In August my father celebrated his 80th birthday, ordered a Cake Box platter & was frankly blown away with the product’s quality, freshness & taste.

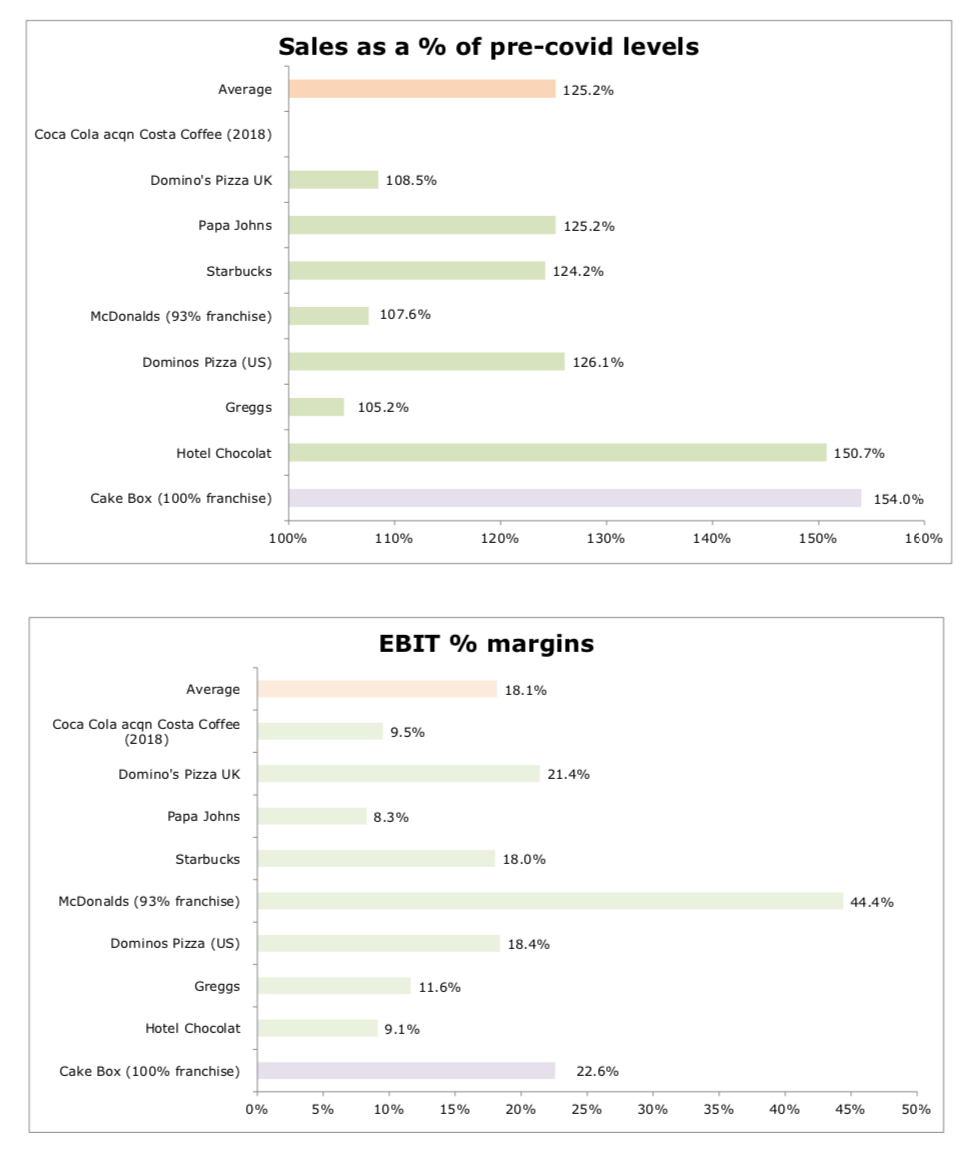

Similarly today, I suspect CBOX shareholders will enjoy the firm’s cracking H1’22 trading update. Posting revenues up 91% to £16.4m (LY £8.6m) & +87% vs pre-pandemic H1’20 levels – thanks to “strong” franchised (+13.3% LFL) store, kiosk (19 vs 14 LY), supermarket & online growth (+68% to £6.7m), alongside an expanding shop footprint (174 vs 139 LY & 122 H1’20).

Elsewhere, net cash closed Sept’21 at a healthy £4.2m vs £3.6m Mar’21 & £1.5m Sept’19. Aided by a jump in franchisee deposits to 62 from 32 in Sept’19, alongside the brand’s increasing resonance with consumers & capital-lite model - especially in attracting new entrepreneurial talent & outside funding.

Better still, there’s also been minimal supply chain disruption (eg ingredient shortages). And besides CBOX appears well positioned anyway to manage input cost inflation due to its robust pricing power.

CEO Sukh Chamdal adding: “Our H1’22 performance demonstrates the appeal of our unique cake offering. With strong sales growth accompanied by record expansion of our store estate, the Board is confident of making further progress in H2 & meeting FY’22 expectations”. Here Shore Capital are forecasting adjusted EBIT of £6.5m on turnover up +31% to £28.8m (£21.9m LY).

Interestingly too, there must be fair chance Cake Box actually beats these numbers, since it assumes H2’22 revenues of £12.4m vs £13.3m H2’21. Leaving IMO, scope for possible upgrades, even if the Board decides to accelerate its ‘growth strategy’.

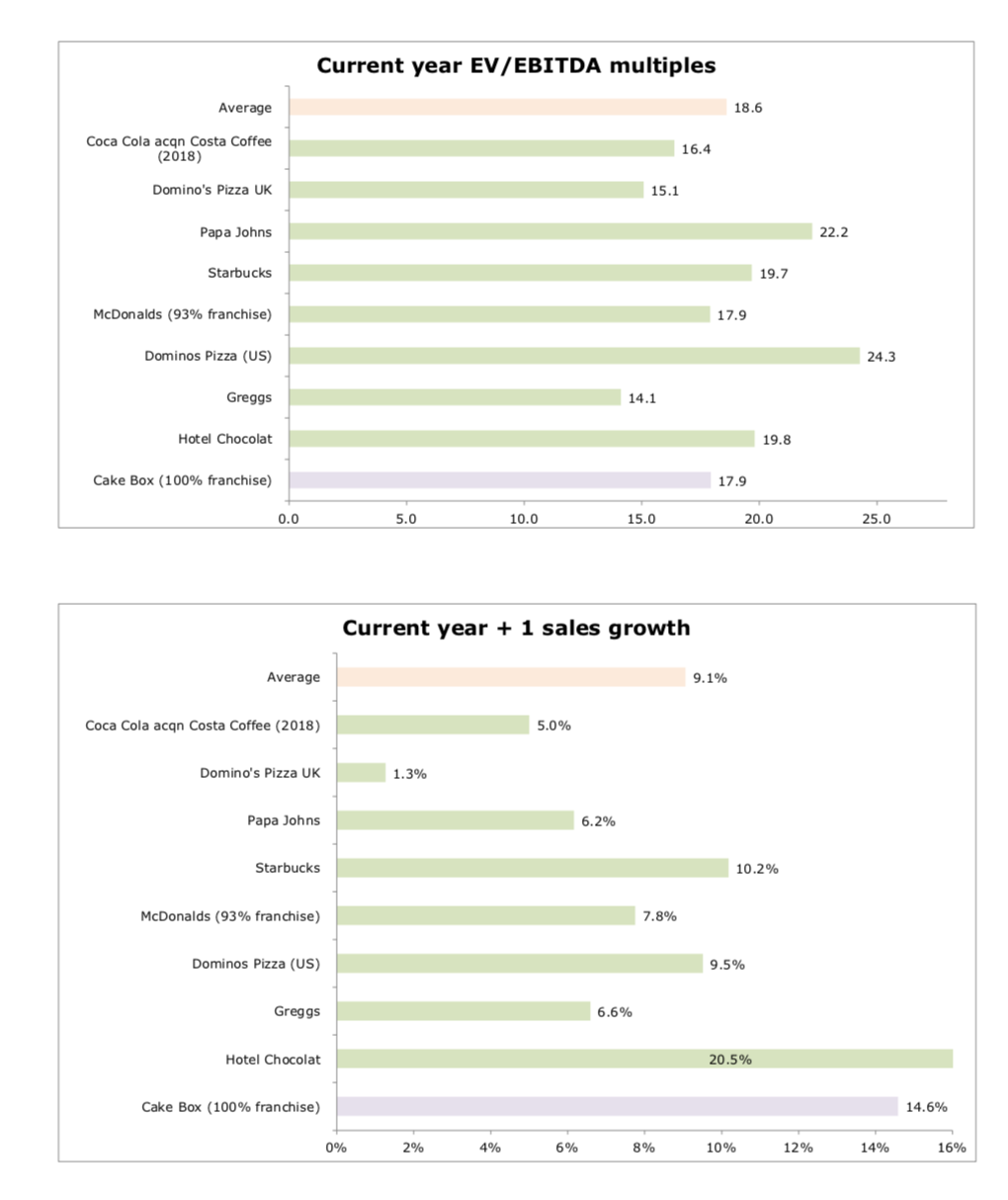

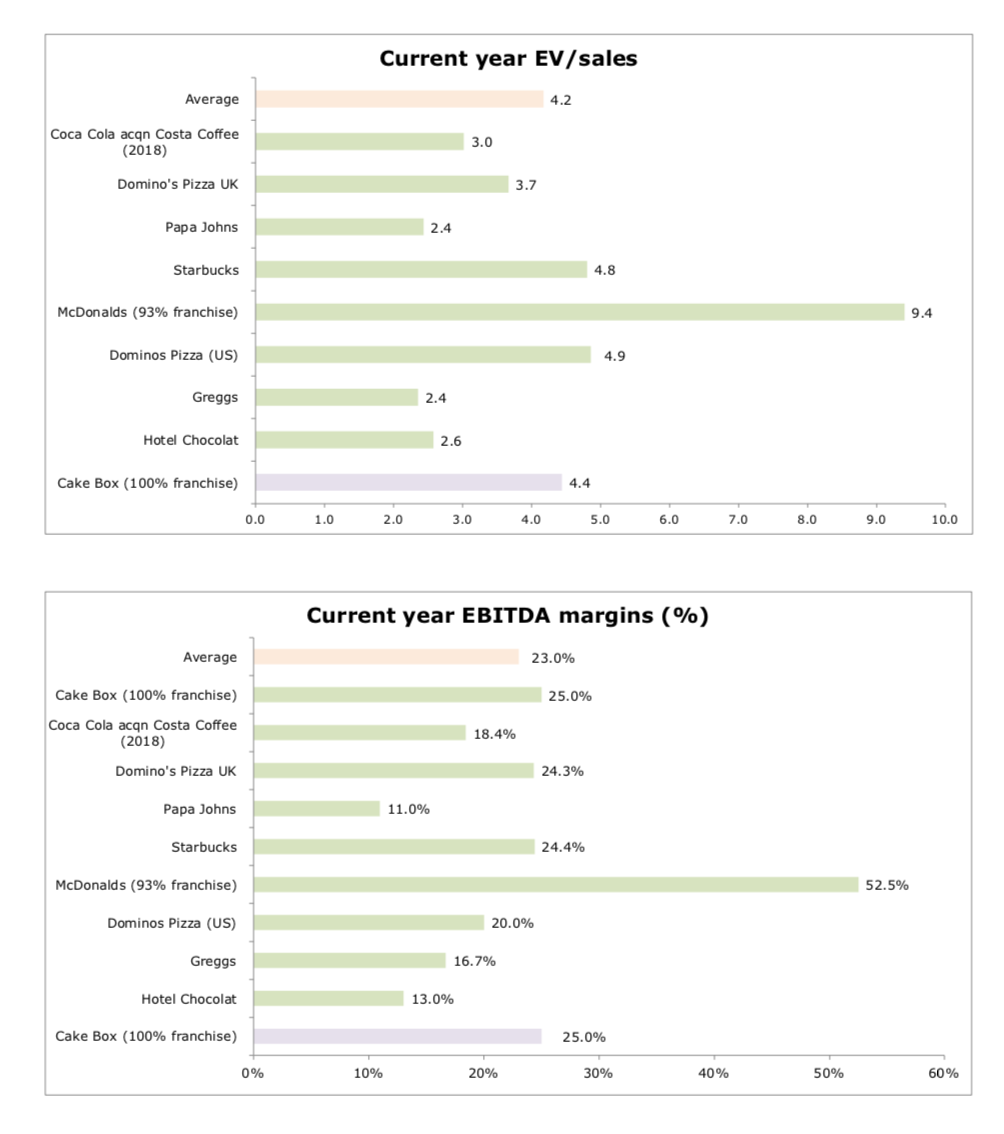

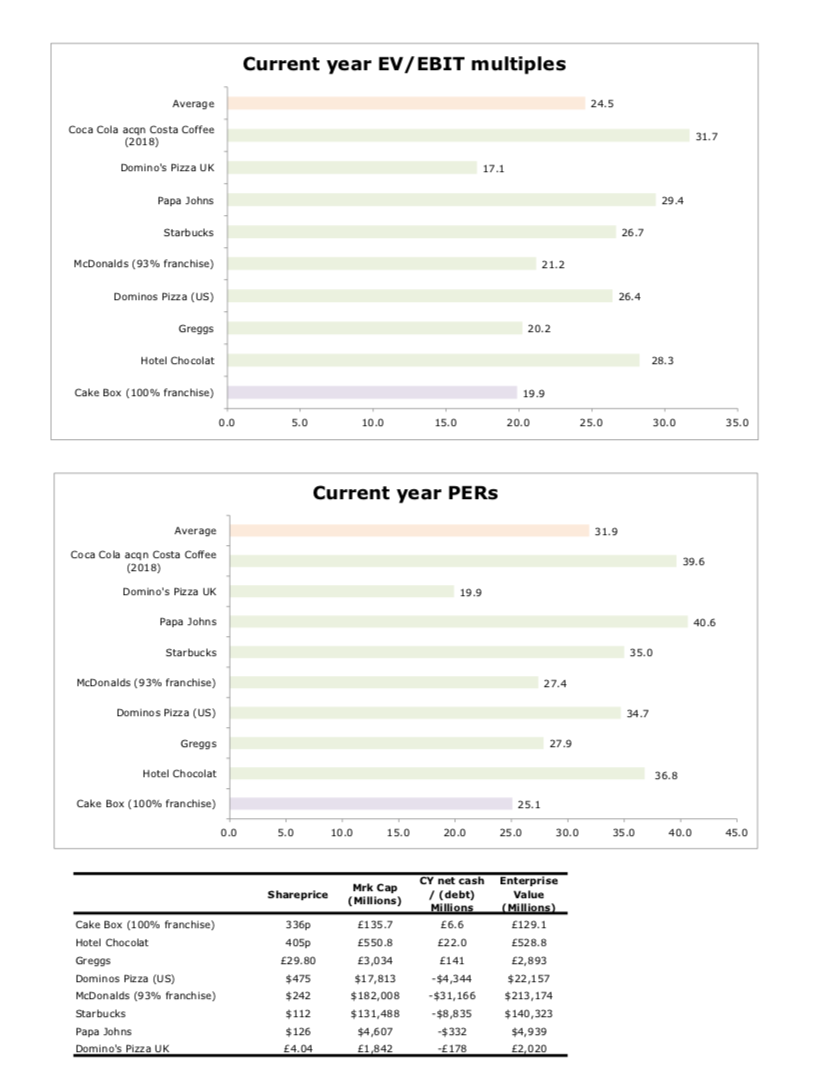

Wrt valuation, the stock at 336p trades on <20x FY22 EV/EBIT & 25x PER (or 22.7x ex cash) – which seems undemanding in light of the delicious H1 figures & positive outlook.

Personally on a 5 year view, I could see sales hit £60m coupled with 25%+ EBIT margins - driven by UK/overseas expansion, new product launches (eg Naked collection) & greater consumption (re treats). Which if rated on a sector 18x multiple (see attached), would produce a theoretical 675p/share valuation.