracts with the largest pool of consultant radiologists in the UK and Ireland, performing remote access teleradiology across its customer base of more than 100 NHS Trusts in the UK, the Irish HSE, private hospital and insurance groups, as well as diagnostic imaging companies. This enables the Company to offer a fast, responsive service. In addition, Medica operates in Australia and New Zealand through MedX, a 50:50 Joint Venture with Integral Diagnostics Limited Pty.

The Company currently offers two primary services to hospital radiology departments:

· NightHawk - urgent reporting service

· Elective - includes routine cross-sectional reporting on MRI and CT scans, and routine plain film reporting on x-ray images.

These services are underpinned by Medica's bespoke, secure IT platform that provides market-leading linkage between a hospital's Radiology Information System (RIS) and consultant radiologists who contract with the Company. Direct RIS access ensures that where the wider patient medical history is available, it can be reviewed by the consultant as part of every report.