With strong niche positions in regulated, long cycle & challenging environments, Avingtrans - a specialist engineer - has seen its shares climb >20% CAGR (excl divs) over the past decade vs 5% for AIM & 3% for the FTSE100.

Here its differentiated products include blast proof doors (Re HS2/submarines), ultra-secure storage boxes for nuclear waste (Sellafield), performance / safety critical parts (eg pumps/motors for difficult-to-handle fluids such as molten salt) & aftermarket services.

However one less well understood & certainly undervalued ‘jewel’ in the AVG crown, is its 58% stake in Magnetica. A medical devices firm developing a ground-breaking, small form & cryogen free MRI scanner for the orthopaedics, neonatal & veterinary sectors, with an est £400m TAM.

In order to further broaden this functionality, AVG said it had invested £2.5m for 5.9% in Oxford based Adaptix. A similarly ‘disruptive’ & highly complementary emerging medtech leader that is creating a low-cost, low dose, 3D portable X-ray imaging machine that could transform radiology.

The aim being to ultimately ‘fuse’ both MRI & X-ray images into one simple to use device. Thus enabling doctors to cheaply & quickly view full 3D graphics of say skeletal & soft tissue damage in broken bones at the point-of-care. Whilst later on adding ultrasound capability too.

Altogether not only producing a more compelling user proposition, but also significantly increasing the speed-to-market, adoption rate & opportunity (say if monetised on a PAYG basis).

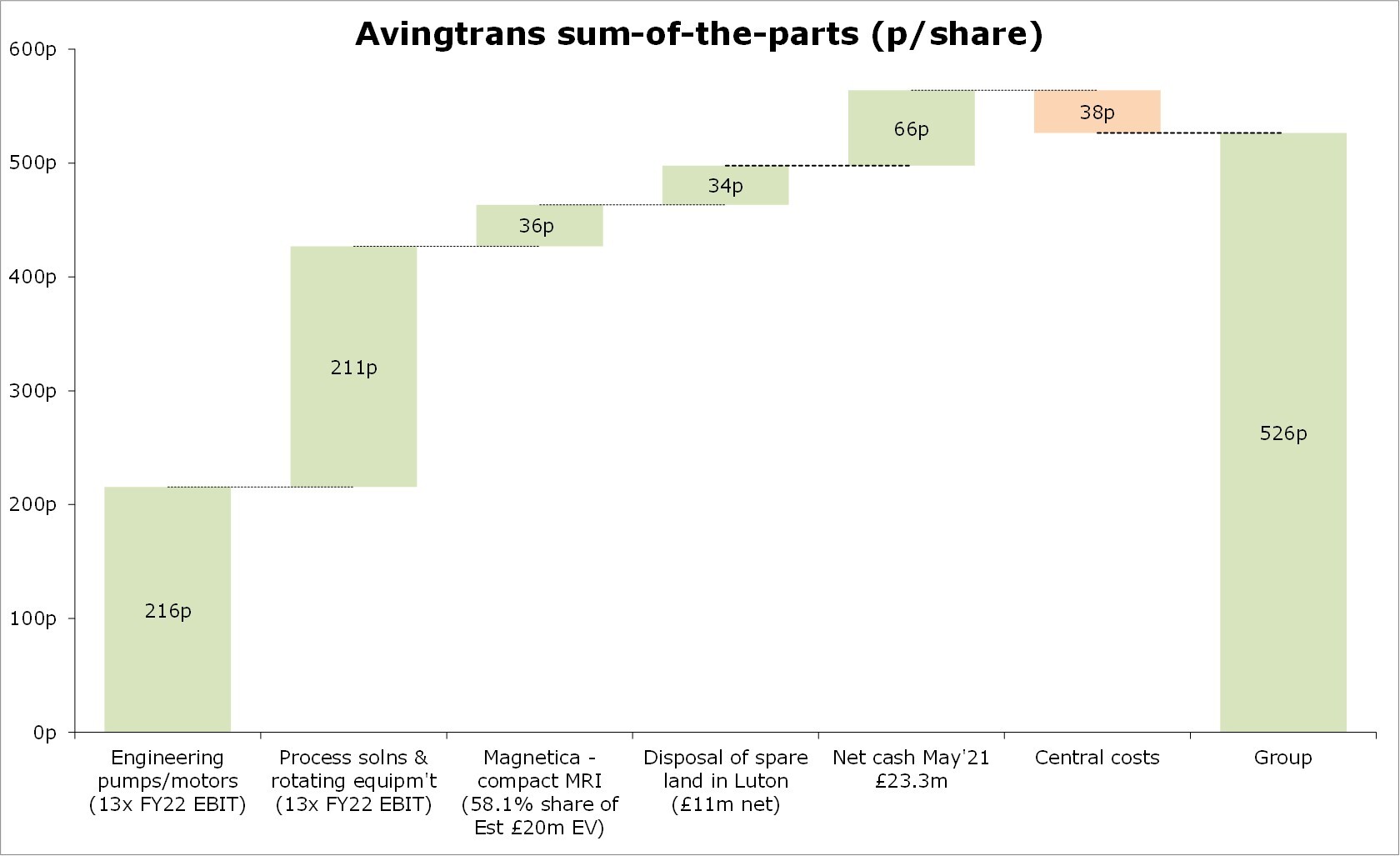

Wrt the numbers, my ‘sum-of-the-parts’ valuation comes out at 526p/share - underpinned by robust forward visibility, including several large, flagship contracts. Plus at 440p, AVG looks attractively priced, trading on FY22 EV/EBITDA & EV/EBIT multiples of 8.2x & 11.7x respectively. Alongside paying a 1.1% dividend yield & offering considerable upside, if it can sustainably accelerate LFL revenue growth