If you find this podcast useful please give it a rating and review on iTunes by clicking here

In this episode of Vox Screens Stocks, John Hughman & Justin Waite pick two stocks using the Piotroski Score

Welcome back to our new podcast series Vox Screens Stocks. There are lots of ways of finding investment opportunities, but one of the most fruitful is to start your search by crunching stock market data. With thousands of listed companies, using tools to filter for certain financial characteristics can whittle the market down to a manageable number that you can use to focus your research efforts.

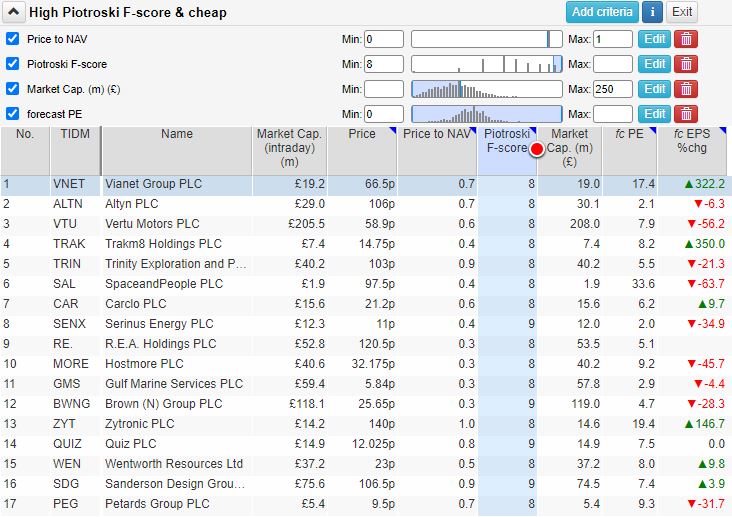

Each week we'll use a variety of stock screening approaches to come up with a list of stocks which fit the criteria of this week’s stock screener, then John & Justin will pick a stock from the list, explain what they like about it.

This week we are filtering using the Piotroski Score

The Piotroski F score is a score between zero and nine that reflects nine criteria used to determine the strength of a company's financial position. The Piotroski score is used to look for value stocks, with nine being the best and zero being the worst. The scoring system is often used in conjunction with the price to book ratio, which looks for shares worth less than the value of net asset value per share as an indicator of cheapness.

The Piotroski score was named after Chicago Accounting Professor Joseph Piotroski, who devised the scale in 2000. The system is focused on the company’s accounting results in recent time periods (years), including positive post-tax profit; positive operating cashflow; higher post-tax profits than the previous year; higher operating cash then post-tax profits; falling gearing (net debt/net assets); the current ratio up on the previous year; no shares issued in the past 12 months; higher gross margins than the previous year.

For every criterion met, one point is awarded; otherwise, no points are awarded. The points are then added up to determine the best value stocks. Some software - including SharePad which we use here - offer this as a preset screen.

John's Pick is:

Sanderson Design Group #SDG

Sanderson Design Group PLC is a luxury interior furnishings company that designs, manufactures and markets wallpapers, fabrics and paints. In addition, the Company derives licensing income from the use of its designs on a wide range of products such as bed and bath collections, rugs, blinds and tableware.

Sanderson Design Group's brands include Zoffany, Sanderson, Morris & Co., Harlequin, Scion, Clarke & Clarke and Archive by Sanderson Design.

Its wealthier clientele are less likely to be feeling the pinch from the cost of living crisis, reflected in impressive growth forecasts, and the strength of its balance sheet offers insulation from broader market worries. It should benefit from a strengthening dollar as it seeks to grow its US business, and gross margins are likely to be further improved from the already impressive 65.8% as licencing sales grow.

Justin's Pick is:

SpaceandPeople #SAL

The SpaceandPeople markets sell and administer promotional space as well as on-mall and short-term retail space in high footfall venues, including shopping centres, garden centres, city centres, retail parks and train stations.

They match brands, promoters and retailers to the venues and footfalls that are right for them.

Here are the full results: